Few economic events carry as much weight as the U.S. Non-Farm Payroll (NFP) report. Released monthly by the Bureau of Labor Statistics, this report reveals the number of jobs added or lost in the U.S. economy, excluding farm workers and a few other employment categories. While the data itself provides valuable insight into the health of the U.S. labor market, its real power lies in how it moves the markets. For those involved in EUR/USD trading, NFP day is often a high-stakes event that can reshape the short-term and even medium-term direction of the pair.

Jobs Data That Speaks to Traders Everywhere

The significance of the NFP report stems from its direct link to monetary policy. The Federal Reserve closely monitors employment trends when deciding whether to tighten or loosen interest rates. A stronger-than-expected jobs number may signal inflationary pressure, increasing the chances of a rate hike. A weaker figure, on the other hand, might push the Fed toward a more dovish stance.

Since interest rate expectations play a central role in currency valuation, the release of the NFP report creates sharp movements in the dollar. When the dollar strengthens in response to a positive surprise, the euro often weakens against it, pushing EUR/USD lower. This dynamic makes NFP one of the most watched events in EUR/USD trading calendars.

Immediate Reactions and Price Volatility

NFP Fridays often start quietly, with traders waiting for the 8:30 a.m. Eastern Time release. The reaction to the report is typically swift and powerful. Within seconds, EUR/USD can move dozens of pips, making execution and timing critically important. Price often overshoots in the first few minutes, then stabilizes or reverses depending on how the market interprets the full details of the report.

Experienced traders understand that the headline number is only part of the story. Alongside the job additions or losses, the report also includes the unemployment rate and average hourly earnings. These secondary figures can create additional waves of volatility, especially if they contradict the initial data. In EUR/USD trading, the most successful traders look at the full picture before deciding how to act.

Preparing for the Data Before It Hits

Preparation is everything when it comes to trading the NFP. Traders should already know the market consensus, understand recent trends in employment, and identify key technical levels on the chart. Many choose to stay out of the market entirely until after the data is released and the initial reaction settles.

Others may set bracket orders or use tight stops to catch quick moves, but this approach requires experience and a deep understanding of risk management. In EUR/USD trading, the minutes following the NFP release often feel like a pressure test of both strategy and nerves. Having a clear plan in place can make the difference between reacting emotionally and acting with precision.

Impact That Extends Beyond the Initial Spike

The effects of the NFP report are not always limited to the initial surge in volatility. Sometimes the market digests the data throughout the day, adjusting positions and expectations well into the New York session. If the report significantly alters the outlook for Federal Reserve policy, it may influence trends in EUR/USD for days or even weeks to come.

Traders who use higher timeframes should not dismiss the importance of NFP, even if they do not trade the report live. The data may create breakouts, confirm trends, or shift sentiment in ways that impact longer-term setups. In EUR/USD trading, these macro events help frame the broader narrative.

The Non-Farm Payroll report remains one of the most influential economic releases in the financial world. For EUR/USD traders, it offers both danger and opportunity. Navigating it successfully requires awareness, patience, and a willingness to stay disciplined under pressure. Those who treat it with the respect it deserves often find it becomes a valuable part of their trading edge.

Even the best strategy can underperform if executed during the wrong market hours. Timing your entries when volume is thin can lead to false signals and poor follow-through. Conversely, aligning your trades with the most active sessions allows you to take advantage of liquidity, speed, and movement.

Experienced traders in EUR/USD trading do not just ask what setup they are using—they also ask when they are trading it. Timing is not just about getting in and out. It is about choosing the moments when the market is most likely to reward you.

Knowing the best times to trade EUR/USD is not a secret. It is a discipline. And once you build your trading around these windows, your consistency and confidence are likely to improve dramatically.

- EUR/USD and the Impact of Non-Farm Payroll Reports

- For those involved in EUR/USD trading, NFP day is often a high-stakes event that can reshape the short-term and even medium-term direction of the pair.

- EUR/USD trading

Related posts:

Dresses Dry Cleaner services Lisle, IL: BY Napervalue Cleaners

Dresses Dry Cleaner services Lisle, IL: BY Napervalue Cleaners

Easy EMI Card: Your Go-To Solution for Easy Monthly Payments

Easy EMI Card: Your Go-To Solution for Easy Monthly Payments

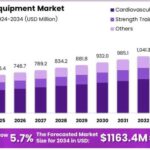

Aqua Gym Equipment Used in Holistic Wellness and Mind-Body Programs

Aqua Gym Equipment Used in Holistic Wellness and Mind-Body Programs

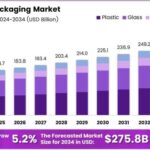

Transparency and Trust Through Beverage Packaging Supports Anti-Counterfeiting Measures

Transparency and Trust Through Beverage Packaging Supports Anti-Counterfeiting Measures

Key Time Management Strategies for Small Business Owners and Freelancers in 2025

Key Time Management Strategies for Small Business Owners and Freelancers in 2025

Sell My House Fast Miramar Florida – Close in as Little as 7 Days

Sell My House Fast Miramar Florida – Close in as Little as 7 Days

Law Notes PDF Download: A Smart Resource for Law Students and Aspirants

Law Notes PDF Download: A Smart Resource for Law Students and Aspirants

A Section 8 Company Registration Process with the ngoexperts

A Section 8 Company Registration Process with the ngoexperts