Master Algorithmic Trading With ICFM’s Algo Trading Course for New-Age Traders and Investors

As stock markets become more technology-driven, traditional trading methods are no longer enough to stay ahead. Smart investors and traders are now turning to automation and data-driven strategies to increase speed, precision, and profitability. That’s why the demand for a practical and professional algo trading course is growing rapidly in India. If you’re looking for a reliable, hands-on, and industry-focused algo trading course, look no further than ICFM – Stock Market Institute.

ICFM offers a comprehensive algo trading course designed specifically for aspiring traders who want to leverage technology in financial markets. With years of experience in trading education and a deep understanding of Indian market dynamics, ICFM is one of the few institutes offering a truly application-based algo trading course. Whether you’re a student, working professional, or full-time trader, this program equips you with the tools and knowledge to automate and optimize your trading strategies.

Why ICFM’s Algo Trading Course Is The Right Choice for Serious Trading Enthusiasts

ICFM’s algo trading course is a one-of-a-kind program tailored to meet the needs of modern traders who wish to integrate coding, automation, and strategy development into their market approach. Unlike general trading classes, this algo trading course dives deep into algorithmic structures, backtesting, coding techniques, and the logic behind rule-based trading systems.

The course is taught by expert traders, programmers, and market analysts who bring real-world experience into the classroom. Participants not only learn how to create trading algorithms but also how to test and refine them using real-time and historical market data. ICFM ensures that each student of the algo trading course walks away with the practical capability to build, deploy, and manage trading bots or automated systems across platforms.

Course Structure and Technical Training Offered in ICFM’s Algo Trading Course

ICFM’s algo trading course starts with a strong foundation in trading logic and financial markets, preparing students to understand the language and mechanics of algorithmic strategies. The course then introduces key programming concepts necessary for algorithmic trading, such as Python scripting, APIs, and integration with broker terminals. Even those without a strong coding background are guided step-by-step to ensure they understand the logic behind algorithm design.

Students of the algo trading course are introduced to backtesting tools, strategy optimization, and performance metrics. They learn how to test a strategy against historical data to evaluate risk, returns, drawdowns, and accuracy before going live in the market. This critical step allows traders to build confidence in their system while reducing errors that could result in financial losses.

Later modules of the algo trading course include exposure to market data feeds, order routing, and execution systems. Learners are taught how to automate trades based on technical indicators, price action, or custom triggers. They explore how to adjust algorithms based on volatility, market conditions, or asset class. Throughout the course, ICFM emphasizes practical projects and hands-on labs that simulate real-market execution.

Practical Market Integration and Real-World Simulations in the Algo Trading Course by ICFM

What sets ICFM apart from other training centers is its practical and immersive learning experience. The algo trading course offered here goes beyond classroom theories and teaches students how to connect trading algorithms to real broker platforms. This means you don’t just build theoretical models—you build actual trading bots and test them in real-time environments.

Students interact with industry-level platforms and APIs, learning how to configure, monitor, and adjust their algorithms during market hours. With access to simulated trading environments and historical datasets, the algo trading course enables you to experiment with multiple strategies like mean reversion, breakout systems, and trend-following bots.

ICFM’s faculty also mentor students on how to manage trading risk, track performance, and understand compliance frameworks applicable to algorithmic trading in India. Whether you aim to become a quant trader, start your own trading desk, or automate personal trades, this algo trading course gives you a full-spectrum learning experience.

Who Should Enroll in ICFM’s Algo Trading Course and What Career Opportunities Await

ICFM’s algo trading course is perfect for individuals who want to combine trading knowledge with technical skills. It is highly recommended for finance students, engineering graduates, computer programmers, working professionals in fintech, and traders who want to enhance their performance using automation. You do not need to be an expert coder—basic understanding and interest are enough, as the course starts from the fundamentals and gradually progresses.

Career prospects after completing the algo trading course from ICFM are extremely promising. You can pursue roles like algorithmic trader, quantitative analyst, trading strategist, fintech developer, or automated systems consultant. The finance industry is rapidly embracing automation, and the skills you gain from ICFM’s algo trading course will give you a competitive edge in both jobs and entrepreneurship.

Conclusion: Build the Future of Trading With ICFM’s Algo Trading Course in India

In conclusion, algorithmic trading is the future of financial markets, and learning how to master it is no longer optional for serious traders. ICFM – Stock Market Institute offers India’s most practical and industry-relevant algo trading course, giving learners the ability to automate, optimize, and outperform in today’s fast-paced trading environment.

With expert mentorship, hands-on projects, real-market simulations, and cutting-edge tools, the algo trading course by ICFM is the ideal stepping stone for anyone looking to move beyond traditional trading methods. If you’re ready to embrace the technology-driven world of trading, ICFM’s algo trading course is your smartest move toward long-term success.

Read More Blog:-

https://www.icfmindia.com/blog/the-hidden-power-of-tick-trading-how-to-predict-moves-before-they-happen

- ICFM Algo Trading Course – Master Automated Trading With India’s Top Market-Focused Training Program

- Join ICFM’s expert-led algo trading course and learn algorithmic trading with real-time strategies, Python coding, and live market practice. Build trading bots and automate profits with India’s top stock market institute.

- algo trading course

Related posts:

Fitness for Mental Clarity: Unlock Your Focus and Inner Strength with DG FIT MIND

Fitness for Mental Clarity: Unlock Your Focus and Inner Strength with DG FIT MIND

Essentials Hoodie Design Philosophy: Minimalism Meets Statement

Essentials Hoodie Design Philosophy: Minimalism Meets Statement

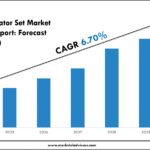

Chile Generator Set Market Trends & Forecast: Outlook to 2030

Chile Generator Set Market Trends & Forecast: Outlook to 2030

Trusted Fiber Laser Cutting Machine Supplier Delivering Advanced Automatic Laser Cutting Machines

Trusted Fiber Laser Cutting Machine Supplier Delivering Advanced Automatic Laser Cutting Machines

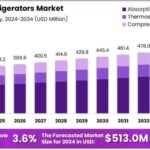

Small-Space Cooling: The Rise of the Minibar Fridge in Minibar Refrigeration

Small-Space Cooling: The Rise of the Minibar Fridge in Minibar Refrigeration

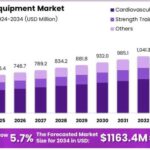

Aqua Gym Equipment Used in Holistic Wellness and Mind-Body Programs

Aqua Gym Equipment Used in Holistic Wellness and Mind-Body Programs

Transparency and Trust Through Beverage Packaging Supports Anti-Counterfeiting Measures

Transparency and Trust Through Beverage Packaging Supports Anti-Counterfeiting Measures

Key Time Management Strategies for Small Business Owners and Freelancers in 2025

Key Time Management Strategies for Small Business Owners and Freelancers in 2025