Navigating the complexities of Goods and Services Tax (GST) compliance can be a daunting task for businesses, especially when it comes to filing the annual return in the form of GSTR-9. For businesses in Hyderabad, OnEasy offers professional, reliable, and accurate GST Annual Return filing services that ensure your compliance is met on time, without any stress or penalties.

Why is GST Annual Return (GSTR-9) Important?

The GST Annual Return, filed through GSTR-9, is a comprehensive summary of all the outward and inward supplies made or received during a financial year. It consolidates the data from your monthly or quarterly GSTR-1, GSTR-2A, GSTR-3B filings and provides a complete picture of your GST compliance for the year.

Filing GSTR-9 correctly is critical because:

-

It helps reconcile the input tax credit claimed during the year.

-

It allows the government to verify the accuracy of returns filed throughout the year.

-

Non-compliance or incorrect filing can lead to penalties and scrutiny from tax authorities.

-

It is mandatory for all regular taxpayers under GST.

Given its importance, accurate and timely filing of GSTR-9 is essential for businesses to remain compliant and avoid legal issues.

Challenges Businesses Face in Filing GSTR-9

Many businesses in Hyderabad, especially SMEs and growing enterprises, struggle with the complexities of GST Annual Return filing due to:

-

The volume and complexity of transactional data across the entire financial year.

-

Reconciliation of sales and purchase data from multiple sources.

-

Identifying and correcting errors or discrepancies in GST returns filed monthly/quarterly.

-

Understanding the latest amendments and compliance requirements.

-

Time constraints and lack of in-house expertise to manage tax filings efficiently.

This is where OnEasy steps in as your trusted partner, offering specialized GST Annual Return filing services tailored for Hyderabad-based businesses.

OnEasy’s Professional GSTR-9 Filing Services in Hyderabad

At OnEasy, we understand the critical nature of GST Annual Return filing and the challenges it brings. Our expert tax professionals bring years of experience in GST compliance and bring you a seamless filing experience. Here’s why businesses in Hyderabad choose OnEasy for GSTR-9 filing:

1. Experienced Tax Professionals

Our team consists of skilled GST consultants and Chartered Accountants who stay updated with the latest GST rules, notifications, and amendments. We ensure that your GSTR-9 return is prepared with utmost accuracy, reflecting all your transactions correctly.

2. Comprehensive Data Reconciliation

One of the major hurdles in annual return filing is reconciling your monthly/quarterly returns (GSTR-1, GSTR-3B) with your purchase registers and input tax credits claimed. We perform meticulous data checks and reconciliation, ensuring that all discrepancies are identified and rectified before filing.

3. Error Identification & Correction

Incorrect or incomplete data can lead to penalties or future scrutiny. OnEasy uses advanced tools and expertise to detect errors such as mismatches in invoice details, missing documents, or unclaimed credits. We help correct these issues proactively to ensure your return is error-free.

4. Timely Filing to Avoid Penalties

GST Annual Return filing has strict deadlines, and late submissions attract hefty penalties. Our streamlined process ensures your GSTR-9 is filed well before the due date, giving you peace of mind and protecting your business from unnecessary financial strain.

5. Customized Solutions for All Business Sizes

Whether you are a sole proprietor, SME, or a large enterprise in Hyderabad, our GST services are tailored to your business size and complexity. We offer flexible packages and transparent pricing to suit your requirements, ensuring value for money.

6. Transparent Pricing & Dedicated Support

At OnEasy, we believe in transparency. You get clear pricing with no hidden costs. Our dedicated support team is available to answer your queries and provide guidance throughout the filing process, making GST compliance hassle-free.

7. Focus on Your Business, Leave GST to Us

We handle the complexities of annual GST compliance while you concentrate on growing your business. With OnEasy managing your GSTR-9 filing, you get expert support, timely updates, and complete peace of mind.

How OnEasy Simplifies GSTR-9 Filing Process

-

Step 1: Submit your transactional data and GST returns filed during the year.

-

Step 2: Our experts review, reconcile, and cross-verify data for accuracy.

-

Step 3: Identify and rectify discrepancies, missing invoices, or mismatches.

-

Step 4: Prepare and draft the GSTR-9 return.

-

Step 5: Review with you for any clarifications.

-

Step 6: File the return on the GST portal before the deadline.

-

Step 7: Provide you with acknowledgment and filing confirmation.

Client Success Stories

Many Hyderabad-based businesses have trusted OnEasy for their GST Annual Return filing needs. Our clients appreciate our professionalism, quick turnaround, and the ease we bring to a complex process. From small retailers to service providers and manufacturers, OnEasy has helped numerous businesses avoid penalties and maintain impeccable GST compliance.

Why Choose OnEasy for GST Annual Return Filing in Hyderabad?

-

Local understanding of Hyderabad’s business environment.

-

Expert knowledge in GST laws and latest amendments.

-

Proven track record of timely and accurate GSTR-9 filings.

-

Advanced technology and tools for data reconciliation.

-

Personalized service with dedicated account managers.

-

Competitive pricing without compromising quality.

Contact OnEasy Today for Stress-Free GSTR-9 Filing

Don’t let GST Annual Return filing become a burden. With OnEasy, you get trusted, expert assistance that guarantees accuracy, compliance, and timely filing of your GSTR-9 in Hyderabad. Avoid penalties, reduce errors, and stay stress-free with our professional GST services.

Reach out to OnEasy today to discuss your GST Annual Return filing needs. Let us simplify the complexities of GST for you and ensure your business stays compliant and focused on growth. Contact us now and experience hassle-free GST Annual Return filing in Hyderabad.

- Food License Registration in Hyderabad | Get FSSAI License - OnEasy

- Looking to start or run a food business? OnEasy offers complete support for Food License Registration in Hyderabad, helping you obtain your FSSAI License quickly and legally. Whether you're opening a restaurant, cloud kitchen, catering service, food truck, or packaged food brand, FSSAI registration is mandatory for compliance and consumer trust. Our experts assist with document preparation, application filing, and follow-up until approval—making Food License Registration in Hyderabad simple and stress-free. We help you choose the right license type: Basic, State, or Central, depending on your business scale. OnEasy ensures your FSSAI License is processed accurately, so you avoid delays, penalties, or rejection. With transparent pricing and professional guidance, we are your trusted partner in setting up a compliant and credible food business. Contact OnEasy today to get your FSSAI License and start operating with confidence and legal clarity.

- Food License Registration in Hyderabad | Get FSSAI License - OnEasy

Related posts:

Enjoy Ultra 9000 Box of 10 – Power, Flavour, and Convenience Combined

Enjoy Ultra 9000 Box of 10 – Power, Flavour, and Convenience Combined

Crystal Pro Max + 10000 Box of 10: Long-Lasting Flavour from a Trusted Vape Store in UK

Crystal Pro Max + 10000 Box of 10: Long-Lasting Flavour from a Trusted Vape Store in UK

How to Style Your XPLR Merch? Master the Look with Confidence and Edge

How to Style Your XPLR Merch? Master the Look with Confidence and Edge

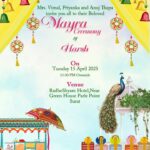

Online Editable Wedding Invitation Cards Free Download – Make Your Wedding Invite Truly Yours

Online Editable Wedding Invitation Cards Free Download – Make Your Wedding Invite Truly Yours

The Essential Guide to Swimming Pool Plant Rooms: Function, Design & Maintenance

The Essential Guide to Swimming Pool Plant Rooms: Function, Design & Maintenance

Data-driven SEO strategies using predictive AI AbdulHadi Blog

Data-driven SEO strategies using predictive AI AbdulHadi Blog

Experienced PIP Attorney – Protecting Your Rights with Mass Pip

Experienced PIP Attorney – Protecting Your Rights with Mass Pip

Top Recommended Materials for Long-Lasting Flat Roof Systems

Top Recommended Materials for Long-Lasting Flat Roof Systems