Property valuation in Dubai is a crucial process for homeowners looking to buy, sell, refinance, or assess their real estate investments. Understanding how property valuation works helps homeowners make informed decisions, ensuring they get the best possible value for their property. In this article, we will explore the key aspects of property valuation in Dubai, the factors influencing it, and how British Arabian can assist homeowners in this process.

What Is Property Valuation in Dubai?

Property valuation in Dubai refers to the process of determining the current market value of a residential or commercial property. This valuation is conducted by professional appraisers who assess various factors such as location, size, condition, and market trends to arrive at an accurate estimate. Whether you are selling, buying, or refinancing, a precise property valuation in Dubai ensures transparency and fairness in real estate transactions.

British Arabian specializes in providing reliable property valuation services in Dubai, helping homeowners navigate the complexities of the real estate market with confidence.

Why Is Property Valuation Important for Homeowners?

Accurate property valuation in Dubai is essential for several reasons. For sellers, it helps in setting a competitive yet realistic price, attracting genuine buyers. For buyers, it ensures they are paying a fair price based on the property’s true worth. Additionally, banks and financial institutions require a professional valuation before approving mortgages or loans.

Homeowners also need property valuation for legal purposes, such as inheritance disputes, divorce settlements, or tax assessments. With British Arabian’s expertise, homeowners can obtain a credible valuation report that meets all legal and financial requirements.

Key Factors Influencing Property Valuation in Dubai

Several factors influence the outcome of a property valuation Dubai. Understanding these can help homeowners anticipate how their property’s value is determined.

Location

Location is one of the most significant factors in property valuation. Properties in prime areas like Palm Jumeirah, Downtown Dubai, or Emirates Hills typically command higher values due to their proximity to business hubs, tourist attractions, and premium amenities. Even within the same neighborhood, factors like views, accessibility, and noise levels can impact valuation.

Property Size and Layout

The size of the property, including built-up area and plot dimensions, directly affects its valuation. Larger properties with efficient layouts and optimal space utilization tend to have higher valuations. British Arabian’s appraisers carefully measure and evaluate the property’s dimensions to ensure an accurate assessment.

Condition and Age of the Property

Newer properties or well-maintained homes generally have higher valuations. Upgrades such as modern kitchens, high-quality flooring, and smart home features can further enhance value. Older properties may require renovations to achieve a competitive market price.

Market Trends and Demand

The Dubai real estate market is dynamic, with fluctuations in supply and demand influencing property values. A professional property valuation in Dubai considers current market conditions, including recent sales of comparable properties, to provide an up-to-date estimate.

Amenities and Facilities

Properties with access to premium amenities like swimming pools, gyms, parks, and security services often have higher valuations. Proximity to schools, hospitals, and shopping centers also plays a role in determining value.

The Property Valuation Process in Dubai

The property valuation process in Dubai follows a structured approach to ensure accuracy and reliability. Here’s how it typically works:

Initial Inspection

A certified appraiser from British Arabian conducts an on-site inspection of the property. They assess the condition, layout, and any unique features that may affect value.

Comparative Market Analysis

The appraiser compares the property with similar recently sold properties in the area. This helps in determining a fair market value based on real-time data.

Document Verification

Legal documents, including title deeds, maintenance records, and permits, are reviewed to confirm the property’s legal standing and any encumbrances.

Final Valuation Report

After thorough analysis, British Arabian provides a detailed valuation report outlining the property’s estimated market value, supported by data and professional insights.

How British Arabian Supports Homeowners with Property Valuation in Dubai

British Arabian is a trusted name in Dubai’s real estate sector, offering comprehensive property valuation services tailored to homeowners’ needs. Their team of certified appraisers ensures unbiased and accurate valuations, helping clients make informed decisions.

Whether you need a valuation for selling, refinancing, or legal purposes, British Arabian follows industry best practices to deliver reliable results. Their in-depth knowledge of Dubai’s property market ensures homeowners receive a fair and competitive valuation.

Conclusion

Property valuation in Dubai is a vital step for homeowners, whether they are buying, selling, or managing their real estate investments. By understanding the factors that influence valuation and working with experts like British Arabian, homeowners can ensure they receive an accurate and fair assessment of their property’s worth.

If you require a professional property valuation in Dubai, British Arabian provides expert services to guide you through the process with transparency and precision.

- How Property Valuation Dubai Works for Homeowners

- Learn how property valuation Dubai helps homeowners determine accurate real estate prices. Discover key factors influencing valuations in Dubai's dynamic market.

- Property Valuation Dubai

Related posts:

Porta Cabin Sizes in the UAE: A Comprehensive Guide for Builders and Developers

Porta Cabin Sizes in the UAE: A Comprehensive Guide for Builders and Developers

Discover Your Dream Home at Paradise Sai World City Panvel – A Landmark Address in Mumbai

Discover Your Dream Home at Paradise Sai World City Panvel – A Landmark Address in Mumbai

Discover Your Dream Home at Kalpataru Blossoms Sinhagad Road – Premium Property for Sale in Pune

Discover Your Dream Home at Kalpataru Blossoms Sinhagad Road – Premium Property for Sale in Pune

Invest in Sobha Magnum – Premium Apartments in Bannerghatta Road, Bangalore

Invest in Sobha Magnum – Premium Apartments in Bannerghatta Road, Bangalore

What Are the Pros and Cons of Buying a Furnished Apartment for Sale in Abu Dhabi?

What Are the Pros and Cons of Buying a Furnished Apartment for Sale in Abu Dhabi?

Top 5 Reasons to Invest in Properties in Yas Bay Before Prices Rise

Top 5 Reasons to Invest in Properties in Yas Bay Before Prices Rise

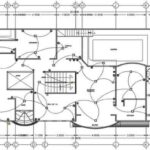

Why Electrical Drawing Services is Essential in BIM Projects

Why Electrical Drawing Services is Essential in BIM Projects

Pakistan Real Estate Market Trends in 2025: What Buyers and Investors Must Know!

Pakistan Real Estate Market Trends in 2025: What Buyers and Investors Must Know!