Investing in life insurance is one of the most important steps you can take to safeguard your family’s financial wellbeing. A suitable policy creates a safety net for your loved ones by offering financial protection in exchange for regular premium payments. While life insurance plans are designed to serve this essential purpose, the amount you pay as premium is influenced by a combination of factors.

Many people are surprised to discover that their lifestyle choices can directly affect their premiums. The way you live, the activities you engage in, and your daily habits can all play a role in determining how much you pay for coverage. Understanding these factors will help you make informed decisions when comparing the many types of life insurance available.

Understanding life insurance premiums

A life insurance premium is a fixed payment you must make to maintain your policy. Timely payment ensures your family receives the agreed benefits if something happens to you. Although the concept appears simple, insurers consider several variables to calculate premiums.

Some of the most important factors are:

- Age: Younger individuals pay lower premiums because they are statistically healthier and less likely to pass away during the policy term.

- Gender: Insurers consider life expectancy statistics. In India, women tend to live longer than men, which usually results in lower premiums for female policyholders.

- Family medical history: If your family has a record of critical illnesses such as heart disease, cancer, or diabetes, you may pay higher premiums to account for this additional risk.

- Pre-existing conditions: Health conditions diagnosed before applying for life insurance can also increase premiums. The impact depends on the severity and nature of the condition.

- Sum assured and policy term: Higher coverage and longer policy durations usually lead to higher premiums.

While these elements form the foundation of premium calculation, your lifestyle choices can also have a considerable impact.

Lifestyle factors affecting premiums

Health and medical condition

Your current health and medical records are among the most significant considerations when determining premium costs. Insurers often request a medical examination or recent health reports to evaluate your risk profile.

Factors such as high blood pressure, obesity, and chronic diseases can result in higher premiums because they increase the chance of early claims. By maintaining a healthy lifestyle, you demonstrate lower risk and may qualify for more affordable premiums.

Smoking and substance use

One of the most well-known lifestyle habits affecting life insurance premiums is smoking. Tobacco consumption significantly raises the likelihood of developing heart disease, cancer, and respiratory illnesses.

Most insurers classify applicants as smokers even if they only use tobacco occasionally. Smoking can nearly double your premium compared to non-smokers. The same applies to alcohol and recreational drug use. Insurers consider frequent substance consumption a serious health risk, which is reflected in higher premium charges.

Occupation and hobbies

Your job and leisure activities can also increase the cost of life insurance. People working in high-risk professions such as mining, oil and gas, or construction face greater chances of accidents or hazardous exposure.

Similarly, adventurous hobbies such as scuba diving, rock climbing, or paragliding are considered risky. If you participate in these activities regularly, insurers may apply higher premiums or specific exclusions in your policy.

Diet and exercise habits

Maintaining a balanced diet and exercising regularly contribute to better health outcomes. Insurers consider applicants with healthy body weight and active lifestyles lower risk.

On the other hand, a sedentary lifestyle and unhealthy eating can lead to obesity, diabetes, and other health concerns, increasing premiums. By adopting healthier habits, you not only improve your overall wellbeing but also make yourself eligible for more competitive insurance rates.

Steps to lower your life insurance premiums

While some factors, such as age or family history, are beyond your control, you can still take steps to improve your lifestyle and lower your premium over time:

- Quit smoking: Stopping tobacco use significantly reduces your risk profile. Many insurers offer non-smoker rates to applicants who have quit for at least 12 months.

- Maintain a healthy weight: Eating nutritious food and staying active can help you reach a healthier body mass index, reducing your likelihood of chronic conditions.

- Manage pre-existing conditions: Regular check-ups and medication adherence help control health issues and demonstrate commitment to good health.

- Reduce high-risk activities: Limiting participation in dangerous sports or occupations can lower the premium.

- Choose the right type of life insurance: Evaluate the different types of life insurance such as term insurance, endowment plans, and unit-linked plans to find the one that suits your needs and budget.

Making these adjustments can improve not only your insurance profile but also your quality of life.

Conclusion

Every lifestyle choice you make shapes your future in more ways than you may realise. Your diet, exercise habits, professional activities, and personal behaviour all have a direct influence on your health and, consequently, the premiums you pay for life insurance.

If you are considering purchasing coverage, understanding these factors will help you select a suitable policy from the many types of life insurance available. By adopting healthier practices and reducing unnecessary risks, you can enjoy the dual benefit of better health and more affordable protection for your family. Thoughtful planning today will secure your loved ones’ future with confidence and peace of mind.

- The Impact of Lifestyle Choices on Life Insurance Premiums

- A life insurance premium is a fixed payment you must make to maintain your policy. Timely payment ensures your family receives

- Life Insurance

Related posts:

Luxury or Budget? Finding the Right Heathrow Transfer for You

Luxury or Budget? Finding the Right Heathrow Transfer for You

What Is Cold Rolled Stainless Steel Coil and Why Does It Matter?

What Is Cold Rolled Stainless Steel Coil and Why Does It Matter?

Make Impact with Commercial Signs Raleigh NC: A Strategic Guide to Business Success

Make Impact with Commercial Signs Raleigh NC: A Strategic Guide to Business Success

PEX vs Copper in New Homes: What’s Right for You? | Creative Repipe

PEX vs Copper in New Homes: What’s Right for You? | Creative Repipe

Top Benefits of Professional Roller Shutter Repair in London

Top Benefits of Professional Roller Shutter Repair in London

What to Expect When Buying a Solar Battery Locally – Pricing, Quality, and Local Support Insights

What to Expect When Buying a Solar Battery Locally – Pricing, Quality, and Local Support Insights

Integrating Type form with High Level: A Comprehensive Guide

Integrating Type form with High Level: A Comprehensive Guide

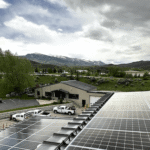

What Solar Looks Like on Flat Roofs, Metal Roofs, and Shingles?

What Solar Looks Like on Flat Roofs, Metal Roofs, and Shingles?