E-commerce fraud losses are expected to cross $48 billion globally by 2025. That number speaks volumes about how crucial fraud prevention is for online sellers. As digital transactions grow, so do scams, fake disputes, and surprise chargebacks. These issues don’t just cost a single sale—they affect profits, cash flow, and long-term success.

This is where ecommerce account management becomes essential. Working closely with an ecommerce accountant helps reduce financial risks, improve how you handle chargebacks, and protect your business from unnecessary losses.

Understanding E-commerce Fraud and Chargebacks

E-commerce fraud isn’t rare—it’s a growing problem. Every online store is a potential target for scams, many of which go unnoticed until the money is already gone.

Here are the most common types of e-commerce fraud:

- Card-not-present fraud: Criminals use stolen credit card numbers to make online purchases.

- Account takeovers: Hackers gain access to real customer accounts and place unauthorized orders.

- Friendly fraud: A buyer claims they didn’t authorize the charge or didn’t receive the item, even though they did.

Each of these cases often leads to chargebacks, which occur when a cardholder disputes a transaction and the payment is reversed. This means not only lost revenue but added fees and strained relationships with payment processors.

Why Ecommerce Accountants Must Be Involved

An ecommerce accountant near you does more than manage bookkeeping—they spot early warning signs. By analyzing trends, an accountant can help identify fraud risks before they cause damage.

For example, a sudden increase in chargebacks could point to issues with fulfillment, pricing, or checkout errors. With strong ecommerce account management, these trends don’t go unnoticed.

Chargebacks also damage your relationship with payment processors. Too many disputes may lead to increased fees or a frozen merchant account. Proactive accounting helps you avoid this.

Fraud Prevention Through Financial Monitoring

Good accounting habits are key to reducing fraud risks. Here are proven ways to strengthen your financial monitoring:

- Daily reconciliation: Match each order with payment and payout records. This helps catch refund fraud, delays, or missing transactions.

- Cross-check fulfillment data: Ensure every order has tracking numbers, confirmation, and an invoice on file.

- Spot unusual activity: High returns from a specific region or repeated issues from the same buyer may signal fraud.

With strong ecommerce account management, these checks become routine. That means fewer surprises and faster action when something looks off.

Accounting Best Practices for Managing Chargebacks

Chargebacks are part of doing business online, but how you handle them makes a difference. An ecommerce accountant ensures you’re ready to respond.

- Keep digital proof: Save invoices, email confirmations, tracking data, and return requests. These help defend your case.

- Use reason codes: Classify disputes to find out why they happen—fraud, late delivery, or something else.

- Adjust based on trends: If “item not received” is a common reason, you may need to improve your shipping tracking or communication.

When data is organized, accountants can improve your chargeback rate and protect your cash flow.

Tech Tools That Support Prevention

The right tools add another layer of protection to your accounting strategy. These apps integrate with platforms like Shopify or WooCommerce and support fraud prevention directly.

Popular tools include:

- Stripe Radar – Detects fraud patterns using machine learning.

- QuickBooks and Xero – Flag suspicious transactions and refund trends.

- Ecommerce platform filters – Screen high-risk orders in real-time.

With these tools in place and reviewed by an ecommerce accountant, risks are identified faster and handled more effectively.

Strategic Advice from an E-commerce Accountant

Accounting isn’t just about the past—it helps shape better decisions. A qualified ecommerce accountant offers strategic insight:

- Analyze refund trends and return abuse.

- Identify high-risk buyers or markets with frequent disputes.

- Create documentation systems that support faster chargeback responses.

- Improve pricing or promo structures based on chargeback data.

Ecommerce account management is more than spreadsheets. It’s about turning numbers into smarter strategies that reduce risk and increase control.

Final Thoughts and Takeaway

Fraud is rising, and so are chargeback challenges. But with the right accounting support, you’re not left guessing.

Work with an ecommerce accountant near you who understands digital sales, fraud trends, and chargeback risks. They’ll help you build better systems and keep financial surprises to a minimum.

Strong ecommerce account management keeps your online store profitable and protected. Don’t wait for the next chargeback to take action—get the right financial help in place now.

A qualified ecommerce accountant can protect your bottom line and help you build systems that reduce risk. Let your numbers tell the truth—before fraud does.

- E-coE-commerce Fraud & Chargebacks: Preventive Accounting Measuresmmerce Fraud & Chargebacks: Preventive Accounting Measures

- E-comE-commerce fraud losses are expected to cross $48 billion globally by 2025. merce fraud losses are expected to cross $48 billion globally by 2025. That number speaks volumes about how crucial fraud prevention is for online sellers.

- ecommerce account management

Related posts:

Fitness for Mental Clarity: Unlock Your Focus and Inner Strength with DG FIT MIND

Fitness for Mental Clarity: Unlock Your Focus and Inner Strength with DG FIT MIND

Top Carrier Oil Suppliers in India for Bulk & Wholesale Buyers

Top Carrier Oil Suppliers in India for Bulk & Wholesale Buyers

Atlas Pro ONTV : La Révolution de la Télévision par Internet

Atlas Pro ONTV : La Révolution de la Télévision par Internet

Make Your Message Stick: The Power of Flyers & Posters in Plano!

Make Your Message Stick: The Power of Flyers & Posters in Plano!

Integrating Type form with High Level: A Comprehensive Guide

Integrating Type form with High Level: A Comprehensive Guide

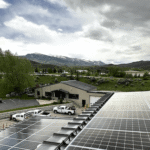

What Solar Looks Like on Flat Roofs, Metal Roofs, and Shingles?

What Solar Looks Like on Flat Roofs, Metal Roofs, and Shingles?

When Best Stock Market Institute Delhi Becomes Your Turning Point Forever

When Best Stock Market Institute Delhi Becomes Your Turning Point Forever

Learn Advanced Derivatives Trading Course from ICFM and Build Expertise in Financial Market Strategies

Learn Advanced Derivatives Trading Course from ICFM and Build Expertise in Financial Market Strategies