Introduction

In the fast-evolving world of global commerce, managing trades effectively is more complex than ever. With the explosion of data, volatile markets, evolving regulatory frameworks, and growing client expectations, traditional trade management systems are often inadequate. Enter Artificial Intelligence (AI) and Machine Learning (ML)—technologies that are not only disrupting but also transforming trade management from a reactive function into a proactive, predictive, and strategic component of modern finance.

Definition

Trade management refers to the process of overseeing and controlling the execution of trades in financial markets to maximize returns and minimize risks. It involves planning trade entries and exits, managing position sizes, setting stop-loss and take-profit levels, and adjusting strategies based on market conditions. Effective trade management is essential for maintaining discipline and consistency in both short-term and long-term trading.

Understanding Trade Management

Trade management refers to the entire lifecycle of a trade—from execution to settlement—covering processes like order management, compliance monitoring, risk assessment, reporting, and reconciliation. For decades, these tasks have relied on rule-based systems and manual intervention, often resulting in inefficiencies, errors, and increased operational risk. AI and ML are now addressing these challenges by automating processes, providing intelligent insights, and enhancing decision-making.

The Role of AI and ML in Trade Management

Automated Decision-Making:

AI-driven systems can analyze large volumes of market data in real-time and make trading decisions with minimal human intervention. These systems use algorithms that learn from historical data and current market conditions to suggest or even execute trades that optimize outcomes. This speeds up trade operations and lowers the possibility of human error.

Predictive Analytics and Forecasting:

Machine learning models can identify patterns in historical trade data to forecast future trends, price movements, and market behavior. For instance, ML algorithms can analyze data across commodities, forex, equities, and derivatives to provide early warnings of market shifts. These predictions help traders and managers make more informed decisions, manage risks better, and seize opportunities faster.

Enhanced Risk Management:

Managing risk is key to successful trade management. AI tools can evaluate thousands of variables—including geopolitical developments, market volatility, and credit ratings—to assess risks associated with specific trades or counterparties. ML algorithms continuously learn from new data, allowing risk assessments to become more accurate over time.

In real-time, AI systems can also flag anomalies or suspicious transactions, helping prevent fraud or violations of trading policies. This is especially useful in high-frequency and algorithmic trading environments where manual oversight is impractical.

Compliance and Regulatory Reporting:

Trade management is heavily influenced by regulatory requirements such as MiFID II, Dodd-Frank, and Basel III. These mandates demand extensive data capture, reporting, and transparency. AI can automate the monitoring of compliance rules, flag potential violations, and ensure accurate reporting to regulators.

Natural Language Processing (NLP), a subfield of AI, can extract relevant information from vast documentation and convert it into structured data for compliance audits. This reduces the manual effort of sifting through documents and increases the accuracy of regulatory submissions.

Portfolio Optimization:

Machine learning algorithms can analyze investor behavior, portfolio performance, and market dynamics to offer real-time suggestions for asset allocation and diversification. These tools adjust strategies dynamically based on incoming data, helping fund managers align portfolios with risk tolerance, market conditions, and investment goals.

Post-Trade Processing Efficiency:

AI streamlines post-trade operations like settlement, reconciliation, and reporting. By automating these routine tasks, financial institutions reduce settlement failures, eliminate bottlenecks, and ensure faster transaction closure. Intelligent bots can match trades with confirmations, validate instructions, and detect discrepancies instantly.

Real-World Applications and Case Studies

JPMorgan Chase – COiN:

JPMorgan has developed an AI-powered platform called Contract Intelligence (COiN) that reviews legal documents and extracts key data points with high accuracy. While initially applied to loan agreements, the bank is extending its use to trade documentation, drastically reducing processing time and improving compliance.

BlackRock – Aladdin:

BlackRock’s Aladdin system uses AI and analytics to assess risks and help clients manage their investments. It integrates data from multiple sources to provide a holistic view of portfolios, simulate various scenarios, and suggest optimal trade strategies.

HSBC and IBM Watson:

HSBC partnered with IBM Watson to automate and improve its anti-money laundering (AML) processes. By using machine learning to detect unusual patterns and flag suspicious transactions, HSBC has enhanced trade surveillance and compliance.

Benefits of AI and ML in Trade Management

- Speed and Efficiency: Automation reduces the time needed for trade execution, settlement, and reporting.

- Accuracy: AI reduces human errors and improves data quality, especially in reconciliation and compliance.

- Cost Reduction: Reduce operational costs by automating repetitive and labour-intensive processes.

- Scalability: AI systems can handle increasing transaction volumes without requiring equal increases in resources.

- Strategic Insight: Enhanced analytics allow for better forecasting, decision-making, and risk management.

Challenges and Considerations

While AI and ML offer transformative benefits, their integration into trade management also comes with challenges:

Data Quality and Availability:

AI systems require high-quality, structured, and comprehensive datasets. Poor data hygiene can compromise the effectiveness of ML models. Organisations should invest in strong data governance frameworks.

Model Transparency and Explainability:

Financial institutions must ensure that AI decisions are explainable to regulators, clients, and internal stakeholders. Black-box models can be problematic, especially in compliance and audit scenarios.

Cybersecurity Risks:

AI systems, like all digital infrastructure, are vulnerable to hackers. Firms must ensure that AI deployments are secure and comply with data privacy laws.

Skill Gaps:

There is a scarcity of financial and artificial intelligence workers. Bridging this gap through training and strategic hiring is crucial for successful implementation.

Regulatory Uncertainty:

As AI becomes more entrenched in trade processes, regulators are still catching up. Organisations must maintain agility in order to meet emerging AI-specific compliance needs.

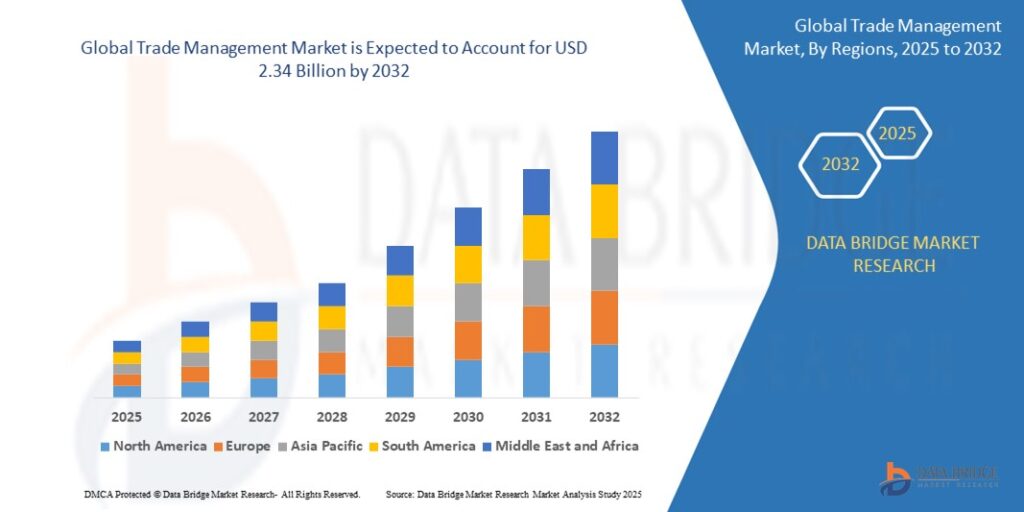

Growth Rate of Trade Management Market

According to Data Bridge Market Research, the Global Trade Management market was valued at USD 1.20 billion in 2024 and is predicted to grow to USD 2.34 billion by 2032, with a CAGR of 8.71% over the forecast period.

Learn More: https://www.databridgemarketresearch.com/reports/global-trade-management-market

The Future Outlook

The role of AI and ML in trade management is poised to expand further. With advancements in technologies such as quantum computing, blockchain integration, and federated learning, we can expect more robust, secure, and collaborative trade ecosystems. Institutions that embrace these innovations will not only gain a competitive edge but also redefine how trade is conducted in a data-driven, globalized economy.

Moreover, as ESG (Environmental, Social, and Governance) considerations become critical in investment strategies, AI can analyze non-financial data – like climate risk or social impact and incorporate these into trade decision-making.

Conclusion

AI and machine learning are no longer experimental in the realm of trade management—they are essential. From improving speed and accuracy to enabling smarter risk management and compliance, these technologies are revolutionizing how trades are handled across the financial world. Organizations that harness the power of AI and ML will not only streamline operations but also elevate trade management to a strategic function that drives innovation, profitability, and resilience in an ever-changing market.

- How AI and Machine Learning Are Revolutionizing Trade Management

- The Trade Management market was valued at USD 4.10 Billion in 2024 and is expected to reach USD 8.20 Billion by 2032, growing at a CAGR of 10.4% (2025-2032). Get insights on trends, segmentation, and key players with Data Bridge Market Research Reports.

- Trade Management Market Size, Trade Management Market Share, Trade Management Market Growth, Trade Management Market Analysis, Trade Management Market Trends, Trade Management Market Forecast, Trade Management Market Segments

Related posts:

Samsung Galaxy S24 Ultra Price in Pakistan: A Closer Look at the Mid-Range Marvel

Samsung Galaxy S24 Ultra Price in Pakistan: A Closer Look at the Mid-Range Marvel

Top Remote Tech Jobs for Beginners in 2025 (No Experience Required)

Top Remote Tech Jobs for Beginners in 2025 (No Experience Required)

What is a step-by-step printer troubleshooting guide for 2025?

What is a step-by-step printer troubleshooting guide for 2025?

The Role of an ATS in Onboarding: Bridging the Gap Between Offer and Start Date

The Role of an ATS in Onboarding: Bridging the Gap Between Offer and Start Date

How Ecommerce ERP Transforms Inventory and Order Management – Rholab

How Ecommerce ERP Transforms Inventory and Order Management – Rholab

Benefits of AI-powered CCTV Cameras for Business Surveillance

Benefits of AI-powered CCTV Cameras for Business Surveillance

Top App Development Agency UK – Transforming Ideas into Apps

Top App Development Agency UK – Transforming Ideas into Apps

Transforming Oil and Gas Operations in Qatar with Microsoft Dynamics 365 Supply Chain Management

Transforming Oil and Gas Operations in Qatar with Microsoft Dynamics 365 Supply Chain Management