Automating Skylines: Global Construction Robot Market 2024-2033

Introduction

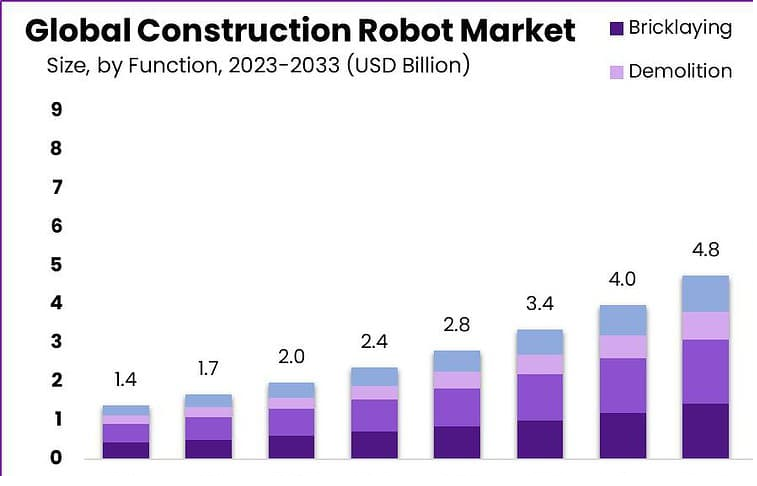

The Global Construction Robot Market is set to surge from USD 1.4 billion in 2023 to USD 8.0 billion by 2033, with a CAGR of 19.1%. Construction robots, integrating AI and automation, enhance precision, safety, and efficiency in building processes. Fueled by labor shortages, escalating construction needs, and technological advancements, the market is revolutionizing residential, commercial, and infrastructure projects. By automating tasks such as material handling and bricklaying, these robots optimize costs and timelines, paving the way for sustainable innovation and growth in the global construction industry.

Key Takeaways

-

Market Surge: From USD 1.4 billion in 2023 to USD 8.0 billion by 2033, at a 19.1% CAGR.

-

Growth Drivers: Labor shortages, construction demand, and AI advancements.

-

Leading Segments: Material handling, articulated robots, and infrastructure dominate.

-

Challenges: High costs, skill gaps, and regulatory complexities.

-

Regional Outlook: North America leads; Asia-Pacific grows fastest due to urbanization.

Function Analysis

Functions encompass material handling, bricklaying, inspection, and finishing. Material handling led with a 48% share in 2023, driven by automated logistics and lifting solutions. Inspection, growing at a 24% CAGR, uses AI for real-time safety and quality checks. Bricklaying and finishing boost precision. Material handling dominates for its efficiency gains, while inspection drives growth by enhancing compliance and reducing risks, significantly elevating productivity and safety on construction sites.

Robot Type Analysis

Robot types include articulated, cartesian, cylindrical, and others. Articulated robots held a 54% share in 2023, valued for their adaptability in complex tasks. Cartesian robots, with a 22% CAGR, excel in linear operations like material transport. Cylindrical robots address niche tasks. Articulated robots lead due to versatility, while cartesian robots fuel growth, enabling precise automation in repetitive construction processes, improving operational efficiency.

End-Use Analysis

End-uses cover residential, commercial, and infrastructure. Infrastructure led with a 44% share in 2023, driven by large-scale projects adopting automation. Commercial, growing at a 19% CAGR, utilizes robots for urban developments. Residential emphasizes cost efficiency. Infrastructure dominates due to high investment, while commercial drives growth, propelled by urbanization and demand for robotic solutions in complex projects.

Genre Analysis

Genres include traditional, robotic-assisted, and fully autonomous construction. Robotic-assisted held a 64% share in 2023, blending human oversight with automation. Fully autonomous, growing at a 25% CAGR, focuses on precision tasks. Traditional methods decline as automation rises. Robotic-assisted leads for its practical adoption, while fully autonomous drives growth, signaling a shift toward AI-driven, labor-efficient construction globally.

Market Segmentation

-

By Function: Material Handling, Bricklaying, Inspection, Finishing

-

By Robot Type: Articulated, Cartesian, Cylindrical, Others

-

By End-Use: Residential, Commercial, Infrastructure

-

By Genre: Traditional, Robotic-Assisted, Fully Autonomous

-

By Region: North America, Asia-Pacific, Europe, Latin America, Middle East & Africa

Restraints

High upfront costs and integration challenges hinder adoption, especially for smaller firms. Skill shortages in managing advanced robots limit deployment. Regulatory uncertainties surrounding safety standards pose risks. Limited awareness in developing regions slows growth. Addressing these demands affordable technologies, training initiatives, and regulatory alignment to ensure scalable robotic adoption in construction.

SWOT Analysis

-

Strengths: Enhanced precision, safety, and efficiency.

-

Weaknesses: High costs, skill shortages, and integration hurdles.

-

Opportunities: Urbanization, automation demand, and AI innovations.

-

Threats: Regulatory complexities and economic uncertainties. This analysis highlights construction robots’ transformative potential while stressing the need to overcome cost and skill barriers for widespread adoption.

Trends and Developments

Trends include AI-driven autonomous robots, 3D printing integration, and IoT-based site monitoring. Investments, like Fastbrick Robotics’ $95 million fund in 2023, spur innovation. Partnerships, such as Husqvarna’s construction collaborations, accelerate adoption. Sustainability and modular construction gain momentum. These trends position construction robots as enablers of efficient, eco-friendly building, emphasizing innovation and scalability across global projects.

Key Player Analysis

Key players include Boston Dynamics, Komatsu, Husqvarna, Fastbrick Robotics, and Ekso Bionics. Boston Dynamics and Komatsu lead with cutting-edge autonomous robots. Husqvarna excels in finishing solutions. Fastbrick focuses on bricklaying automation, while Ekso Bionics develops wearable robotics. Strategic alliances, like Komatsu’s partnerships, and acquisitions strengthen market positions, shaping construction with innovative solutions.

Conclusion

The Global Construction Robot Market, growing from USD 1.4 billion in 2023 to USD 8.0 billion by 2033 at a 19.1% CAGR, is transforming construction. Despite cost and skill challenges, automation drives efficiency. Investments and training will ensure sustainable, innovative growth.

- Automating Skylines: Global Construction Robot Market 2024-2033

- Automating Skylines: Global Construction Robot Market 2024-2033 Introduction The Global Construction Robot Market is set to surge from USD 1.4 billion in 2023 to USD 8.0 billion by 2033, with a CAGR of 19.1%. Construction robots, integrating AI and automation, enhance precision, safety, and efficiency in building processes. Fueled by labor shortages, escalating construction needs, and technological advancements, the market is revolutionizing residential, commercial, and infrastructure projects. By automating tasks such as material handling and bricklaying, these robots optimize costs and timelines, paving the way for sustainable innovation and growth in the global construction industry. Key Takeaways Market Surge: From USD 1.4 billion in 2023 to USD 8.0 billion by 2033, at a 19.1% CAGR. Growth Drivers: Labor shortages, construction demand, and AI advancements. Leading Segments: Material handling, articulated robots, and infrastructure dominate. Challenges: High costs, skill gaps, and regulatory complexities. Regional Outlook: North America leads; Asia-Pacific grows fastest due to urbanization. Function Analysis Functions encompass material handling, bricklaying, inspection, and finishing. Material handling led with a 48% share in 2023, driven by automated logistics and lifting solutions. Inspection, growing at a 24% CAGR, uses AI for real-time safety and quality checks. Bricklaying and finishing boost precision. Material handling dominates for its efficiency gains, while inspection drives growth by enhancing compliance and reducing risks, significantly elevating productivity and safety on construction sites. Robot Type Analysis Robot types include articulated, cartesian, cylindrical, and others. Articulated robots held a 54% share in 2023, valued for their adaptability in complex tasks. Cartesian robots, with a 22% CAGR, excel in linear operations like material transport. Cylindrical robots address niche tasks. Articulated robots lead due to versatility, while cartesian robots fuel growth, enabling precise automation in repetitive construction processes, improving operational efficiency. End-Use Analysis End-uses cover residential, commercial, and infrastructure. Infrastructure led with a 44% share in 2023, driven by large-scale projects adopting automation. Commercial, growing at a 19% CAGR, utilizes robots for urban developments. Residential emphasizes cost efficiency. Infrastructure dominates due to high investment, while commercial drives growth, propelled by urbanization and demand for robotic solutions in complex projects. Genre Analysis Genres include traditional, robotic-assisted, and fully autonomous construction. Robotic-assisted held a 64% share in 2023, blending human oversight with automation. Fully autonomous, growing at a 25% CAGR, focuses on precision tasks. Traditional methods decline as automation rises. Robotic-assisted leads for its practical adoption, while fully autonomous drives growth, signaling a shift toward AI-driven, labor-efficient construction globally. Market Segmentation By Function: Material Handling, Bricklaying, Inspection, Finishing By Robot Type: Articulated, Cartesian, Cylindrical, Others By End-Use: Residential, Commercial, Infrastructure By Genre: Traditional, Robotic-Assisted, Fully Autonomous By Region: North America, Asia-Pacific, Europe, Latin America, Middle East & Africa Restraints High upfront costs and integration challenges hinder adoption, especially for smaller firms. Skill shortages in managing advanced robots limit deployment. Regulatory uncertainties surrounding safety standards pose risks. Limited awareness in developing regions slows growth. Addressing these demands affordable technologies, training initiatives, and regulatory alignment to ensure scalable robotic adoption in construction. SWOT Analysis Strengths: Enhanced precision, safety, and efficiency. Weaknesses: High costs, skill shortages, and integration hurdles. Opportunities: Urbanization, automation demand, and AI innovations. Threats: Regulatory complexities and economic uncertainties. This analysis highlights construction robots’ transformative potential while stressing the need to overcome cost and skill barriers for widespread adoption. Trends and Developments Trends include AI-driven autonomous robots, 3D printing integration, and IoT-based site monitoring. Investments, like Fastbrick Robotics’ $95 million fund in 2023, spur innovation. Partnerships, such as Husqvarna’s construction collaborations, accelerate adoption. Sustainability and modular construction gain momentum. These trends position construction robots as enablers of efficient, eco-friendly building, emphasizing innovation and scalability across global projects. Key Player Analysis Key players include Boston Dynamics, Komatsu, Husqvarna, Fastbrick Robotics, and Ekso Bionics. Boston Dynamics and Komatsu lead with cutting-edge autonomous robots. Husqvarna excels in finishing solutions. Fastbrick focuses on bricklaying automation, while Ekso Bionics develops wearable robotics. Strategic alliances, like Komatsu’s partnerships, and acquisitions strengthen market positions, shaping construction with innovative solutions. Conclusion The Global Construction Robot Market, growing from USD 1.4 billion in 2023 to USD 8.0 billion by 2033 at a 19.1% CAGR, is transforming construction. Despite cost and skill challenges, automation drives efficiency. Investments and training will ensure sustainable, innovative growth.

- construction,

Related posts:

Enjoy Ultra 9000 Box of 10 – Power, Flavour, and Convenience Combined

Enjoy Ultra 9000 Box of 10 – Power, Flavour, and Convenience Combined

Crystal Pro Max + 10000 Box of 10: Long-Lasting Flavour from a Trusted Vape Store in UK

Crystal Pro Max + 10000 Box of 10: Long-Lasting Flavour from a Trusted Vape Store in UK

Outrank Competitors with Help from a Trusted Denver SEO Agency

Outrank Competitors with Help from a Trusted Denver SEO Agency

Marathi Birthday Invitation Card Maker Free – Design Stunning Invites Online

Marathi Birthday Invitation Card Maker Free – Design Stunning Invites Online

Best Inter Colleges In Hyderabad | Shamshabad – Accomplish Academy

Best Inter Colleges In Hyderabad | Shamshabad – Accomplish Academy

Gojek Clone: Launch a Successful All-In-One Service Platform in 2025

Gojek Clone: Launch a Successful All-In-One Service Platform in 2025

Why Search Intent Mapping Is Becoming the New Enterprise Content Strategy

Why Search Intent Mapping Is Becoming the New Enterprise Content Strategy

Discover Expert Massage Therapy Near New Hope with BetterHealthConcept

Discover Expert Massage Therapy Near New Hope with BetterHealthConcept