Buying a dream home is a significant milestone, and with the right financial support, it becomes easier and more affordable. PNB Housing proudly introduces the Roshni Home Loan scheme, designed to help aspiring homeowners secure their ideal property with attractive benefits and flexible terms. In this article, we’ll explore the eligibility criteria, key benefits, and the simple application process for the Roshni Home Loan.

What is the Roshni Home Loan Scheme?

The Roshni Home Loan by PNB Housing is a tailored housing finance product aimed at making home ownership accessible to a wide range of customers. Whether you are a first-time buyer or looking to upgrade your living space, this scheme offers competitive interest rates, flexible repayment options, and quick processing to make your home-buying journey smooth and hassle-free.

Eligibility Criteria for Roshni Home Loan

To apply for the Roshni Home Loan, you must meet the following basic eligibility conditions:

-

Age: The applicant should be between 21 and 65 years at the time of loan maturity.

-

Income: Both salaried and self-employed individuals with a steady income source are eligible.

-

Property Type: The scheme supports residential properties including apartments, independent houses, and flats.

-

Employment Status: Salaried professionals with a minimum of 2 years of continuous employment and self-employed individuals with at least 3 years in business can apply.

-

Credit History: A good credit score and history of timely repayments enhance loan approval chances.

PNB Housing may have additional criteria depending on the applicant’s profile, but these are the general guidelines.

Benefits of the Roshni Home Loan Scheme

The Roshni Home Loan offers several attractive benefits that distinguish it from other housing finance options:

-

Competitive Interest Rates: PNB Housing offers interest rates that are among the most affordable in the market, making monthly EMIs manageable.

-

Flexible Tenure: Loan tenures up to 30 years allow you to choose repayment terms that best fit your financial planning.

-

Minimal Processing Fees: The scheme comes with low processing charges, reducing the upfront cost of taking the loan.

-

Quick Approval & Disbursal: With a streamlined application process, you can expect faster loan sanctioning and disbursal.

-

Balance Transfer Facility: Existing home loan borrowers can transfer their loans to PNB Housing under the Roshni scheme for better interest rates and service.

-

Tax Benefits: Loan repayment interest and principal qualify for tax deductions under Section 80C and 24(b) of the Income Tax Act, saving you money in the long run.

How to Apply for the Roshni Home Loan

Applying for the Roshni Home Loan with PNB Housing is straightforward:

-

Check Eligibility: Review your income, age, and property status to ensure you meet the basic criteria.

-

Prepare Documents: Gather essential documents like identity proof, address proof, income proof (salary slips, bank statements), property papers, and KYC details.

-

Submit Application: Visit the nearest PNB Housing branch or apply online through the official website by filling out the home loan application form.

-

Verification & Approval: The PNB Housing team will verify your documents and conduct a credit assessment.

-

Loan Sanction & Disbursal: Upon approval, the loan amount will be disbursed directly to the seller or builder as per the agreement.

PNB Housing offers expert assistance throughout the process, ensuring clarity and support at every step.

Conclusion

The Roshni Home Loan scheme by PNB Housing is a customer-friendly and affordable financing option for anyone looking to invest in a new home. With flexible eligibility, attractive benefits, and a simple application process, this scheme lights the path to your dream home with ease. If you’re ready to make that big move, the Roshni Home Loan is the perfect partner to help you turn your aspirations into reality.

For more details and to apply, visit the official PNB Housing website or your nearest branch today!

- Roshni Home Loan Scheme : Eligibility, Benefits & How to Apply

- The Roshni Home Loan scheme by PNB Housing is a customer-friendly and affordable financing option for anyone looking to invest in a new home.

- Roshni Home Loan

Related posts:

Easy EMI Card: Your Go-To Solution for Easy Monthly Payments

Easy EMI Card: Your Go-To Solution for Easy Monthly Payments

Syna World Redefining Modern Fashion & Syna Worldwide More Than a Brand

Syna World Redefining Modern Fashion & Syna Worldwide More Than a Brand

How the AED to PKR Open Market Rate Affects Pakistani Expats in UAE

How the AED to PKR Open Market Rate Affects Pakistani Expats in UAE

Top Temperature Data Logger Manufacturers in India – Reliable & Accurate Solutions Powered by Nimbus Technologies

Top Temperature Data Logger Manufacturers in India – Reliable & Accurate Solutions Powered by Nimbus Technologies

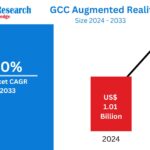

GCC Augmented Reality Market Size, Forecast 2025-2033: A Comprehensive Industry Analysis

GCC Augmented Reality Market Size, Forecast 2025-2033: A Comprehensive Industry Analysis

Embracing the Call — Supporting Life Through Christian Faith

Embracing the Call — Supporting Life Through Christian Faith

Make Waves on Your Birthday with SunFunFTL’s Luxury Boat Rentals in Fort Lauderdale

Make Waves on Your Birthday with SunFunFTL’s Luxury Boat Rentals in Fort Lauderdale

Biodegradable Packaging Trends Across Asia-Pacific & Global Markets

Biodegradable Packaging Trends Across Asia-Pacific & Global Markets