Introduction

The global future of CV depot charging market rapid electrification of commercial vehicles (CVs)—including light, medium, and heavy-duty trucks, delivery vans, and buses—is reshaping the global transportation landscape. Central to this transformation is the rise of CV depot charging infrastructure, a market poised for explosive growth. As logistics firms, public transport operators, and large fleets transition to electric powertrains, depot-based charging solutions are emerging as critical enablers of operational efficiency, cost control, and regulatory compliance.

This article explores the future of the CV depot charging market, including growth projections, trends, regional developments, and challenges.

Source – https://www.databridgemarketresearch.com/reports/global-future-of-cv-depot-charging-market

Market Outlook and Growth Projections

The global CV depot charging market was valued at around USD 3.7 billion in 2022, growing to an estimated USD 4.8 billion in 2024. Industry analysts project the market will surge to USD 30–46 billion by 2030–2032, with compound annual growth rates (CAGR) ranging between 26% and 31%.

Key Drivers of Growth:

-

Fleet electrification mandates

-

Emission reduction targets

-

Government subsidies and incentives

-

Rising fuel costs and maintenance savings with EVs

-

Growth in last-mile logistics and urban deliveries

Market Segmentation

By Vehicle Type

-

Electric Light Commercial Vehicles (eLCVs) dominate with over 70% market share.

-

Electric Medium and Heavy Commercial Vehicles (eMCVs & eHCVs) are gaining traction as battery range and charging power improve.

-

Electric Buses remain a cornerstone in public transport electrification efforts.

By Charging Type

-

DC Fast Charging Systems lead in large depots requiring rapid vehicle turnaround.

-

AC Depot Charging remains relevant for overnight charging in smaller fleets.

-

Megawatt Charging Systems (MCS) are emerging to support long-haul heavy-duty trucks.

By Ownership Model

-

Private Fleet-Owned Depots

-

Third-Party Managed Charging as a Service (CaaS)

-

Public-Private Partnerships

Regional Market Trends

Europe

Europe leads in policy-driven adoption, with countries like Germany, the UK, and the Netherlands developing large-scale depot infrastructure. The region is projected to grow at over 30% CAGR, supported by EU Green Deal targets and zero-emission zones in major cities.

North America

The U.S. and Canada are investing heavily in fleet electrification, supported by state-level incentives (e.g., California’s ACT Rule) and federal funding through the Infrastructure Investment and Jobs Act (IIJA).

Asia-Pacific

China dominates with its extensive electric bus networks and growing eLCV segment. India and Southeast Asia are following suit with rapid electrification of last-mile delivery vehicles.

Key Trends Shaping the Future

1. Megawatt and Ultra-Fast Charging

New standards like MCS (Megawatt Charging System) are enabling heavy-duty trucks to recharge in under an hour, essential for freight and logistics fleets.

2. Vehicle-to-Grid (V2G) Integration

Bi-directional charging allows commercial fleets to support the grid during off-peak times, turning depots into active grid participants.

3. Smart Energy Management

AI-powered systems optimize charging schedules, manage peak loads, and integrate with renewable energy sources, enhancing cost-efficiency and sustainability.

4. Fleet-as-a-Service (FaaS) Models

New business models provide depot charging as a managed service, reducing capital expenditures and simplifying operations for fleet owners.

5. Multi-Fuel Depot Hubs

Future-ready depots are incorporating EV chargers, hydrogen fueling, and biofuel infrastructure to support mixed-energy fleets.

Challenges to Address

Despite its promise, the CV depot charging market faces several challenges:

-

High Infrastructure Costs: Installation, equipment, and grid upgrades require substantial capital investment.

-

Permitting and Policy Gaps: Complex zoning laws and slow regulatory approvals can delay deployment.

-

Grid Constraints: Local utility limitations may restrict high-power charging installation.

-

Interoperability Issues: Lack of universal standards can hinder integration across platforms and providers.

-

Operational Downtime Risks: Insufficient charging capacity can disrupt fleet schedules without proper planning.

Leading Market Players

Several key players are driving innovation and deployment in the CV depot charging market, including:

-

ABB

-

Siemens

-

ChargePoint

-

bp pulse

-

Kempower

-

Heliox

-

Schneider Electric

-

Scania (Erinion) – aiming to deploy 40,000 chargers by 2030

-

Aegis Energy – developing hybrid fuel and EV depot solutions

Strategic Recommendations for Stakeholders

-

Collaborate with Utilities: Plan early for grid upgrades and secure energy supply commitments.

-

Standardize Infrastructure: Embrace open protocols like ISO 15118 for better plug-and-play compatibility.

-

Adopt Smart Charging: Invest in software platforms that optimize charging times and reduce operational costs.

-

Consider Modular Deployment: Start small and scale up based on vehicle growth and energy availability.

-

Explore Public-Private Partnerships: Share capital risk while accelerating deployment.

Conclusion

The future of the CV depot charging market is both dynamic and vital to the decarbonization of commercial transport. As EV adoption accelerates, depot charging infrastructure will evolve from a cost center into a strategic asset for logistics providers, municipal fleets, and energy grid stakeholders. With the right policy support, investment, and innovation, depot charging will become the backbone of clean, efficient, and intelligent commercial mobility.

- The global future of CV depot charging market was valued at USD 4.7 million in 2023 and is expected to reach USD 14.38 million by 2031, registering a CAGR of 13.8%% during the forecast period of 2024-2031

- The global future of CV depot charging market was valued at USD 4.7 million in 2023 and is expected to reach USD 14.38 million by 2031, registering a CAGR of 13.8%% during the forecast period of 2024-2031

- future of CV depot charging market, future of CV depot charging market size, future of CV depot charging market scope

Related posts:

Discover the Best Fence Installation Services in Omaha with Huskins Services LLC

Discover the Best Fence Installation Services in Omaha with Huskins Services LLC

Summer Solstice Party Ideas & Activities for a Magical Celebration | BizzCrave

Summer Solstice Party Ideas & Activities for a Magical Celebration | BizzCrave

At the Time of Booking: What to Keep in Mind During a Medical Emergency

At the Time of Booking: What to Keep in Mind During a Medical Emergency

Streamline Your Business with an Automated Employee Payroll System

Streamline Your Business with an Automated Employee Payroll System

Nutrition and Wellness Programs in Assisted Living Communities in Oakville

Nutrition and Wellness Programs in Assisted Living Communities in Oakville

How UAE Fitout Experts Are Elevating Luxury Brand Spaces in 2025

How UAE Fitout Experts Are Elevating Luxury Brand Spaces in 2025

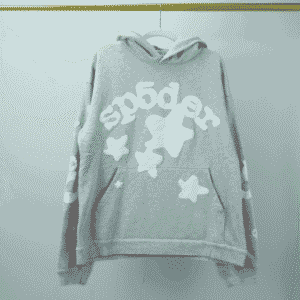

Sp5der Hoodie: Comfort, Fit, and Real-World Functionality Redefined

Sp5der Hoodie: Comfort, Fit, and Real-World Functionality Redefined

Lightning-Quick Printing: Same Day Custom Long Sleeve Shirt Printing London

Lightning-Quick Printing: Same Day Custom Long Sleeve Shirt Printing London