Electric cars sell in much higher numbers than five years ago. Car makers now offer more models with better driving range. The public shows growing interest in cleaner driving options. Charging points appear in more places across the country now. Roads fill with silent cars that plug in rather than fuel up. This shift marks a huge change in how we think about cars.

Long-term math shows electric cars can save real money. Charging costs much less than filling up with fuel. Fewer moving parts mean fewer things break down over time. Tax breaks and cheaper road fees add to the savings. The true cost looks very different after several years. These facts change how smart buyers view the total cost.

Finding Help with Costs

Running costs drop when you switch to electric power. Home charging costs far less than petrol or diesel. Road tax stays very low for cars with no pipe smoke. Parking comes free in many towns for clean cars. The service bills shrink due to simpler motors. These savings add up to big money over just a few years.

Electric car loans in Ireland match these long-term savings. The loan terms stretch to match the life of the car. Your monthly costs stay low while fuel savings pile up. The math works best when you keep the car for years. Most buyers find the real savings kick in after year two. The full picture shows a much brighter money story.

Electric car loans make sense for many drivers now. The rates keep falling as more banks join this market. Your choice of loan terms grows wider each year. The best deals come when you shop at several banks. Clean cars now make both green sense and money sense. The gap between old and new technology keeps shrinking fast.

Upfront Costs Vs Petrol Cars

Car makers charge more for the newer technology and batteries. The higher cost reflects years of research and fresh parts. Most buyers need to weigh this big start-up cost carefully. The gap between gas and electric prices keeps shrinking each year. Still, the jump feels big when looking at similar car types.

Used electric cars offer a way into this market for less. The supply remains tight since fewer old models exist now. Many early buyers hold their cars longer than gas car owners. This makes finding good used deals harder for most shoppers. The market should open up as more leases end soon. Prices drop each year as more used models hit the lots.

- Check both the total cost and the monthly payments

- Compare similar models across different power types

- Look beyond the first price tag

- Consider how long you’ll keep the car

- Research which grants might help you

Charging and Fuel Costs

Daily running costs show where electric cars truly shine brightest. Home charging costs far less than any gas station visit. The price gap grows wider as fuel costs keep rising. Most owners wake up each day to a fully charged car. The stress of watching fuel prices simply fades away. This daily saving builds into major money over just a few months.

Public charging stations cost more, but still beat fuel prices. Fast chargers help during long trips when time matters most. The network grows wider each month across more areas. Finding a spot to charge gets easier than in past years. The fear of being stranded has faded for most drivers. Planning longer trips just needs a quick app check.

- Save by charging during off-peak hours

- Install a home charger for the best rates

- Track your actual costs with simple apps

- Compare your old fuel bills with new ones

- Switch to the plans made for car charging

Servicing and Maintenance

Electric cars bring peace with far fewer moving parts inside. The oil change reminder becomes a thing of the past. Brakes last much longer thanks to special slowing systems. The cooling system works simply than in gas cars. Many fixes happen through software, not garage visits. This means less time waiting at repair shops.

Car finance for bad credit history opens doors to clean driving. Many lenders now offer special plans for credit-challenged buyers. The focus shifts to current income rather than past mistakes. More options exist now than just a few years back. The trend shows banks wanting to help green car sales. These loans help bridge the credit gap for many shoppers.

Car finance for bad credit often comes with fair rates. The green factor helps offset some of the credit risk. Lenders see the lower running costs as helping with payments. The math works better when fuel savings help pay loans. Many buyers fix their credit scores through these car loans. This creates a double win for those needing fresh starts.

- Apply with proof of steady income

- Seek lenders who focus on green cars

- Prepare a larger down payment if possible

- Show how fuel savings offset payments

- Consider shorter terms for better rates

Tax and Insurance Impact

The tax breaks for clean cars add extra savings yearly. Many places cut or drop yearly fees for zero-emission cars. The savings continue throughout the whole life of the car. These breaks help offset the higher starting price tag. Local rules may add more perks in certain areas. The total tax picture looks much brighter for electric cars.

Parking costs drop or vanish in towns with green goals. Some toll roads offer reduced fees for cars without pipes. City access becomes cheaper or free in traffic-controlled zones. These small savings add up to real money over time. The perks vary widely between different areas, though. Check local rules to see which benefits apply to you.

Conclusion

Loans made just for electric cars offer real help. These loans often come with lower rates than normal car loans. Banks want to back green choices with better terms. The monthly payments feel much easier to handle with good rates. Special loan deals can make electric cars truly cheaper now. The right loan turns a dream car into a real choice.

Green loans show how banks now care about clean choices. The push toward cleaner air gets help from money from firms. Better loan terms mean more electric cars on Irish roads. The banks win new happy clients with these special deals. Your green choice gets backed by smart money plans. The system works for both sides in this deal.

- Are electric cars actually cheaper? A Complete Guide on Electric Cars

- Electric cars can easily cut fuel and service costs, but high prices remain. Check long-term savings, tax perks, and use to know if EVs suit you.

- electric cars, electric car loans in ireland, car finance

Related posts:

Top Electric Vehicle Companies Dominating the Market in 2025

Top Electric Vehicle Companies Dominating the Market in 2025

Electric Car Chargers in the UK – A Complete Guide for EV Owners

Electric Car Chargers in the UK – A Complete Guide for EV Owners

Why Regular E-Bike Repair Is the Secret to a Longer-Lasting Ride?

Why Regular E-Bike Repair Is the Secret to a Longer-Lasting Ride?

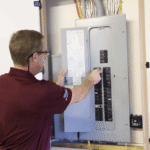

Essential Tips for Residential Panel Replacement in Appleton

Essential Tips for Residential Panel Replacement in Appleton

Do Mobile Repairing Institutes Provide Certification After Course Completion

Do Mobile Repairing Institutes Provide Certification After Course Completion

Safe Driver Dubai: A Smart Way to Travel the City in safe driver dubai

Safe Driver Dubai: A Smart Way to Travel the City in safe driver dubai

What’s the Difference Between Basic and Advanced E-Scooter Repairs?

What’s the Difference Between Basic and Advanced E-Scooter Repairs?

Simplifying Payroll Leading Payroll Outsourcing Company in Mumbai

Simplifying Payroll Leading Payroll Outsourcing Company in Mumbai