Singapore is one of the most sought-after places to live in Asia, thanks to its excellent infrastructure, high quality of life, and stable economy. Whether you’re a first-time homebuyer or an experienced investor, the process to buy residential property in Singapore can be both exciting and complex.

This guide will walk you through everything you need to know before making your property purchase in the Lion City.

Why Singapore is a Hot Property Destination

Singapore’s real estate market continues to attract interest from both locals and foreigners. Here’s why:

-

Strong Legal Framework: Transparent regulations and strong legal protection for property owners.

-

Political Stability: Singapore ranks among the most stable countries in Asia.

-

High Rental Yields: Ideal for investors looking for stable returns.

-

Safe & Clean Environment: One of the safest and cleanest cities in the world.

-

Strategic Location: Excellent connectivity across Southeast Asia.

Types of Residential Properties Available

Before you buy, it’s crucial to understand the different types of residential properties available in Singapore:

1. HDB Flats (Public Housing)

-

Managed by the Housing & Development Board.

-

Only available to Singapore citizens and some PRs.

-

Affordable but come with ownership restrictions.

2. Executive Condominiums (ECs)

-

Hybrid of public and private housing.

-

Can be purchased by Singaporeans and PRs.

-

Eligible for CPF grants but must fulfill a 5-year minimum occupation period.

3. Private Condominiums

-

Open to locals, PRs, and foreigners.

-

Offers premium facilities like pools, gyms, and security.

-

Located in prime areas like Orchard, Sentosa, and River Valley.

4. Landed Properties

-

Includes terrace houses, semi-detached, bungalows, and good class bungalows (GCBs).

-

Generally not available to foreigners without special approval.

-

High in value and prestige.

Who Can Buy Residential Property in Singapore?

Singapore Citizens:

-

Can buy HDB flats, ECs, condos, and landed properties.

-

Eligible for CPF housing grants and bank loans.

Permanent Residents (PRs):

-

Can buy ECs (after 5 years from launch), and private condos.

-

Cannot buy HDB flats directly from the government.

Foreigners:

-

Can buy private condominiums freely.

-

Need government approval to purchase landed properties.

-

Additional Buyer’s Stamp Duty (ABSD) applies.

Legal & Financial Considerations

1. Buyer’s Stamp Duty (BSD)

Applicable to all buyers. The amount varies depending on the purchase price or market value.

2. Additional Buyer’s Stamp Duty (ABSD)

-

0% for Singapore Citizens (1st property).

-

5-30% for PRs and foreigners depending on ownership and residency status.

3. Legal Fees

You’ll need a lawyer to help with the legal paperwork, which typically costs between SGD 2,500 and SGD 5,000.

4. Loan-to-Value (LTV) Ratio

This refers to the maximum amount you can borrow from the bank. Currently, it’s up to 75% of the property price (subject to eligibility).

Steps to Buy Residential Property in Singapore

Step 1: Determine Your Budget

Start by evaluating your financial situation. Consider the down payment, stamp duties, legal fees, and renovation costs.

Step 2: Get Loan Approval in Principle (AIP)

Apply for a mortgage pre-approval from a bank to know your maximum loan limit.

Step 3: Engage a Property Agent

A reliable agent will help you find the right property and handle negotiations.

Step 4: Property Search & Viewing

Shortlist properties based on your preferences such as location, size, price, and amenities.

Step 5: Make an Offer

Once you find a suitable property, you can make an offer and negotiate the price.

Step 6: Sign Option to Purchase (OTP)

Pay a booking fee (typically 1% of the property price) and sign the OTP.

Step 7: Exercise OTP & Pay Stamp Duties

You’ll need to pay BSD and ABSD within 14 days of exercising the OTP.

Step 8: Finalize Mortgage & Complete Sale

Secure your housing loan and settle the remaining payment. The legal transfer of property is completed at this stage.

Popular Residential Areas in Singapore

Some of the most popular places to buy residential property include:

-

Orchard Road: For luxury living and convenience.

-

Bukit Timah: Known for top schools and landed homes.

-

Sentosa Cove: Exclusive waterfront living, ideal for high-end buyers.

-

Tampines & Punggol: Affordable condos and family-friendly amenities.

Tips for First-Time Homebuyers

-

Always check your eligibility for grants and loans.

-

Factor in maintenance fees and property taxes.

-

Choose properties with future MRT or infrastructure developments for better ROI.

-

Don’t rush—take time to compare prices and evaluate the resale value.

Is Now a Good Time to Buy?

Singapore’s real estate market is known for its resilience. While prices have steadily increased, the government has introduced cooling measures to prevent overheating. For long-term homeowners or investors, buying residential property in Singapore still offers good potential for capital appreciation and rental income.

Conclusion

Buying residential property in Singapore is a significant milestone and a valuable investment. With the right research, preparation, and guidance, you can confidently navigate the property market and secure a home that suits your lifestyle and budget.

Whether you are a local or a foreign buyer, Singapore offers a range of options that cater to various needs—from affordable HDB flats to luxurious private condominiums. Take your time, do your homework, and start your journey towards homeownership in one of Asia’s most vibrant cities.

Important Links

How to Find Off Market Real Estate Deals Near Me

Lakeside Grand – A New Benchmark in Jurong Lakeside Living

Best Places to Buy Rental Property for Cash Flow in 2025

Step-by-Step Guide to Buying a House for the First Time

Discover Your Dream Home at Lakeside Drive Condo

- A Complete Guide to Buy Residential Property in Singapore

- Singapore is one of the most sought-after places to live in Asia, thanks to its excellent infrastructure, high quality of life, and stable economy. Whether you’re a first-time homebuyer or an experienced investor, the process to buy residential property in Singapore can be both exciting and complex.

- blog

Related posts:

Enjoy Ultra 9000 Box of 10 – Power, Flavour, and Convenience Combined

Enjoy Ultra 9000 Box of 10 – Power, Flavour, and Convenience Combined

Crystal Pro Max + 10000 Box of 10: Long-Lasting Flavour from a Trusted Vape Store in UK

Crystal Pro Max + 10000 Box of 10: Long-Lasting Flavour from a Trusted Vape Store in UK

How to Style Your XPLR Merch? Master the Look with Confidence and Edge

How to Style Your XPLR Merch? Master the Look with Confidence and Edge

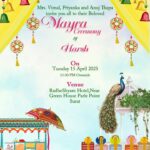

Online Editable Wedding Invitation Cards Free Download – Make Your Wedding Invite Truly Yours

Online Editable Wedding Invitation Cards Free Download – Make Your Wedding Invite Truly Yours

Best Junior Colleges for CEC | Shamshabad | Hyderabad – Accomplish Academy

Best Junior Colleges for CEC | Shamshabad | Hyderabad – Accomplish Academy

The Essential Guide to Swimming Pool Plant Rooms: Function, Design & Maintenance

The Essential Guide to Swimming Pool Plant Rooms: Function, Design & Maintenance

Data-driven SEO strategies using predictive AI AbdulHadi Blog

Data-driven SEO strategies using predictive AI AbdulHadi Blog

Syna World: Redefining Streetwear with the Iconic Syna World Tracksuit

Syna World: Redefining Streetwear with the Iconic Syna World Tracksuit