Managing a business in New Zealand comes with many responsibilities—from customer service to product delivery to paying your staff on time. One of the most time-consuming tasks is handling payroll. Between keeping up with legal requirements, tax rules, and employee entitlements, payroll can easily become overwhelming.

That’s why more and more businesses are choosing to Outsource Payroll to experts who can handle it efficiently and accurately. This blog will help you understand what outsourcing payroll means, its advantages, and how a Tax Agent In Auckland can further streamline your financial responsibilities.

Introduction to Payroll Outsourcing

When you Outsource Payroll, you hire a third-party service or consultant to manage your employee payments, PAYE tax filings, KiwiSaver deductions, leave calculations, and more. These services are tailored to New Zealand’s employment and tax laws.

Instead of doing everything in-house, you let experienced professionals handle the compliance work while you focus on growing your business.

Why New Zealand Businesses Choose to Outsource Payroll

In cities like Auckland, where competition is high and regulations are tight, business owners are realising the benefits of outsourcing. Here’s why it makes sense:

Saves Time

Processing payroll takes hours—especially if you’re doing it manually or with outdated software. By outsourcing, you free up time to focus on operations, sales, or customer service.

Ensures Compliance

New Zealand has strict employment laws. Missing a payday or underpaying taxes can lead to penalties. Payroll providers stay updated with the latest IRD changes, helping you avoid legal trouble.

Improves Accuracy

Human errors in payroll can cause stress for both the employer and employee. An outsourced team uses modern tools to ensure accurate calculations for wages, KiwiSaver, leave, and PAYE.

Reduces Costs

You might think outsourcing is expensive, but doing it yourself can cost more in the long run—especially if you get fined or make repeated mistakes.

Key Payroll Tasks Handled by Experts

A trusted provider can take care of the following:

-

Preparing and processing payslips

-

Filing PAYE with the Inland Revenue Department (IRD)

-

Calculating leave balances, holiday pay, and bonuses

-

Managing KiwiSaver deductions

-

Generating employee tax summaries

-

Issuing payslips and final pays during resignation or termination

This makes it clear why many smart businesses prefer to Outsource Payroll rather than deal with the burden themselves.

The Role of a Tax Agent in Auckland

A Tax Agent In Auckland plays a critical role in ensuring your business is financially compliant—not just with payroll but also with income tax, GST, and company returns. They can also liaise directly with IRD on your behalf.

Here’s how a tax agent complements your payroll outsourcing:

Tax Advice

They provide personalised guidance on tax-saving opportunities while ensuring you follow the rules.

Deadline Management

Never miss IRD deadlines again. A Tax Agent In Auckland keeps your payroll filings, GST returns, and annual accounts in check.

Problem Solving

Facing a tax audit or penalty? Your agent can help resolve it faster through professional communication with IRD.

Business Planning

Many tax agents go beyond numbers. They advise on growth, funding, and business structure too.

Signs It’s Time to Outsource Payroll

Not sure if you need to make the switch? Here are some clear indicators:

-

You’re spending too much time on payslips and tax filings.

-

You’ve made payroll mistakes in the past.

-

You find IRD rules confusing or overwhelming.

-

Your employee count is growing.

-

You want to ensure 100% compliance and accuracy.

If any of these sound familiar, it’s time to Outsource Payroll to professionals like accountrix.co.nz who understand both the local rules and your specific needs.

Common Misconceptions About Outsourcing Payroll

Let’s clear up a few myths:

It’s too expensive.

In reality, the cost of payroll mistakes, penalties, and lost time often exceeds the cost of outsourcing.

We’ll lose control.

You still approve payments and retain full control—experts simply do the legwork.

It’s only for large businesses.

Even a small business with just 1–5 employees can benefit from outsourcing.

Benefits Specific to Auckland Businesses

Auckland is New Zealand’s business hub, with thousands of startups, retail chains, contractors, and professional services. These businesses often face:

-

Tight deadlines

-

High turnover

-

Complex tax scenarios

By choosing to Outsource Payroll, Auckland business owners reduce stress and stay competitive. When supported by a qualified Tax Agent In Auckland, compliance becomes smooth and worry-free.

Case Study: How Outsourcing Helped a Local Retail Store

A boutique clothing shop in Auckland was struggling with weekly payroll. The owner did everything manually, including PAYE filings and KiwiSaver calculations. After getting fined twice for late submissions, they turned to a payroll service and a Tax Agent In Auckland.

The results:

-

Saved 10 hours per week

-

Avoided all future penalties

-

Gained confidence in financial compliance

-

Staff payments became timely and stress-free

This shows how outsourcing doesn’t just fix problems—it prevents them from happening again.

What to Look for in a Payroll Service Provider

Not all providers offer the same value. When selecting a service to Outsource Payroll, consider:

-

Experience with NZ laws

-

Use of trusted software (e.g., Xero or MYOB)

-

Clear pricing with no hidden fees

-

Strong client testimonials

-

Availability of bundled services (payroll + tax + accounting)

Working with a local firm like accountrix.co.nz gives you the advantage of accessibility, personalised service, and proven results.

Final Thoughts

If you’re a New Zealand business owner, the decision to Outsource Payroll could be one of the smartest moves you make this year. It saves time, improves accuracy, and reduces risk—all while freeing you to focus on growing your business.

And when combined with the support of a trusted Tax Agent In Auckland, you can rest easy knowing your payroll and taxes are handled with precision and care.

Don’t let payroll problems slow down your success. Let professionals like accountrix.co.nz take the weight off your shoulders and keep your business running smoothly in 2025 and beyond.

- Outsource Payroll: Smart Choice for All NZ Businesses in 2025

- Outsource payroll to save time, ensure compliance, and boost efficiency. Discover why NZ businesses are making the smart move in 2025. Ask ChatGPT

- Outsource payroll

Related posts:

Dresses Dry Cleaner services Lisle, IL: BY Napervalue Cleaners

Dresses Dry Cleaner services Lisle, IL: BY Napervalue Cleaners

Easy EMI Card: Your Go-To Solution for Easy Monthly Payments

Easy EMI Card: Your Go-To Solution for Easy Monthly Payments

Law Notes PDF Download: A Smart Resource for Law Students and Aspirants

Law Notes PDF Download: A Smart Resource for Law Students and Aspirants

A Section 8 Company Registration Process with the ngoexperts

A Section 8 Company Registration Process with the ngoexperts

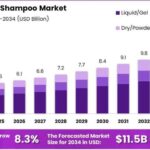

Why the World Is Going Sulfate-Free—One Shampoo Bottle at a Time

Why the World Is Going Sulfate-Free—One Shampoo Bottle at a Time

The mystery to great connections? Acknowledge family and companions for who they truly are

The mystery to great connections? Acknowledge family and companions for who they truly are

Alpaca Apparel Market on the Rise: Sustainability Meets Sophistication

Alpaca Apparel Market on the Rise: Sustainability Meets Sophistication

Warning Signs You May Be Working With An Unqualified Roofing Contractor

Warning Signs You May Be Working With An Unqualified Roofing Contractor