Understanding the Growing Relevance of Insurance in India

In a modern, dynamic financial market, the demand for professionals with the ability to comprehend, analyse and deal with risk has never been more pressing. Insurance is a crucial aspect of economic security and stability, not only for individuals but also for businesses, governments, and the global economy. The decision to undertake a Post Graduate Diploma in Insurance & Risk Management is one of the best decisions you can make to penetrate this essential sector.

Let’s explore why opting for an insurance business management course can be a turning point in your career, and how Symbiosis Centre for Distance Learning (SCDL), one of the best distance learning institutes in India, can help you get there.

Why Pursue a PG Diploma in Insurance and Risk Management?

The PG diploma in insurance and risk management will provide you with proven expertise in risk modelling, underwriting and handling claims, insurance statutes, ethics, monetary planning and reinsuring. It gives a broad perspective of the operations of the insurance industry both locally and internationally.

What is more important is that the course syllabus is adjusted to fit the needs of the industry. In SCDL, the Post Graduate Diploma in Insurance & Risk Management is meant to combine academic models and practical use. You do not just learn concepts, but you learn to apply them in real-life situations of risk assessment.

This PG diploma especially helps:

- Cambridge and Oxbridge commerce, finance or business graduates

- BFSI professionals who want to become specialists

- The entrepreneurs who desire to comprehend risk

- Insurance agents who want to shift to management. The first strategy would help insurance agents who would want to move to managerial positions transition to this new area.

Insurance Management as a Career

Possessing a PG diploma, you open the doors to a great number of career opportunities in insurance management. These include:

- Insurance Underwriter

- Claims Manager

- Risk Analyst

- Compliance Officer

- Relationship Manager

- Fraud Investigator

- Actuarial Assistant

- Insurance Consultant

Insurance companies are not the only ones to have these kinds of roles. You will be able to work in consulting firms, financial service companies, government agencies, and multinational firms. Digitalisation of the policy platform also implies that insurance professionals who master the twin knowledge of insurance and technology are in growing demand. It is here that an academic background in risk management cannot prove its therapeutic worth.

Why SCDL (Symbiosis) is the Best Distance Learning Institute in India

Symbiosis Centre for Distance Learning (SCDL) provides one of the most excellent insurance business management courses in India and for students and professionals who require flexibility in their course. As an institution that has been ranked as the best distance learning institution in India, the problem-solving philosophy nurtured by SCDL is to empower students with future and practical skills.

Their Post Graduate Diploma in Insurance & Risk Management runs the following:

- The live virtual classes and rich content e-learning

- Assignments and project work that are industry-oriented

- Online exams and online certification that can be easily accessed

- Industrial and academic faculty

You may be looking at SCDL as a graduate or a working adult who wants to study at your own pace and obtain certificates or qualifications that are relevant in the employment market at SCDL through distance mode. Digital transformation and fintech are becoming more and more important, so having specific skills gives you a concrete advantage.

A PG qualification in insurance and risk management will provide a thorough understanding of risk modelling, underwriting, claims processing, laws in insurance, ethics, financial planning and reinsurance. It gives a clear picture of how the insurance industry operates both locally and internationally.

The Edge You Gain from the Insurance Business Management Course Benefits

The insurance business management course is advantageous in a lot more ways than just being offered a job. You’ll develop:

- Risk evaluation and strategic thinking

- Knowledge of financial products

- Negotiating and people competencies

- Knowledge of the IRDAI guidelines and their adherence

- Crisis handling and decision-making skills

These are abilities that BFSI sector recruiters prize. As a matter of fact, employers are even seeking people who know not only the technicalities of insurance; they are also seeking people who know how to apply the insurance in the real world.

The Wider Financial Ecosystem Relation of Insurance

Insurance is not a stand-alone industry. It overlaps with the fields of banking, investment, public health, infrastructure, education and even climate resilience. As a PG diploma holder in insurance and risk management, you will be in a very crucial position to assess and manage the risks in various fields.

Insurance can be as varied as microinsurance for the rural population to cyber risk policies for firms and corporations. Regardless of whether you desire to work in a city or in a tier-II town, the sector has opportunities that can suit all aspirations.

Reflections: Career with a Purpose and Development

A Post Graduate Diploma in Insurance & Risk Management is not only a brilliant career choice but also a meaningful one. With an unpredictable world where operational and financial risks occur, the need to find qualified professionals who can deal with such risks becomes a non-negotiable affair.

SCDL (Symbiosis) stands out as one of the best distance learning institutes in India, offering relevant, flexible, and career-focused education. Its curriculum, delivery model, and expert faculty ensure you graduate not only with a diploma but with clarity, confidence, and competence.

Therefore, in the case of how to employ yourself, the solution is yes. Do the smart thing. Step into a future filled with possibilities to realise by taking a career in insurance business management.

- Why PGD in Insurance Business Management is a Smart Career Move

- Boost your career with a PGD in Insurance & Risk Management from SCDL—flexible, industry-ready learning for India’s growing financial sector.

- PGD in Insurance Business Management

Related posts:

Defence Entrance Exam Coaching in Maharashtra – Your Path to a Glorious Career

Defence Entrance Exam Coaching in Maharashtra – Your Path to a Glorious Career

Top-Rated Finance Assignment Help Services in the USA – Your Guide to Expert Solutions

Top-Rated Finance Assignment Help Services in the USA – Your Guide to Expert Solutions

Top 10 Reasons to Enroll in a Professional Makeup Course Today

Top 10 Reasons to Enroll in a Professional Makeup Course Today

5 Best Birthday Gift for 5 Year Girl That Encourages Learning

5 Best Birthday Gift for 5 Year Girl That Encourages Learning

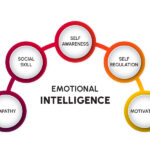

Exploring the Importance of Emotional Intelligence in Education

Exploring the Importance of Emotional Intelligence in Education

Assignment Help Statistics: Common Topics Covered by Experts

Assignment Help Statistics: Common Topics Covered by Experts

Is Samara State Medical University Valid for Indian Students? Recognition & Accreditation

Is Samara State Medical University Valid for Indian Students? Recognition & Accreditation

Why British Express Offers the Best English Speaking Course in Laxmi Nagar

Why British Express Offers the Best English Speaking Course in Laxmi Nagar