Introduction: Chasing Powder and Profits

How Snowboarding Became Big Business

Snowboarding didn’t start out sleek. It was raw, rebellious, and deeply rooted in counterculture. But what was once a fringe winter activity has carved out a lucrative space in the global sports gear economy. Over the past two decades, snowboarding has transformed into a commercial powerhouse, particularly in North America, Europe, and the rapidly rising Asia-Pacific market.

For more info visit : https://market.us/report/snowboard-equipment-market/

Breaking Down the Gear Game

Boards, Boots, Bindings: The Core Product Segments

Let’s talk product. The market revolves around three main pillars: boards, boots, and bindings. Each plays a distinct role, both functionally and financially.

Boards take up the largest chunk of the market share. There’s a wide array—freestyle decks, all-mountain cruisers, backcountry powder boards. Materials have evolved from simple wood cores to sophisticated composites with torsional stiffness and responsive flex patterns. Riders now look for versatility and durability without compromising speed or control.

Boots have come a long way from the rigid, ankle-bruising models of the ’90s. Today, it’s all about ergonomic fit, lightweight construction, and tech like BOA lacing systems or heat-moldable liners. The goal? Maximum support with zero foot fatigue.

Bindings might be the most underappreciated yet crucial component. They connect the rider to the board, and every millimeter matters. Recent innovations include step-in mechanisms, adjustable highbacks, and shock-absorbing footbeds that cater to aggressive and casual riders alike.

Together, these segments create an ecosystem where performance, customization, and brand differentiation are king.

For more info visit : https://market.us/report/snowboard-equipment-market/

What’s Fueling the Ride?

Pop Culture, Tourism, and the Allure of the Alpine

So what’s driving demand? First up: pop culture. Snowboarding is visually addictive. It dominates winter sports highlight reels and social feeds alike. With influencers shredding in slow motion on Instagram and Olympic athletes turning heads every four years, the sport stays relevant and aspirational.

Tourism plays a massive role too. Ski towns are evolving into winter wonderlands, offering terrain parks, luxury lodges, and full-service rentals. Resorts in Japan, Switzerland, Canada, and even China are drawing global crowds. More people hitting the slopes equals more gear flying off the shelves.

Lastly, snowboarding is no longer a niche scene. It’s now seen as a stylish, high-adrenaline lifestyle. Brands capitalize on this by blending function with fashion—think sleek graphics, edgy branding, and collabs with streetwear labels. For many consumers, buying a board is as much about aesthetics as it is about carving through powder.

Slippery Slopes: Market Headwinds

Environmental Uncertainty and Industry Seasonality

It’s not all bluebird days and deep snow. The snowboard equipment market is staring down a few cold realities.

The biggest? Climate change. Shorter winters, erratic snow conditions, and melting glaciers are becoming the norm, not the exception. Resorts in lower altitudes are struggling to maintain consistent snowpack, leading to fewer visitors and shrinking equipment sales in some regions.

There’s also the issue of seasonality. Unlike basketball or running, snowboarding is confined to a tight seasonal window. That means manufacturers and retailers have to forecast demand with precision or risk being buried under unsold inventory.

And then there’s the learning curve. Snowboarding is intimidating for beginners. The initial investment—both in time and money—can be steep. If new users don’t stick with it, the long-term value of customer acquisition drops significantly.

The Future’s Got Grip

Smart Tech, Green Materials, and Subscription Gear

Despite the hurdles, the future of snowboard equipment is anything but static. Innovation is dropping in hard.

First, smart tech. Boards are being embedded with sensors that track airtime, speed, G-force, and terrain adaptation. Mobile apps sync data, helping riders fine-tune their skills. This digitization is opening up a whole new frontier for performance analytics.

Next, sustainability is moving from niche to necessity. Brands are experimenting with bio-based resins, recycled edges, and responsibly sourced wood cores. Eco-conscious consumers are demanding products that don’t trash the mountains they love to ride.

And then there’s the subscription model. Much like fashion or tech, snowboard gear is heading toward access over ownership. Services offering seasonal rentals or rotating gear memberships are becoming popular among urban riders and casual participants. It reduces upfront costs, minimizes waste, and keeps riders equipped with the latest models every year.

Conclusion: Beyond the Bindings

The snowboard equipment market is riding a fascinating edge—balancing performance with personality, heritage with innovation. It’s a world shaped by adrenaline, culture, and technology, and it’s evolving fast. As snowboarding continues to grow as both a sport and a statement, the gear game will only get sharper, smarter, and more sustainable. The only real question is—are the brands ready to keep up with the ride?

- Snowboard Equipment Market Rides High on Innovation and Lifestyle Trends

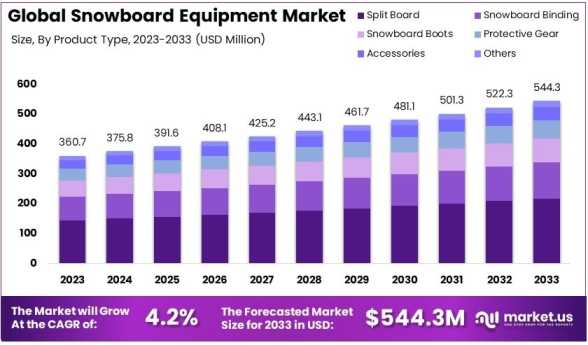

- Snowboard Equipment Market size is expected around USD 544.3 Million by 2033, from USD 360.7 Million in 2023, growing at a CAGR of 4.2%.

- snowboardingindustry, wintergear

Related posts:

Start Your Child in Boxing: A Practical Parent’s Guide Boxing isn’t just for adults—it’s becoming one of the most popular sports for children. From building discipline to improving fitness, it offers a fun and engaging way for kids to grow stronger, inside and out. If you’re exploring boxing as a sport for your child, understanding the right is a great place to start.

Start Your Child in Boxing: A Practical Parent’s Guide Boxing isn’t just for adults—it’s becoming one of the most popular sports for children. From building discipline to improving fitness, it offers a fun and engaging way for kids to grow stronger, inside and out. If you’re exploring boxing as a sport for your child, understanding the right is a great place to start.

Top Five Fantasy Sports Mistakes and Smart Ways to Avoid Them

Top Five Fantasy Sports Mistakes and Smart Ways to Avoid Them

Real Winnings And Real Bonuses With reals Cricket Betting ID

Real Winnings And Real Bonuses With reals Cricket Betting ID

Top 5 Cast Nets for Sale: Pairing Them with Sinker Moulds for Optimal Performance

Top 5 Cast Nets for Sale: Pairing Them with Sinker Moulds for Optimal Performance

Kheloyaar 8 Exclusive Bonus and reward Only for Kheloyaar Players

Kheloyaar 8 Exclusive Bonus and reward Only for Kheloyaar Players

Online Cricket ID Turn Passion into Profit with a Betting ID

Online Cricket ID Turn Passion into Profit with a Betting ID

Mastermind Concealed Carry Wedge – A Smart Upgrade for Your Holster Setup

Mastermind Concealed Carry Wedge – A Smart Upgrade for Your Holster Setup

Online Cricket ID WhatsApp Number: Register & Get Instant Bonus Offers

Online Cricket ID WhatsApp Number: Register & Get Instant Bonus Offers