Fixed deposits (FDs) have long been the cornerstone of secure investments in India. The allure of guaranteed returns coupled with minimal risk makes FDs a preferred choice for conservative investors. As we edge closer to 2025, there is considerable anticipation regarding the highest FD rates that will shape the investment landscape in the coming year. With the fixed deposit space evolving, understanding the dynamics that govern these rates is essential for anyone planning to secure their financial future effectively.

Understanding Fixed Deposits

Before delving into the intricacies of the highest FD rates, it is pivotal to comprehend what fixed deposits entail. An FD is essentially a savings instrument offered by banks and non-banking financial companies (NBFCs) wherein investors deposit a lump sum for a fixed tenure at a predetermined interest rate. Upon maturity, the investor receives the principal amount along with the accrued interest. In India, FDs are considered extremely safe, with a relatively predictable return on investment that is insulated from market volatilities.

The Landscape of FD Rates in 2025

The highest FD rates in 2025 are likely to be influenced by several macroeconomic factors, including inflation rates, monetary policies, and economic growth projections. Keeping an eye on these factors can offer insights into potential interest rate trends. Historically, FD rates have varied significantly across different institutions, contingent upon their liquidity needs and financial strategies. Banks may offer competitive FD rates to attract more depositor funds during periods of liquidity crunch, whereas during times of surplus funds, FD rates may witness a downward trend.

Comparison of Bank FD Rates

As of now, several top banks promise attractive FD rates for varied tenure periods. For instance, if State Bank of India (SBI) offers an annual FD interest rate of 6.50% for a tenure of 3 years and HDFC Bank provides a slightly higher rate of 6.75% for the same period, prospective investors may incline towards the latter for higher returns. To illustrate, consider an investment of Rs. 1,00,000:

– At 6.50%, SBI would offer a maturity amount of approximately Rs. 1,20,896 at the end of 3 years.

– At 6.75%, HDFC’s maturity amount would be almost Rs. 1,21,688 after 3 years.

Albeit the difference appears modest, larger investments magnify this variance, underlining the significance of choosing banks cautiously based on their FD rates.

NBFCs and their Competitive Rates

NBFCs are also potential candidates for offering high FD rates, especially given their need to attract deposits for lending operations. It’s foreseeable that NBFCs might offer higher interest compared to conventional banks in 2025, but investors must be aware of the credit ratings and financial health of these organizations before committing funds.

Factors Influencing FD Rates

Several factors play a pivotal role in driving the rates for fixed deposits:

- Inflation: Higher inflation tends to result in higher FD interest rates as financial institutions aim to offer competitive real returns.

- Monetary Policy: The Reserve Bank of India’s (RBI) policy rates profoundly affect how interest rates are set across banking institutions.

- Economic Outlook: Economic growth projections and fiscal policies may influence bank liquidity, thus affecting FD rate structures.

Tax Implications

Interest earned on FDs is taxable under Indian law as ‘Income from Other Sources’. Investors effective returns are hence influenced by their tax bracket. For instance, in the 20% tax bracket, earning an interest of Rs. 10,000 results in a tax impact of Rs. 2,000, reducing the effective gains.

Calculation of FD Returns

Understanding how to calculate potential returns from FDs can aid in better financial planning:

Maturity Amount = Principal * (1 + (Rate of Interest * Tenure in Years) / 100)

This formula facilitates the computation of returns basis various tenure and interest offers.

Disclaimer:

While the prospect of securing high returns through FDs is enticing, it is imperative for investors to thoroughly examine all associated risks and the economic backdrop. Fixed deposit, albeit safe, are bound by regulatory guidelines and interest rates contingent upon macroeconomic factors. Thus, informed decisions based on comprehensive evaluations are encouraged before investing.

Summary:

Fixed deposits continue to be a vital instrument for ensuring financial security. As 2025 approaches, understanding the trends and factors governing the highest FD rates becomes crucial. Combining both banking and NBFC options, prospective investors can evaluate varying interest rates across tenures to maximize their returns. Calculations demonstrate the tangible impact that differing rates can have on maturity amounts, emphasizing the importance of strategic selection. However, investors should factor in the tax implications of their earnings and gauge the broader economic context. A disclaimer reminding investors to assess all aspects before investing is essential for making sound financial decisions. FDs offer predictable returns, but complete financial diligence and awareness of changing rate structures mark a prudent investment strategy.

- Secure Your Future with the Highest FD (Fixed Deposit ) Rates of 2025

- Fixed deposits continue to be a vital instrument for ensuring financial security. As 2025 approaches, understanding the trends and factors governing the highest FD rates becomes crucial.

- FD

Related posts:

From The First AI Unicorn To The Death Of Angel Tax: The Biggest Highlights For Indian Startups In 2024

From The First AI Unicorn To The Death Of Angel Tax: The Biggest Highlights For Indian Startups In 2024

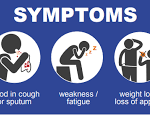

Uncommon Symptoms of TB: When Tuberculosis Affects Other Parts of the Body

Uncommon Symptoms of TB: When Tuberculosis Affects Other Parts of the Body

Winter Park Lawyer: Your Legal Ally in Florida’s Charming City

Winter Park Lawyer: Your Legal Ally in Florida’s Charming City

A Step-by-Step Guide to Private Limited Registration in Bangalore

A Step-by-Step Guide to Private Limited Registration in Bangalore

A Step-by-Step Guide to Private Limited Registration in Bangalore

A Step-by-Step Guide to Private Limited Registration in Bangalore

Rigid Setup Boxes: The Gold Standard in Premium Packaging Excellence

Rigid Setup Boxes: The Gold Standard in Premium Packaging Excellence

Rod Wave has become one of the most influential voices in modern hip-hop, blending emotional lyricism with soulful melodies.

Rod Wave has become one of the most influential voices in modern hip-hop, blending emotional lyricism with soulful melodies.

Speedtimer: A Legacy of Precision Timing and Modern Performance

Speedtimer: A Legacy of Precision Timing and Modern Performance