Introduction: Why You Should Consider Term Life Insurance

When it comes to securing your family’s future, finding the right life insurance policy is one of the most important decisions you can make. Term life insurance offers an affordable way to ensure that your loved ones are financially protected in case the unexpected happens.

In this blog, we will explore why term life insurance is a great option, what makes it simple and affordable, and how you can find the right policy for your needs.

What Is Term Life Insurance?

Simple and Affordable Term Life Insurance is a policy that provides coverage for a specific period, or “term.” This can range from as short as one year to as long as 30 years. During this period, if the insured person passes away, the beneficiary receives a lump sum payout, called the death benefit.

Unlike permanent life insurance policies, such as whole or universal life insurance, term life insurance does not accumulate cash value over time. However, it is often much more affordable, making it an excellent option for those seeking a cost-effective solution.

Why Choose Term Life Insurance?

1. Simple to Understand One of the biggest advantages of term life insurance is its simplicity. Unlike more complex policies, term life insurance is straightforward. You choose the term length and the amount of coverage you need, and in return, you pay regular premiums. If something happens to you during the term, your beneficiaries will receive the death benefit.

2. Affordable Premiums Term life insurance is generally much more affordable than permanent life insurance. This makes it an ideal choice for young families, individuals on a budget, or anyone who needs coverage but doesn’t want to pay high premiums. For the same amount of coverage, you could pay a fraction of what you would for a whole life policy.

3. Ideal for Temporary Coverage Needs Term life insurance is perfect for people who need coverage for a specific time frame. For example, if you’re a parent with young children, you might only need life insurance until your kids are financially independent. Or, if you have a mortgage, you may want to ensure your family is covered until the loan is paid off.

4. Flexibility in Policy Length Term life policies offer a range of term lengths, from 10 to 30 years or more. This allows you to select a policy that aligns with your financial obligations, such as the duration of your mortgage or the age at which your children will be self-sufficient.

How to Choose the Right Term Life Insurance Policy

1. Determine Your Coverage Needs The first step in choosing a term life insurance policy is to determine how much coverage you need. Consider your family’s financial situation, including any debts (such as a mortgage), daily living expenses, and future needs (like your children’s education).

A general rule of thumb is to choose a coverage amount that is 10 to 15 times your annual income. This ensures that your family can maintain their lifestyle and cover any major expenses.

2. Choose the Right Term Length Next, think about how long you need coverage. If your children are young, a 20- or 30-year term may be appropriate. If you’re older and your children are grown, a shorter term might suffice.

The length of the term should match your financial obligations. For example, if you plan to pay off your mortgage in 20 years, a 20-year term life policy would provide coverage during that time.

3. Compare Quotes Prices for term life insurance can vary widely depending on your age, health, and lifestyle factors. That’s why it’s important to compare quotes from different insurance providers. Many companies offer online tools that allow you to easily get a quote and compare plans.

4. Check for Riders Some term life insurance policies offer additional coverage options, known as riders. Common riders include critical illness coverage or accidental death benefits. Adding a rider to your policy can help provide extra protection for your family if you need it.

Benefits of Simple and Affordable Term Life Insurance

1. Peace of Mind The biggest benefit of having term life insurance is the peace of mind it provides. Knowing that your family is financially protected in case of your untimely death can help ease your worries, allowing you to focus on living your life to the fullest.

2. Budget-Friendly Term life insurance is affordable, and with the wide range of term lengths and coverage amounts available, it can easily fit into almost any budget. In some cases, you may even be able to get coverage for just a few dollars a month.

3. No Pressure to Stay If your financial situation changes, or if you no longer need coverage, you’re not locked into a permanent policy. At the end of the term, you can choose to let the policy expire, or you can renew it, often at a higher premium.

4. Flexibility Term life insurance policies are flexible and can be customized to meet your unique needs. You can increase your coverage if your circumstances change, or even convert your term policy into a permanent life insurance policy if you decide you need lifelong coverage in the future.

Common Misconceptions About Term Life Insurance

1. “Term Life Insurance is Too Expensive” As mentioned earlier, term life insurance is typically much cheaper than permanent life insurance policies. The affordability of term life insurance makes it an attractive option for many individuals, especially those just starting their families or establishing their financial lives.

2. “You Can’t Renew Your Term Life Insurance” While term life insurance policies do expire after a certain number of years, many policies allow you to renew your coverage once the term ends. However, keep in mind that your premiums may increase based on your age or health condition.

3. “Term Life Insurance Doesn’t Offer Any Value” Unlike permanent life insurance, term life policies don’t accumulate cash value. But they do provide valuable protection for your family, which is the core purpose of life insurance. If you’re primarily interested in protecting your family in the event of your death, term life insurance is an excellent choice.

Conclusion: Get Started with Simple and Affordable Term Life Insurance Today

Finding the right term life insurance policy doesn’t have to be complicated. By focusing on your coverage needs, comparing quotes, and understanding the terms of the policy, you can choose an affordable and simple plan that offers peace of mind for you and your loved ones.

Whether you’re just starting out in life or need coverage for a specific time frame, term life insurance is an excellent, budget-friendly choice that can help protect your family’s future.

- Simple and Affordable Term Life Insurance – Protect Your Future

- Discover the best simple and affordable term life insurance options to secure your family’s future. Learn why it’s an essential, budget-friendly choice.

- Simple and Affordable Term Life Insurance

Related posts:

From The First AI Unicorn To The Death Of Angel Tax: The Biggest Highlights For Indian Startups In 2024

From The First AI Unicorn To The Death Of Angel Tax: The Biggest Highlights For Indian Startups In 2024

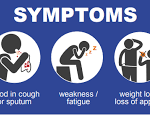

Uncommon Symptoms of TB: When Tuberculosis Affects Other Parts of the Body

Uncommon Symptoms of TB: When Tuberculosis Affects Other Parts of the Body

Winter Park Lawyer: Your Legal Ally in Florida’s Charming City

Winter Park Lawyer: Your Legal Ally in Florida’s Charming City

A Step-by-Step Guide to Private Limited Registration in Bangalore

A Step-by-Step Guide to Private Limited Registration in Bangalore

A Step-by-Step Guide to Private Limited Registration in Bangalore

A Step-by-Step Guide to Private Limited Registration in Bangalore

Rigid Setup Boxes: The Gold Standard in Premium Packaging Excellence

Rigid Setup Boxes: The Gold Standard in Premium Packaging Excellence

Find Your Perfect Leather or Sport Jacket at The Jacket Seller:

Find Your Perfect Leather or Sport Jacket at The Jacket Seller:

How Do Accounts Receivable Outsourcing Services Improve Cash Flow and Reduce Bad Debt?

How Do Accounts Receivable Outsourcing Services Improve Cash Flow and Reduce Bad Debt?