Essential Steps to Prepare Your Business for an IPO in India

When preparing for an Initial Public Offering (IPO), businesses often face complex financial and structural challenges, especially if they have recently undergone mergers or acquisitions. In such cases, partnering with experienced m&a advisory firms in Mumbai becomes essential. These firms not only offer strategic guidance during M&A transactions but also ensure your company’s legal, financial, and operational frameworks are aligned with SEBI requirements and market expectations.

Mumbai, being the financial capital of India, is home to some of the most reputed M&A advisors who possess deep domain knowledge and strong networks with investment bankers, legal experts, and institutional investors. Whether it’s restructuring balance sheets, optimizing shareholder value, or managing due diligence, these firms help businesses position themselves effectively for IPO success. Collaborating with trusted m&a advisory firms in Mumbai ensures a smoother transition from private to public ownership with minimized risk and maximized valuation.

What is an IPO?

An Initial Public Offering (IPO) is the process by which a privately held company offers its shares to the public for the first time on a stock exchange. In India, IPOs are governed by the Securities and Exchange Board of India (SEBI). An IPO provides companies with access to public equity capital and enhances their visibility, credibility, and growth opportunities.

Why Consider an IPO in India?

India’s rapidly growing economy and strong investor base make it an attractive destination for companies considering public listings. Here are some reasons to go public in India:

- Access to Capital: Raise funds for expansion, R&D, or debt reduction.

- Liquidity for Shareholders: Enables early investors to monetize their stakes.

- Brand Visibility: Listed companies enjoy higher brand recognition.

- Exit Strategy: A well-planned IPO can provide an effective exit route for venture capitalists or private equity players.

- Valuation Benchmarking: Public trading offers transparent valuation metrics.

Step-by-Step IPO Preparation Process

Step 1: Internal Assessment

Before beginning the IPO journey, assess your company’s:

- Business model sustainability

- Scalability and market positioning

- Financial health and revenue predictability

- Management team’s experience

- Legal and compliance risks

Use tools like a business valuation calculator online or consult IPO experts to understand where your company stands.

Step 2: Hire the Right Advisors

A successful IPO requires a team of experienced professionals:

- Investment Bankers

- Legal Advisors

- IPO Advisory Firms

- Auditors

- Registered Business Valuer

- SEBI-registered Merchant Bankers

Hiring experts—especially those offering IPO advisory services India—can significantly reduce errors and fast-track the listing.

Step 3: Regulatory Compliance and SEBI Guidelines

Companies must comply with SEBI’s Issue of Capital and Disclosure Requirements (ICDR):

- Minimum net tangible assets of ₹3 crores in the last 3 years

- Minimum average pre-tax profit of ₹15 crores in the last 3 years

- Positive net worth

- Proper corporate governance structure

Step 4: Financial Reporting and Audits

You must present:

- Audited financials of the last 3 years

- Quarterly reports

- Restated financial statements in compliance with Ind-AS

- Reconciliations and accounting notes

Ensure your accounting systems are robust. Many companies even hire certified SharePoint experts to manage secure document sharing and compliance documentation.

Step 5: Improve Corporate Governance

Institutional investors and regulators demand strong governance. Ensure:

- Independent directors on board

- Functioning audit and risk committees

- Clear reporting structures

- Internal control systems in place

Step 6: Draft the DRHP

The Draft Red Herring Prospectus (DRHP) outlines the company’s:

- Financials and business overview

- Risk factors

- Use of proceeds

- Industry overview

- Promoter and shareholder information

SEBI reviews and provides observations on the DRHP before final approval.

Step 7: Prepare for Roadshows and Investor Relations

This is when your company markets itself to institutional investors:

- Conduct roadshows

- Arrange one-on-one meetings

- Prepare investor presentations

- Share financial models and growth forecasts

Step 8: Listing on Stock Exchanges

Once SEBI clears the IPO and investors commit, your company gets listed on platforms like:

- BSE (Bombay Stock Exchange)

- NSE (National Stock Exchange)

This marks the transformation from a private to a public company.

How IPO Advisory Services in India Can Help

Engaging with firms that specialize in IPO advisory services India ensures:

- SEBI compliance is maintained

- Accurate business valuation

- Strategic structuring of equity

- Efficient project management from start to listing

- Post-IPO compliance and reporting support

They also coordinate between legal, financial, and operational teams—allowing you to focus on business growth.

Frequently Asked Questions

1.What is the minimum capital requirement to launch an IPO in India?

You need a net tangible asset base of at least ₹3 crores and minimum average profits of ₹15 crores in the last 3 years.

2.What is DRHP?

DRHP stands for Draft Red Herring Prospectus, the preliminary document submitted to SEBI before the IPO.

3.Can a startup go for an IPO?

Yes, if the startup meets SEBI’s financial and governance criteria, it can go public.

4.How long does the IPO process take?

On average, the IPO preparation and execution process takes 6 to 12 months.

5.Do I need a business valuation?

Yes. Engaging a business valuation services in India provider helps accurately assess your company’s worth and investor potential.

Conclusion

Preparing for an IPO in India is a comprehensive journey that requires more than just financial readiness. From ensuring regulatory compliance to refining governance and engaging investors, each step must be executed with precision. Collaborating with experts in IPO advisory services India, such as Mantraa, ensures access to specialized guidance, robust valuation tools, and strategic insight that streamline the listing process.

Whether you’re a fast-growing startup or an established enterprise, going public can be a game-changing move. With Mantraa’s proven track record in IPO readiness and M&A support, businesses can navigate the complexities of the capital market confidently. The key lies in early preparation, the right guidance, and flawless execution.

- How to Prepare for an IPO in India | IPO Advisory Services by Mantraa

- Get a complete guide on how to prepare your business for an IPO in India. Learn about SEBI requirements, DRHP, valuation, and why Mantraa is the trusted IPO advisory partner. Explore IPO advisory services in India and expert support from M&A firms in Mumbai.

- IPO advisory services India, business valuation services in India, m&a advisory firms in Mumbai, IPO preparation guide, company valuation calculator

Related posts:

From The First AI Unicorn To The Death Of Angel Tax: The Biggest Highlights For Indian Startups In 2024

From The First AI Unicorn To The Death Of Angel Tax: The Biggest Highlights For Indian Startups In 2024

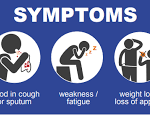

Uncommon Symptoms of TB: When Tuberculosis Affects Other Parts of the Body

Uncommon Symptoms of TB: When Tuberculosis Affects Other Parts of the Body

Winter Park Lawyer: Your Legal Ally in Florida’s Charming City

Winter Park Lawyer: Your Legal Ally in Florida’s Charming City

A Step-by-Step Guide to Private Limited Registration in Bangalore

A Step-by-Step Guide to Private Limited Registration in Bangalore

A Step-by-Step Guide to Private Limited Registration in Bangalore

A Step-by-Step Guide to Private Limited Registration in Bangalore

Rigid Setup Boxes: The Gold Standard in Premium Packaging Excellence

Rigid Setup Boxes: The Gold Standard in Premium Packaging Excellence

Rod Wave has become one of the most influential voices in modern hip-hop, blending emotional lyricism with soulful melodies.

Rod Wave has become one of the most influential voices in modern hip-hop, blending emotional lyricism with soulful melodies.

Speedtimer: A Legacy of Precision Timing and Modern Performance

Speedtimer: A Legacy of Precision Timing and Modern Performance