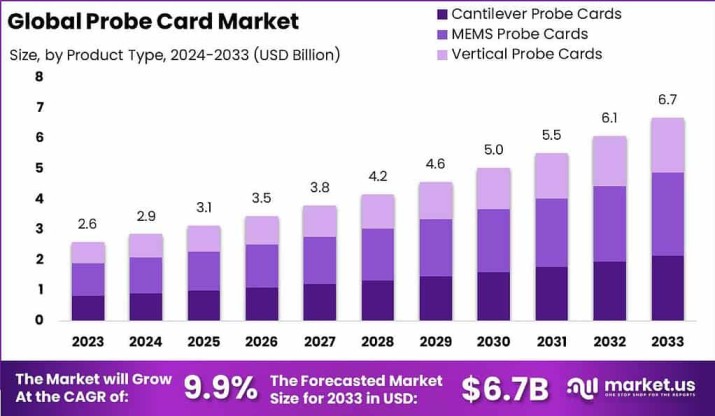

The global probe card market is projected to grow from USD 2.6 billion in 2023 to USD 6.7 billion by 2033, reflecting a CAGR of 9.9%. This robust growth is driven by increasing demand for semiconductor testing amid rising chip complexity and shrinking node sizes. The rising adoption of high-performance computing, 5G, and AI chips has intensified demand for advanced probe cards. Asia-Pacific dominates with a 38.9% market share in 2023, contributing USD 1.0 billion, bolstered by strong manufacturing activity and chip production. This upward trend reflects the critical role of probe cards in ensuring semiconductor reliability and yield.

Key Takeaways:

-

Market Size 2023: USD 2.6 Billion

-

Projected Market Size 2033: USD 6.7 Billion

-

CAGR (2024–2033): 9.9%

-

APAC Market Share 2023: 38.9%

-

APAC Revenue 2023: USD 1.0 Billion

Dominant Market Position:

Asia-Pacific emerged as the leading region in 2023, capturing over 38.9% of the global market with USD 1.0 billion in revenue. This dominance is attributed to the region’s substantial semiconductor manufacturing base, particularly in Taiwan, South Korea, Japan, and China. Governments and private sectors in these regions continue to invest heavily in semiconductor R&D and fabrication facilities. The rising presence of foundries and outsourced semiconductor assembly and test (OSAT) providers has bolstered demand for probe cards. In addition, local availability of testing infrastructure, skilled labor, and the presence of key chip manufacturers further fortify APAC’s leadership position.

Technology Perspective:

Technological advancements in probe card design, such as MEMS (Micro-Electro-Mechanical Systems) probe cards and vertical probe cards, are enhancing test accuracy and supporting ultra-fine pitch probing. These innovations cater to the growing need for high-speed and high-density semiconductor testing in AI, 5G, and automotive applications. Multi-DUT (Device Under Test) probe cards enable simultaneous testing of multiple chips, reducing test time and cost. With semiconductors moving toward nodes below 5nm, probe card technologies must continuously evolve in precision, durability, and thermal control to ensure reliability and throughput across next-gen devices and wafer-level packaging processes.

Dynamic Landscape:

The market is marked by rapid innovation cycles, regional manufacturing shifts, and evolving semiconductor architectures. Consolidation trends and strategic collaborations are shaping competitive dynamics.

Driver, Restraint, Opportunity, Challenges:

Driver: Rising semiconductor complexity and test requirements.

Restraint: High cost of advanced probe card solutions.

Opportunity: Surge in AI and automotive electronics.

Challenge: Technological limitations in ultra-fine pitch probing.

Use Cases:

-

Wafer-level testing of logic and memory ICs

-

Testing of System-on-Chip (SoC) and RF devices

-

Automotive chip quality assurance

-

AI and 5G chip functional validation

-

High-volume production testing in foundries

Key Players Analysis:

Leading probe card vendors are focused on scaling production capacities, developing advanced MEMS probe technologies, and enhancing service capabilities in Asia-Pacific. Their strategies include vertically integrated supply chains, R&D collaborations, and custom solution offerings to cater to diverse semiconductor nodes and package types. Global reach, consistent innovation, and technical reliability are central to their market positioning. Moreover, these firms are strengthening their local presence near chip fabrication hubs to reduce lead times and improve customer support. Continuous upgrades to testing systems, including multi-die and wafer-level systems, enable them to address the evolving needs of HPC, mobile, and automotive segments.

Recent Developments:

-

Expansion of MEMS-based probe card production lines

-

Introduction of ultra-fine pitch vertical probe cards

-

Strategic collaborations with leading OSATs

-

Launch of AI-optimized test solutions

-

Investments in localized service and support centers

-

sia-Pacific emerged as the leading region in 2023, capturing over 38.9% of the global market with USD 1.0 billion in revenue. This dominance is attributed to the region’s substantial semiconductor manufacturing base, particularly in Taiwan, South Korea, Japan, and China. Governments and private sectors in these regions continue to invest heavily in semiconductor R&D and fabrication facilities. The rising presence of foundries and outsourced semiconductor assembly and test (OSAT) providers has bolstered demand for probe cards. In addition, local availability of testing infrastructure, skilled labor, and the presence of key chip manufacturers further fortify APAC’s leadership position.

Technology Perspective:

Technological advancements in probe card design, such as MEMS (Micro-Electro-Mechanical Systems) probe cards and vertical probe cards, are enhancing test accuracy and supporting ultra-fine pitch probing. These innovations cater to the growing need for high-speed and high-density semiconductor testing in AI, 5G, and automotive applications. Multi-DUT (Device Under Test) probe cards enable simultaneous testing of multiple chips, reducing test time and cost. With semiconductors moving toward nodes below 5nm, probe card technologies must continuously evolve in precision, durability, and thermal control to ensure reliability and throughput across next-gen devices and wafer-level packaging processes.

Conclusion:

The global probe card market is on a strong upward trajectory, driven by the growing need for precise, high-speed semiconductor testing. With Asia-Pacific at the forefront, supported by rapid technological evolution, the market is poised for significant transformation. Innovations in probe card designs and strategic partnerships will be key to navigating emerging opportunities and challenges.

- Global Probe Card Market Analysis and Forecast (2024–2033)

- The global probe card market is projected to grow from USD 2.6 billion in 2023 to USD 6.7 billion by 2033, reflecting a CAGR of 9.9%. This robust growth is driven by increasing demand for semiconductor testing amid rising chip complexity and shrinking node sizes.

- Probe Card Market,

Related posts:

High-Quality Biomedical Waste Incinerators & Laboratory Glassware Made in India

High-Quality Biomedical Waste Incinerators & Laboratory Glassware Made in India

Understanding the Role of IoT in Modern Manufacturing: A Comprehensive Guide to Smart Factories and Industrial Transformation

Understanding the Role of IoT in Modern Manufacturing: A Comprehensive Guide to Smart Factories and Industrial Transformation

Smarter Business Networks Start with a Cisco Solution Provider Partner

Smarter Business Networks Start with a Cisco Solution Provider Partner

Best Account Management Software for All Businesses – EmizenTech

Best Account Management Software for All Businesses – EmizenTech

Top 15 Global Website Design Companies You Can Hire in the 2025

Top 15 Global Website Design Companies You Can Hire in the 2025

Empowering Qatari Retail Businesses with Microsoft Dynamics 365 Commerce

Empowering Qatari Retail Businesses with Microsoft Dynamics 365 Commerce

Top On-Demand Dating App Trends to Watch and Leverage in 2025

Top On-Demand Dating App Trends to Watch and Leverage in 2025

Safety Procedures in Heavy Equipment Moving: Best Practices for Workplace Security

Safety Procedures in Heavy Equipment Moving: Best Practices for Workplace Security