France is one of the most attractive destinations in Europe for entrepreneurs looking to expand or start fresh. With a strong economy, access to the European Union market, an innovation-friendly ecosystem, and government incentives for startups, starting a business in France can be a strategic and rewarding move.

Whether you’re an EU resident or a non-EU investor, this guide covers everything you need to know about starting a business in France, including the types of business structures, registration steps, tax regulations, and key tips for success.

Why Start a Business in France?

1. Strategic Location:

France is centrally located in Western Europe, making it an ideal hub for trade, logistics, and access to over 500 million EU consumers.

2. Skilled Workforce:

France boasts a highly educated and skilled talent pool, especially in sectors like technology, engineering, fashion, and manufacturing.

3. Government Support for Entrepreneurs:

From the French Tech Visa to tax breaks and startup grants, France has created a startup-friendly climate to attract global founders.

4. Infrastructure and Innovation:

With modern transport systems, access to R&D centers, and a thriving startup scene in cities like Paris, Lyon, and Toulouse, the environment is ripe for business innovation.

Step-by-Step Process to Start a Business in France

1. Choose the Right Business Structure

Your business structure determines your legal obligations, taxation, and liabilities. Common forms include:

-

Sole Proprietorship (Entreprise Individuelle): Suitable for freelancers and small businesses.

-

SAS (Société par Actions Simplifiée): Flexible and popular among startups, allowing for multiple shareholders and investor entry.

-

SARL (Société à Responsabilité Limitée): Similar to a limited liability company, great for small to medium businesses.

-

SA (Société Anonyme): For larger corporations, requiring significant capital and a board of directors.

Each structure has different requirements for capital, management, and accounting, so choosing the right one is crucial.

2. Draft the Articles of Association

Known in French as statuts, this document defines your company’s rules and structure. It must include the company’s name, legal form, address, share capital, and business purpose (objet social).

3. Deposit Initial Capital

Open a French business bank account and deposit the required share capital. For SAS or SARL, this can be as low as €1, but a more realistic amount improves credibility. You’ll receive a deposit certificate needed for registration.

4. Register with the Centre de Formalités des Entreprises (CFE)

The CFE acts as the one-stop shop for company registration. You’ll submit:

-

Articles of Association

-

Capital deposit certificate

-

Proof of business address

-

Director’s ID and declaration of non-conviction

-

Legal publication in a journal of legal notices

Upon approval, you’ll receive your SIRET number (business ID) and Kbis extract, your business’s official registration proof.

5. Register for Tax and Social Security

Once registered, your business will automatically be registered for corporate taxes, VAT (if applicable), and social security contributions. If you hire employees, you must also register with social protection agencies (URSSAF, CPAM).

Taxation in France

France has a reputation for relatively high taxes, but there are many deductions, allowances, and startup schemes available:

-

Corporate Tax: The standard rate is 25% in 2025, but small companies may qualify for reduced rates.

-

VAT (TVA): The standard rate is 20%, with reduced rates for specific goods and services.

-

Social Charges: Employers contribute to pensions, healthcare, and unemployment, making hiring costlier, but workers benefit from strong social security.

Funding and Support Options

France offers multiple options to help startups and SMEs:

-

Bpifrance (Public Investment Bank): Offers funding, guarantees, and advisory services.

-

La French Tech: Provides visas, networking, and financial support for tech startups.

-

Réseau Entreprendre & Initiative France: Non-profits offering mentorship and interest-free loans.

-

Business Incubators: Especially in Paris and major cities, they help foreign entrepreneurs adapt and grow.

Challenges You Might Face

Despite the benefits, starting a business in France comes with its share of hurdles:

-

Bureaucracy: Administrative processes can be slow and paper-heavy.

-

Language Barrier: While English is common in business, all legal documents must be in French.

-

Labor Laws: France has strong labor protections. Hiring and firing employees requires careful compliance.

Tips for Succeeding in the French Market

-

Learn the Local Culture: Business etiquette, punctuality, and formality matter in French corporate culture.

-

Invest in Language: Even basic French skills help build rapport and trust with clients and partners.

-

Hire a Local Accountant or Legal Advisor: Navigating French bureaucracy is much easier with expert support.

-

Adapt Your Offer: Localize your product or service to suit French tastes, regulations, and expectations.

-

Leverage Digital Tools: Build a strong online presence – France has a digitally-savvy customer base.

Conclusion

Starting a business in France can be a rewarding decision both strategically and financially. With its robust infrastructure, supportive ecosystem, and access to the European market, France continues to attract entrepreneurs from around the globe.

Whether you’re launching a tech startup in Paris, opening a boutique in Nice, or setting up a logistics hub in Lyon, the opportunities are plentiful for those who navigate the system thoughtfully.

- Starting a Business in France: Your Complete 2025 Guide

- Discover how to start a business in France in 2025, including legal structures, registration steps, tax details, and expert tips to launch successfully.

- start a business in France, how to start a business in France in 2025

Related posts:

Easy EMI Card: Your Go-To Solution for Easy Monthly Payments

Easy EMI Card: Your Go-To Solution for Easy Monthly Payments

When Best Stock Market Institute Delhi Becomes Your Turning Point Forever

When Best Stock Market Institute Delhi Becomes Your Turning Point Forever

Learn Advanced Derivatives Trading Course from ICFM and Build Expertise in Financial Market Strategies

Learn Advanced Derivatives Trading Course from ICFM and Build Expertise in Financial Market Strategies

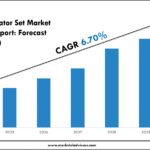

Chile Generator Set Market Trends & Forecast: Outlook to 2030

Chile Generator Set Market Trends & Forecast: Outlook to 2030

Trusted Fiber Laser Cutting Machine Supplier Delivering Advanced Automatic Laser Cutting Machines

Trusted Fiber Laser Cutting Machine Supplier Delivering Advanced Automatic Laser Cutting Machines

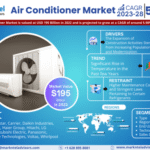

Detailed Market Analysis on Air Conditioner Market | Share, Size & Outlook

Detailed Market Analysis on Air Conditioner Market | Share, Size & Outlook

Best Stock Market Course For Beginners Only At ICFM – Stock Market Institute India

Best Stock Market Course For Beginners Only At ICFM – Stock Market Institute India

CPHI Worldwide 2025 – Where Pharma Meets the Future in Frankfurt

CPHI Worldwide 2025 – Where Pharma Meets the Future in Frankfurt