Insurance is all about timing, especially when a customer submits a claim in a challenging and stressful time. For many, the anxiety of waiting for an insurance claim to be approved and paid is often the most distressing time of the claim. Previously, with claims, once the forms were completed and sent in, claims were buried beneath the paperwork and the slow approval cycle, with what felt like endless to-and-fro communication resulting in ongoing frustrations and delays.

Into this has stepped technology–like so many industries, digital solutions are being leveraged by insurance companies to enhance claims.

Claims processing software is one of those advancements that have made a difference. The claims processing system automates every part of the claims process, from claim intake and submission to final payout as quickly and simply as possible–reducing claim errors–and makes claims processing quicker and improves productivity.

Virtually all insurance businesses can become less competitive in the hunt for market share and revenue without advances in automation and faster payouts.

In this guide, we’ll review how claims reporting software helps insurers pay claims more quickly and why claims management software is becoming essential for insurance businesses that want to streamline their claims process and stay competitive in the evolving marketplace.

The Challenges of Manual Claims Processing

Before understanding the benefits of modern solutions, it’s useful to reflect on the drawbacks of traditional claims handling:

- Manual data entry: Employees needed to input data manually, which greatly augmented the chances of errors and information inadequacy.

- Paper-based record-keeping: Documentation may get lost or papers to be damaged hence creating hundreds of delays or even days to transfer records across departments.

- Lengthy approvals: There were usually various approvals, which were required at various stages, hence unnecessary delays.

- Communication barriers: back and forth emailing, phone calls may prolong the process, and customers are unaware of the status of their claim.

These pain points resulted in longer turnaround times and poor customer experience, underlining the need for more efficient systems.

How Claims Processing Software Speeds Up Payouts

1. Automated Data Capture & Validation

Claims processing software takes uploaded data (i.e., documents, images, or forms) and automatically extracts data from it. Some more advanced systems utilize technology such as Optical Character Recognition (OCR) and Artificial Intelligence (AI) to validate data immediately for accuracy, simplifying the process and ensuring less human error while also shortening the claims process duration.

2. Standardized Workflows

Claims processing system is built with predictable workflows that help guide claims adjusters through the different phases optimizing the chance that nothing is lost in claims processing. Automated task assignments and notifications make the pace of claims processing more rapid. For example, if a claim is submitted, the software immediately notifies the appropriate team members of the submission and their actions going forward, thus minimizing the chance for lag time.

3. Real Time Tracking and Reporting

Through the claims reporting software, the customers and the insurers can view a real-time claim progress update. The claim status of customers is updated on demand, and insurers gain valuable insights into what is causing a bottleneck or recurring problem. This openness fosters confidence and enables a quick response in case of a delay in a claim.

4. Enhanced Communication

All communication functions are integrated so that all parties can communicate using the software. Adjusters, customers, and other stakeholders will be able to share updates, documents or ask questions without the necessity to use external emails or call. This communication style, which is centralized, enhances speed in making decisions and reduces confusion.

5. Risk checks; Fraud Detection

New-age claims processing software is also fitted with artificial intelligence-based fraud detection features that warn against patterns that look suspicious or duplicate claims. Risk checks are automated and those that involve simple cases can be cleared fast without human adjusters having to sort through manual claims, thus being able to devote more time to special cases.

6. Interoperable Data with Other Systems

The packages that perform claims processing are commonly integrated with CRM, payment gateways as well and accounting. This will make exchange of information between various functions of businesses seamless, and accelerate some of their operations such as payment authorizations, transfer of money to the banks, and notification of customers.

The Role Of Claims Reporting Software in Accuracy and Speed

Easy claim: Claims can be filed through web forms or mobile applications, with useful hints available to help the customers enter all the necessary information in the initial stages.

Automated preliminary duplication: Claims reporting system is able to sort and classify claims according to priority and claims will be triced as they are urgent.

All-inclusive dashboards: Insurers have the ability of accessing dashboards that present claims data and trends, therefore, allowing the insurers to utilize the resources effectively and make process improvements at more efficient rates.

Regulatory compliance checks: Automated systems assist in ensuring that all the required documentation is procured with respect to the industry regulations, this prevents last minute holdups or rejection of documentation.

Final Words

In an age where customer expectations are ultra-high, insurance providers must change to modernize operations. Claims reporting software both are important to getting claim payouts faster, provide confidence in the accuracy of claims, and improve the experience for the customer and insurer.

Claims processing software allows for automation of routinized processes, provides a real-time status, and can transfer data to other company systems. Digital solutions are changing the insurance industry for the better. Any insurer looking to be more efficient and stay competitive must embrace digital claims technology—not an option, but a must.

Give your business a new boost with Datagenix’s cloud-based claim processing system? Call now.

- How Claims Processing Software Supports Faster Claim Payouts

- Discover how claims processing software helps payors and TPAs speed up approvals, reduce errors, and ensure faster, more accurate claim payouts.

- Claims Management Software, Claims Software, Claims Processing Software, TPA Software, Healthcare Claims Management Software,

Related posts:

The Rise of the Probiotic Drink: A Wellness Staple for Gut and Liver Health

The Rise of the Probiotic Drink: A Wellness Staple for Gut and Liver Health

What Happens If I Stop Getting Anti-Wrinkle Treatments? – Learn

What Happens If I Stop Getting Anti-Wrinkle Treatments? – Learn

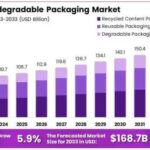

Nature’s Wrap: Exploring the Biodegradable Packaging Revolution

Nature’s Wrap: Exploring the Biodegradable Packaging Revolution

Ashtanga Hridayam Book : The Essence of Ayurveda with CSS Banaras

Ashtanga Hridayam Book : The Essence of Ayurveda with CSS Banaras

How the Neurology and Mental Health Conference 2025 Empowers Patients

How the Neurology and Mental Health Conference 2025 Empowers Patients

Trusted Clinics for Mounjaro Injectables in Islamabad – Guide

Trusted Clinics for Mounjaro Injectables in Islamabad – Guide

Multivitamin and Multimineral Supplements: Do You Need Them for Better Health?

Multivitamin and Multimineral Supplements: Do You Need Them for Better Health?

How Regular Nature Walks Improve Physical And Mental Senior Wellbeing

How Regular Nature Walks Improve Physical And Mental Senior Wellbeing