In today’s fast-paced trading world, algorithmic trading is rapidly transforming how markets operate. For those looking to master this domain, enrolling in a well-designed algo trading course is essential. ICFM – Stock Market Institute offers a highly practical and expertly crafted algo trading course that equips you with the skills to build, test, and execute automated trading strategies in live markets. Unlike general courses available online, ICFM’s program is live, interactive, and built by real traders for serious learners.

If you want to go beyond manual trading and enter the world of logic-based systems, ICFM’s algo trading course is the right choice. Whether you’re a new trader looking to start strong or a professional aiming to scale your edge, this course helps you understand the technology, tools, and mindset required for success.

Why ICFM’s Algo Trading Course Is the Smartest Choice for Today’s Traders

Most retail traders struggle to remain consistent due to emotions, market noise, and human limitations. ICFM’s algo trading course addresses these challenges by helping you automate your trading strategies using rules-based logic and real-time data. The course is structured to take you from foundational concepts to practical implementation with market-tested methods.

ICFM is one of India’s leading institutes for financial education, and its algo trading course is a unique offering not found elsewhere in this format. The institute focuses on live market training, personalized guidance, and full strategy development from scratch.

Students don’t just watch—they build and execute. From coding to testing, every part of the algo trading journey is covered through this focused and professionally guided course.

What You Will Learn in the Algo Trading Course by ICFM

ICFM’s algo trading course begins with the fundamentals of financial markets, algorithmic thinking, and the structure of automated systems. Learners are introduced to trading platforms, APIs, data feeds, and basic coding logic. You’ll understand how to convert trading strategies into code and deploy them on platforms for automated execution.

The course also includes an in-depth understanding of backtesting and optimization. Students learn to test strategies using historical data and fine-tune them for performance. This real-world testing is one of the most important parts of the algo trading course, as it helps traders avoid overfitting and poor execution.

The program covers intraday and positional strategies, event-driven logic, and indicators-based automation. You will gain hands-on experience with tools such as Python, Excel VBA, or trading platforms that support scripting. Each session in the algo trading course builds your capability to run fully automated trades with minimal manual intervention.

Real-Time Practice and Mentorship in Every Algo Trading Class

A highlight of ICFM’s algo trading course is the hands-on practice under the supervision of professional mentors. Unlike online self-paced programs, this course allows you to interact, clarify doubts, and test your logic in live environments. Real-time chart data, trade simulation, and debugging support are integrated into every module.

This real-time guidance makes the learning curve smooth—even for students with limited or no coding background. The instructors simplify every concept and focus on practical implementation, not just theory. Students gradually learn to write clean logic, connect APIs, and monitor algorithm performance in real markets.

ICFM believes that the best way to learn algo trading is by doing—and the course is designed around that philosophy.

Who Should Join ICFM’s Algo Trading Course?

The algo trading course is ideal for traders, finance students, software developers, engineers, analysts, and working professionals who want to apply data-driven logic to financial markets. You don’t need to be an expert programmer. A basic understanding of markets and a willingness to learn technical concepts are enough to get started.

Many students come from non-technical backgrounds and successfully complete the algo trading course with ICFM’s step-by-step approach. Traders frustrated with emotional decision-making find algorithmic trading an ideal solution. Developers looking to apply their coding skills in finance also benefit from this powerful combination.

Whether your goal is personal trading, portfolio management, or building financial technology solutions, this course opens the door to new opportunities.

Career Opportunities After Completing the Algo Trading Course

Completing the algo trading course from ICFM offers several career benefits. Algorithmic trading is a booming field, with financial firms, hedge funds, and fintech companies actively hiring professionals who understand automated systems. After completing the course, students can work as:

-

Quantitative analysts

-

Algo traders

-

Trading system developers

-

Risk model designers

-

Strategy testers and optimizers

ICFM’s certification also adds value to your profile for roles in investment firms and startups. Beyond job roles, the algo trading course enables students to develop their own systems, generate passive income through strategy automation, and trade independently with a structured approach.

How ICFM Ensures the Best Learning Experience for Algo Traders

ICFM ensures that its algo trading course stands out by combining market knowledge with modern tools. The institute uses real-time simulations, interactive coding sessions, and case studies from actual trading environments. You are not left alone with recorded lectures—you get expert mentorship throughout.

The course is designed to match international standards of algo trading education, with updated modules reflecting current market conditions, regulations, and technologies. Whether you attend online or at an ICFM center, you receive full access to trading tools, community discussions, and faculty support.

Conclusion: Enroll in ICFM’s Algo Trading Course to Automate, Analyze, and Trade Smarter

In the modern financial world, the future belongs to traders who combine strategy with automation. ICFM’s algo trading course provides you with the tools, knowledge, and practical experience to become one of them. This course is not just about learning code—it’s about building systems that execute your trading edge without emotional interference.

Whether you’re looking to automate your current strategies, start your journey in fintech, or become a full-time algorithmic trader, ICFM’s algo trading course gives you everything you need. Take the next step in your trading evolution with a course built by traders, for traders—only at ICFM.

Read More Blog:-

https://www.icfmindia.com/blog/the-hidden-power-of-tick-trading-how-to-predict-moves-before-they-happen

- Best Algo Trading Course by ICFM – Learn Strategy Automation

- Join ICFM’s algo trading course to master automated trading strategies, backtesting tools, and live execution. Learn from expert traders and code your edge in markets.

- algo trading course

Related posts:

Easy EMI Card: Your Go-To Solution for Easy Monthly Payments

Easy EMI Card: Your Go-To Solution for Easy Monthly Payments

Essentials Hoodie Design Philosophy: Minimalism Meets Statement

Essentials Hoodie Design Philosophy: Minimalism Meets Statement

When Best Stock Market Institute Delhi Becomes Your Turning Point Forever

When Best Stock Market Institute Delhi Becomes Your Turning Point Forever

Learn Advanced Derivatives Trading Course from ICFM and Build Expertise in Financial Market Strategies

Learn Advanced Derivatives Trading Course from ICFM and Build Expertise in Financial Market Strategies

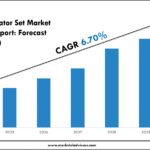

Chile Generator Set Market Trends & Forecast: Outlook to 2030

Chile Generator Set Market Trends & Forecast: Outlook to 2030

Trusted Fiber Laser Cutting Machine Supplier Delivering Advanced Automatic Laser Cutting Machines

Trusted Fiber Laser Cutting Machine Supplier Delivering Advanced Automatic Laser Cutting Machines

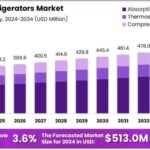

Small-Space Cooling: The Rise of the Minibar Fridge in Minibar Refrigeration

Small-Space Cooling: The Rise of the Minibar Fridge in Minibar Refrigeration

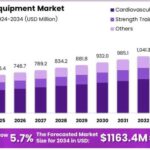

Aqua Gym Equipment Used in Holistic Wellness and Mind-Body Programs

Aqua Gym Equipment Used in Holistic Wellness and Mind-Body Programs