Need Expert Help with Income Tax Return (ITR) Filing for Salaried Employees? OnEasy Has You Covered!

Filing your Income Tax Return (ITR) correctly and on time is one of the most important financial responsibilities for salaried employees. It not only ensures compliance with the law but also helps you claim rightful deductions, avoid penalties, and even receive refunds where applicable. However, the process can often be confusing, especially with changing tax laws, numerous deduction options, and technical jargon.

That’s where OnEasy steps in—offering fast, accurate, and affordable ITR filing services tailored specifically for salaried employees across industries in India. Our experienced tax professionals simplify the entire process for you, making your tax filing stress-free and ensuring you get the maximum benefits under the law.

Why Is Income Tax Return Filing Important for Salaried Employees?

While your employer deducts TDS (Tax Deducted at Source) from your salary every month, filing your annual ITR is crucial to reconcile your actual income and tax paid. It helps you:

-

Stay fully compliant with Income Tax laws

-

Claim deductions under sections such as 80C (investments), 80D (medical insurance), HRA (House Rent Allowance), and more

-

Receive refunds for excess tax paid

-

Maintain a record of your financial transactions for future reference

-

Avoid penalties or notices from the Income Tax Department

-

Build a strong financial profile required for loans, visas, and other official processes

Which ITR Forms Are Applicable for Salaried Employees?

Depending on your income sources and other financial details, the applicable ITR forms for salaried individuals include:

-

ITR-1 (Sahaj): For individuals with income up to ₹50 lakh from salary, one house property, and other sources (excluding lottery and income from racehorses)

-

ITR-2: For individuals earning salary income but having income from capital gains, multiple house properties, or other sources

-

Other forms may apply if you have complex income sources or business income

OnEasy helps you determine the correct form and file it seamlessly to avoid rejections or notices.

How Does OnEasy Simplify ITR Filing for Salaried Employees?

Filing your ITR with OnEasy means expert support at every step—starting from gathering your financial documents to e-filing and beyond.

1. Form 16 Review & Income Verification

We start by reviewing your Form 16 (issued by your employer) to verify salary income, TDS deductions, and other components such as allowances and perquisites. Our experts ensure that all income heads are correctly declared and reconciled with the TDS data filed by your employer.

2. Maximizing Deduction Claims

Many salaried individuals miss out on valuable deductions that can significantly reduce taxable income. Our tax consultants help you claim deductions under key sections including:

-

Section 80C: Investments like PF, PPF, NSC, ELSS, LIC premiums (up to ₹1.5 lakh)

-

Section 80D: Health insurance premiums for self, family, and parents

-

Section 10(13A): House Rent Allowance (HRA) exemptions

-

Section 24(b): Home loan interest deduction

-

Other relevant sections based on your eligibility

By optimizing deductions, we help lower your tax liability and maximize refunds.

3. Accurate Tax Calculation & Filing

We calculate your tax payable or refundable accurately based on your income and deductions. Our team prepares your tax return ensuring no errors, and files it electronically on your behalf through the official Income Tax Department portal.

4. TDS Reconciliation

Mismatch between your TDS records and Form 26AS can trigger notices or delay refunds. We cross-check all TDS details, resolve discrepancies, and ensure smooth processing of your tax return.

5. Timely Filing to Avoid Penalties

OnEasy tracks deadlines to ensure your ITR is filed well before the due date. Avoid the late filing fees, interest, and complications with our timely and reliable service.

6. Post-Filing Support

Filing your return is just the beginning. We assist with:

-

Notice handling: If you receive any communication from the Income Tax Department, we help you respond promptly and correctly

-

Refund tracking: Monitor your tax refund status and follow up for faster disbursal

-

Tax planning: Year-round advisory to optimize your tax-saving strategies for future years

Why Choose OnEasy for Your ITR Filing?

-

Experienced Tax Experts: Our professionals stay updated with the latest tax rules and exemptions to provide accurate advice.

-

User-Friendly Process: Submit your documents online or offline, and let us handle the complexities.

-

Transparent Pricing: No hidden charges—just straightforward, affordable fees.

-

Confidentiality Guaranteed: Your financial information is handled securely and with utmost privacy.

-

Dedicated Customer Support: We’re here to answer your questions and assist throughout the filing process.

Hear from Our Satisfied Clients

“I was unsure about filing my ITR for the first time, but OnEasy made the whole experience simple and smooth. They helped me claim deductions I didn’t know about and got my refund quickly.” – Priya M., IT Professional, Hyderabad

“Professional and prompt service! OnEasy reviewed my Form 16 carefully and ensured everything was filed correctly before the deadline.” – Rakesh K., Marketing Manager

Ready to File Your Income Tax Return?

Don’t let tax season stress you out. With OnEasy, you get a trusted partner to file your Income Tax Return accurately, quickly, and affordably.

Contact OnEasy Today

Get in touch to start your hassle-free ITR filing journey for salaried employees. File with confidence, avoid penalties, and maximize your refund with expert help.

- Income Tax Return (ITR) Filing for Salaried Employees - OnEasy

- Need expert help with Income Tax Return (ITR) Filing for Salaried Employees? OnEasy offers fast, accurate, and affordable ITR filing services tailored for salaried professionals across sectors. Our tax experts ensure correct income declaration, maximum deduction claims under sections like 80C, 80D, HRA, and more, while keeping you fully compliant with income tax laws. Whether you're filing ITR-1 or ITR-2, we simplify the process, review Form 16, reconcile TDS, and make sure your return is filed on time. With OnEasy, Income Tax Return (ITR) Filing for Salaried Employees becomes stress-free and efficient. We also assist with notice handling, refund tracking, and year-round tax planning. No hidden charges, no delays—just professional tax filing with full support. Let OnEasy help you file your return accurately and maximize your refund. Contact us today and file your ITR with confidence.

- Income Tax Return (ITR) Filing for Salaried Employees - OnEasy

Related posts:

Crystal Pro Max + 10000 Box of 10: Long-Lasting Flavour from a Trusted Vape Store in UK

Crystal Pro Max + 10000 Box of 10: Long-Lasting Flavour from a Trusted Vape Store in UK

How to Style Your XPLR Merch? Master the Look with Confidence and Edge

How to Style Your XPLR Merch? Master the Look with Confidence and Edge

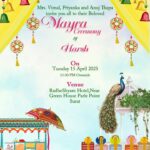

Online Editable Wedding Invitation Cards Free Download – Make Your Wedding Invite Truly Yours

Online Editable Wedding Invitation Cards Free Download – Make Your Wedding Invite Truly Yours

Best Junior Colleges for CEC | Shamshabad | Hyderabad – Accomplish Academy

Best Junior Colleges for CEC | Shamshabad | Hyderabad – Accomplish Academy

The Essential Guide to Swimming Pool Plant Rooms: Function, Design & Maintenance

The Essential Guide to Swimming Pool Plant Rooms: Function, Design & Maintenance

Data-driven SEO strategies using predictive AI AbdulHadi Blog

Data-driven SEO strategies using predictive AI AbdulHadi Blog

Experienced PIP Attorney – Protecting Your Rights with Mass Pip

Experienced PIP Attorney – Protecting Your Rights with Mass Pip

Top Recommended Materials for Long-Lasting Flat Roof Systems

Top Recommended Materials for Long-Lasting Flat Roof Systems