Purchasing a home is a major milestone—but for many individuals in Vancouver, bad credit can make the path to homeownership feel nearly impossible. If you’ve been denied by banks or feel anxious about your credit history, you’re not alone. Many people struggle with financial setbacks due to unexpected life changes like job loss, illness, divorce, or simply tough circumstances. The good news? A less-than-perfect credit score doesn’t have to keep you from owning a home.

As a dedicated mortgage broker in Vancouver, I work with clients from all walks of life—including those with bad credit. This blog will guide you through what a bad credit mortgage is, how it works, and what options are available to help you take the next step toward owning your dream home.

Understanding Bad Credit Mortgages

A bad credit mortgage is specifically designed for individuals who don’t meet the strict lending criteria set by traditional banks. This includes those with a credit score below 600, a history of missed payments, consumer proposals, or bankruptcy.

In a traditional setting, banks rely heavily on your credit score to assess risk. If your score is too low, they may deny your mortgage application—even if you have a stable income and a decent down payment. That’s where alternative lenders and specialized brokers like myself come in. We work to secure mortgage solutions based on your overall financial picture, not just a number.

Why People in Vancouver Need Alternatives

Vancouver is one of the most expensive real estate markets in Canada. While the city’s property values make it an attractive place to invest and grow wealth, they also create major challenges for those with imperfect credit. In such a high-stakes market, timing is everything—and waiting to “fix” your credit might mean missing out on a great opportunity.

This is why a bad credit mortgage Vancouver solution can be so valuable. It gives buyers a real shot at entering the market now, while also providing a structured path to financial recovery.

How a Bad Credit Mortgage Works

When applying for a bad credit mortgage, the approval process is slightly different from a traditional one. Here are some key factors lenders will consider:

-

Equity or Down Payment: A larger down payment (typically 20% or more) helps offset the risk for lenders.

-

Income Stability: If you have a steady income, lenders are more likely to approve your application.

-

Debt-to-Income Ratio: Keeping your monthly debt low in relation to your income helps demonstrate financial responsibility.

-

Collateral and Assets: Additional properties or savings can strengthen your application.

-

Explanation Letter: A letter outlining the reasons for your credit challenges and how you’ve worked to improve your finances can make a big difference.

As your mortgage broker, I help you gather and present all this information clearly and professionally, increasing your chances of approval.

The Role of Private and Alternative Lenders

Bad credit mortgages often involve private or alternative lenders. These lenders operate outside the traditional banking system and are more flexible in their assessments. While their interest rates may be slightly higher, they are often willing to take a chance on borrowers with less-than-perfect credit, as long as other elements of your financial profile are solid.

More importantly, these mortgages can be short-term stepping stones—often 1 to 3 years—giving you time to rebuild your credit while still living in your own home. Once your credit improves, we can refinance you into a lower-rate mortgage with a mainstream lender.

The Value of Working with a Trusted Broker

Finding the right mortgage when you have credit challenges isn’t something you should do alone. As a local Vancouver mortgage broker, I work with a large network of private and alternative lenders. My job is to match you with the right lender for your situation and negotiate the best terms on your behalf.

I also simplify the entire process—helping you with paperwork, explaining every step, and ensuring that you understand all the terms of your loan. You’ll never feel left in the dark.

A bad credit mortgage Vancouver solution isn’t about settling for less. It’s about taking a realistic step forward with support, transparency, and expert guidance.

Tips to Improve Your Mortgage Options

Even if you’re applying with bad credit, there are a few things you can do to boost your chances:

-

Save a larger down payment

-

Avoid taking on new debt before applying

-

Pay your bills on time moving forward

-

Review your credit report and fix any errors

-

Be honest and transparent with your broker

These small steps can make a big impact in your mortgage journey.

Ready to Move Forward? Let’s Talk.

Buying a home with bad credit might seem overwhelming—but it’s absolutely possible. With the right plan, a supportive broker, and access to flexible lenders, your dream home is within reach.

If you’re exploring your options for a bad credit mortgage Vancouver, let’s connect. I’ll help you understand your choices, prepare your application, and guide you every step of the way.

Reach out today for a free consultation—and let’s build your path to homeownership together.

- Don't Let Credit Issues Stop Your Homeownership Goals

- Gurnik Singh - Mortgage Broker knows that poor credit shouldn’t be the end of your homeownership journey. If you're looking for a bad credit mortgage Vancouver, we’ll connect you with lenders who see the whole picture—not just your score. We work to create clear, realistic solutions that fit your current financial position. Whether it's rebuilding or starting fresh, getting a bad credit mortgage Vancouver is possible with the right guidance. Let’s take the first step toward your new beginning—together.

- bad credit mortgage vancouver

Related posts:

Dresses Dry Cleaner services Lisle, IL: BY Napervalue Cleaners

Dresses Dry Cleaner services Lisle, IL: BY Napervalue Cleaners

Easy EMI Card: Your Go-To Solution for Easy Monthly Payments

Easy EMI Card: Your Go-To Solution for Easy Monthly Payments

Integrating Type form with High Level: A Comprehensive Guide

Integrating Type form with High Level: A Comprehensive Guide

What Solar Looks Like on Flat Roofs, Metal Roofs, and Shingles?

What Solar Looks Like on Flat Roofs, Metal Roofs, and Shingles?

When Best Stock Market Institute Delhi Becomes Your Turning Point Forever

When Best Stock Market Institute Delhi Becomes Your Turning Point Forever

Food Product Label Printing – A Crucial Element in Modern Packaging

Food Product Label Printing – A Crucial Element in Modern Packaging

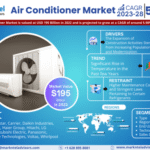

Detailed Market Analysis on Air Conditioner Market | Share, Size & Outlook

Detailed Market Analysis on Air Conditioner Market | Share, Size & Outlook

Best Stock Market Course For Beginners Only At ICFM – Stock Market Institute India

Best Stock Market Course For Beginners Only At ICFM – Stock Market Institute India