In the complex and fast-moving world of stock investing, data is your compass. You may have technical charts, earnings reports, or economic indicators at your disposal, but one of the most telling—and underutilized—sources of information is hidden in plain sight: NSE bulk deals. These high-volume transactions often reveal the subtle moves of big money in the market, offering clues about where the market might be heading long before prices reflect it.

Understanding NSE bulk deals and integrating them into your investment strategy can give you a decisive edge. Especially when monitored through focused platforms like this NSE bulk deals tracker, these trades can help you align your portfolio with the moves of institutional players and seasoned professionals.

What Are NSE Bulk Deals?

At their core, bulk deals are stock transactions involving more than 0.5% of a listed company’s equity, conducted by a single investor in a single day on the National Stock Exchange. These investors are typically large financial institutions, mutual funds, foreign institutional investors (FIIs), and high-net-worth individuals (HNIs). These are not random trades—they’re backed by deep analysis, due diligence, and high conviction.

Because of the volume and the parties involved, NSE bulk deals often signal important trends—be it long-term accumulation, sectoral shifts, or early signs of profit-booking. These are the trades made by people and institutions who often know more, see more, and act sooner.

Platforms like this NSE bulk deals portal serve as a one-stop solution to view, track, and analyze these impactful trades in a simplified manner.

Why Should You Pay Attention to Bulk Deals?

Let’s face it—retail investors don’t have the resources that large institutions do. But what they do have is access to the same data, at the same time, especially when it comes to legally mandated bulk deal disclosures. When analyzed correctly, these deals offer several benefits:

-

Early Insight into Stock Trends: Repeated buying or selling activity by the same fund or investor over days or weeks can signal future movement.

-

Validation of Fundamentals: If a stock you’re watching sees bulk buying by respected institutions, it confirms your research.

-

Idea Generation: Bulk deal reports are great for discovering new companies that you may not have previously considered.

Smart investors monitor these trades every day, using tools like the bulk deals dashboard to pick up signals before the crowd catches on.

Who’s Trading and Why It Matters

Knowing that a bulk deal took place is only half the story. The real question is—who executed it?

-

Mutual Funds: These are conservative, research-driven, long-term investors. Their presence in bulk deals typically indicates strong fundamental value.

-

FIIs: Foreign investors are macro-driven. Their bulk trades often reflect shifts in global confidence toward Indian markets or specific sectors.

-

HNIs: High-net-worth individuals often trade on unique insights or early business intelligence. Tracking them can reveal under-the-radar opportunities.

-

Proprietary Desks: These could be brokerage firms betting on short- to mid-term moves based on technical triggers or market structure.

Understanding the nature of the participant is crucial. For instance, a mutual fund buying 1% of a stock is different from a speculative trader doing the same.

Real-World Stories of Market Moves Driven by Bulk Deals

Let’s bring theory to life with real examples:

-

A mid-cap pharmaceutical company began appearing repeatedly in the NSE bulk deal reports over two months. The buyers? Three respected mutual funds. At that time, the stock was trading at a low PE multiple. Over the next year, it delivered 3x returns, driven by improved earnings and regulatory approvals.

-

A major FMCG firm saw consistent exits by an FII through bulk deals. This coincided with flat earnings growth and margin pressures. The stock underperformed the sector index by 20% over the next quarter.

-

In a lesser-known case, a small-cap auto ancillary stock caught investor attention after being bought in large quantities by a known HNI. The bulk deal led to media interest and triggered retail participation. The stock doubled in six months.

Tracking NSE bulk deals is about spotting such moments before they become common knowledge.

How to Analyze Bulk Deals for Investment Strategy

Step 1: Use a Reliable Portal

Don’t rely on scattered or delayed data. Use a consolidated, real-time, and filterable interface like the NSE bulk deals listing where you can search by stock, date, or institution.

Step 2: Compare Deal Size with Daily Volume

If the bulk deal size is unusually high compared to average daily traded volume, it suggests strong interest or exit—both worth investigating.

Step 3: Note the Price of the Deal

Was the deal struck at a price above the current market price? That may indicate bullishness. If below, it might be a sign of panic exit or discount selling.

Step 4: Track Repeat Patterns

One deal may be noise. Multiple deals by the same institution across days signal intent.

Step 5: Cross-Verify with News and Fundamentals

Check if the company has recently posted earnings, received regulatory news, or announced a new project. Bulk deals often come just before or after such triggers.

Bulk Deals and Sector Trends: Macro Signals Within Micro Data

Beyond individual stocks, bulk deal data can also indicate larger sectoral or thematic shifts.

-

If multiple power companies see institutional buying, it may reflect confidence in energy reforms.

-

Bulk deal selling across mid-cap IT firms could suggest weakening global tech demand.

-

Buying in defense and infrastructure stocks may signal alignment with government policy pushes.

These are signals that savvy investors use to rotate portfolios ahead of macro moves.

Mistakes to Avoid While Interpreting NSE Bulk Deals

While bulk deal data is valuable, it must be handled wisely:

-

Don’t Chase Every Deal: Not every bulk buy is a sign to invest. Understand the context.

-

Avoid Low-Liquidity Stocks: A bulk deal in a stock with very little volume could be hard to exit later.

-

Watch for Pump-and-Dump: Occasionally, bulk deals may be followed by hype or social media buzz—always verify the fundamentals.

-

Don’t Ignore Other Indicators: Use bulk deals as part of a holistic strategy—not the sole deciding factor.

NSE Bulk Deals vs Block Deals

To clarify, block deals are separate from bulk deals and occur in a dedicated trading window with a minimum transaction size of ₹10 crore. While both reveal institutional interest, bulk deals offer broader insights as they occur throughout the day and across more stocks.

How Beginners Can Use Bulk Deals to Learn

If you’re just starting out in investing, tracking bulk deals is an excellent educational tool:

-

Watch which sectors are attracting money.

-

Learn the names of top investing firms and their patterns.

-

Understand how major investors respond to earnings or news.

Reading NSE bulk deals daily for just 10 minutes builds the habit of research-based investing.

Where to Track Bulk Deals Easily and Reliably

While NSE itself publishes daily data, it’s scattered and hard to analyze in real-time. That’s why using a focused platform like this NSE bulk deals tool is a better choice. It allows filtering by buyer, date, or stock and offers a clean view of trends.

Having a tool that curates and simplifies this information helps you focus on interpretation instead of data collection.

Final Thoughts: When Big Money Talks, Smart Investors Listen

The equity market has many signals, but few are as revealing as bulk deals. These are not mere statistics—they are the footprints of those who shape the market. Institutions, funds, and smart money don’t follow the crowd—they lead it. By learning how to track and analyze NSE bulk deals, you’re learning to follow the leaders.

If you’re serious about investing—whether you’re managing your first ₹10,000 or scaling a seven-digit portfolio—you should be tracking where the giants are placing their bets. And to do that, make it a habit to review daily bulk deals on a professional-grade, investor-friendly platform like this NSE bulk deals tracker.

Knowledge may not guarantee profits, but lack of knowledge almost always guarantees missed opportunities. Bulk deals are public knowledge. Use them wisely, and they might just lead you to your next winning stock.

- The Hidden Signals of NSE Bulk Deals: How Smart Investors Decode Market Moves

- In the complex and fast-moving world of stock investing, data is your compass. You may have technical charts, earnings reports, or economic indicators at your disposal, but one of the most telling

- NSE Bulk Deals

Related posts:

From The First AI Unicorn To The Death Of Angel Tax: The Biggest Highlights For Indian Startups In 2024

From The First AI Unicorn To The Death Of Angel Tax: The Biggest Highlights For Indian Startups In 2024

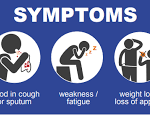

Uncommon Symptoms of TB: When Tuberculosis Affects Other Parts of the Body

Uncommon Symptoms of TB: When Tuberculosis Affects Other Parts of the Body

Winter Park Lawyer: Your Legal Ally in Florida’s Charming City

Winter Park Lawyer: Your Legal Ally in Florida’s Charming City

A Step-by-Step Guide to Private Limited Registration in Bangalore

A Step-by-Step Guide to Private Limited Registration in Bangalore

A Step-by-Step Guide to Private Limited Registration in Bangalore

A Step-by-Step Guide to Private Limited Registration in Bangalore

Rigid Setup Boxes: The Gold Standard in Premium Packaging Excellence

Rigid Setup Boxes: The Gold Standard in Premium Packaging Excellence

Rod Wave has become one of the most influential voices in modern hip-hop, blending emotional lyricism with soulful melodies.

Rod Wave has become one of the most influential voices in modern hip-hop, blending emotional lyricism with soulful melodies.

Speedtimer: A Legacy of Precision Timing and Modern Performance

Speedtimer: A Legacy of Precision Timing and Modern Performance