To many business owners, insurance premiums are just an arbitrary expense or amount paid without a clear notion of how it is arrived at. According to Charles Spinelli, but in reality, every premium amount is calculated based on risk assessment, industry standards, and the specific business operation. Having a clear understanding is equally important for businesses to find that the premium they pay is reasonable, while enabling them to make more informed decisions.

- Industry Risk Classification

One of the fundamental considerations that can affect the premium of business insurance is the type of industry. Insurance companies typically categorize industries on a risk scale according to their claim history and the probability of a claim being made. For example, a construction company is likely to pay higher premiums than a marketing agency would because of the greater chance of injury to an employee, missing a deadline, or defective work.

The nature of business is the foremost consideration in assessing insurance needs. A retail store has a different exposure than a manufacturing facility or a construction business. Physical businesses that have direct interaction with customers usually need general liability and property insurance, while service providers and professionals should be more concerned with professional liability or errors and omissions (E&O) coverage.

Every sector has a classification code utilized by insurers to gauge baseline risk. Companies operating in high-liability industries such as manufacturing, transportation, or healthcare are understandably quoted higher premiums than companies operating in low-risk sectors.

- Business Size and Revenue

According to Charles Spinelli, the business size also plays an important part in deciding premiums. This encompasses factors such as yearly revenue, infrastructure, number of staff, machines, and overall square footage of the work environment. A bigger company generally has more exposure to possible claims, as its greater revenue level also indicates an increase in accountability in the eyes of the insurer.

If a business generates $5 million annually, it could be more liable than a small startup, even if no claims are made. Therefore, premiums would be charged to reflect that premium.

Industry-centric risks and legal mandates are important factors in deciding the right type of business insurance. Typically, different businesses experience unique risks. For instance, workplace injuries are a widespread experience of construction companies, making them legally obligated to get coverage of workers’ compensation insurance. On the other hand, for IT firms, facing cyber threats can happen at any moment. Knowing these legal rules and industry risks helps ensure proper protection, legal compliance, and financial safety against possible claims, lawsuits, or business interruptions.

- Coverage Limits and Deductibles

The amount of coverage business opts for directly influences the premium they are supposed to pay. More coverage will provide better financial protection, but will cost more. On the other hand, lower deductibles lead to higher premiums, given that the insurance company shoulders increased risk on claims.

Business entrepreneurs who wish to pay lower monthly premiums can do the same by increasing their deductibles. However, under such circumstances, they are supposed to pay more from themselves in the event of a claim. Choosing the right balance offers both affordability and protection.

- Claims History and Risk Management

The history of past claims is another driving factor that determines future premiums. An enterprise with a horrible history of high-frequency claims is preserved as a high-risk client. Consequently, this may require them to pay a considerably higher premium, while an experience of denial of coverage is nothing strange. Insurers carefully examine a firm’s history to anticipate future liability.

Conversely, companies that have sound risk management in place—safety training, security measures, and data security protocols—tend to qualify for premium reductions. Most insurers nowadays provide incentiveto companies that undertake proactive steps to minimize their risk exposure.

- Location and Environmental Factors

It is worth noting that the location of a business is another major factor that affects its insurance premium. Regions vulnerable to disasters like hurricanes, floods, or fires could have more expensive property insurance. Businesses located in areas with high crime rates can lead to higher premiums due to higher theft or vandalism coverage.

Knowing how business insurance premiums are set helps owners make smarter decisions. This understanding allows them to manage costs by improving safety, choosing higher deductibles, and focusing on reducing risks.

- Charles Spinelli on How Business Insurance Premiums Are Calculated

- Marketing agency would because of the greater chance of injury to an employee, missing a deadline, or defective work.

- Business Insurance Premiums

Related posts:

Dresses Dry Cleaner services Lisle, IL: BY Napervalue Cleaners

Dresses Dry Cleaner services Lisle, IL: BY Napervalue Cleaners

Easy EMI Card: Your Go-To Solution for Easy Monthly Payments

Easy EMI Card: Your Go-To Solution for Easy Monthly Payments

Syna World Redefining Modern Fashion & Syna Worldwide More Than a Brand

Syna World Redefining Modern Fashion & Syna Worldwide More Than a Brand

How the AED to PKR Open Market Rate Affects Pakistani Expats in UAE

How the AED to PKR Open Market Rate Affects Pakistani Expats in UAE

Top Temperature Data Logger Manufacturers in India – Reliable & Accurate Solutions Powered by Nimbus Technologies

Top Temperature Data Logger Manufacturers in India – Reliable & Accurate Solutions Powered by Nimbus Technologies

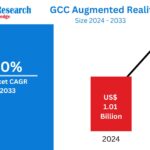

GCC Augmented Reality Market Size, Forecast 2025-2033: A Comprehensive Industry Analysis

GCC Augmented Reality Market Size, Forecast 2025-2033: A Comprehensive Industry Analysis

Embracing the Call — Supporting Life Through Christian Faith

Embracing the Call — Supporting Life Through Christian Faith

CPT vs ICD-10 Codes: What Every Medical Biller Needs to Know

CPT vs ICD-10 Codes: What Every Medical Biller Needs to Know