Step-Up SIP Strategy: Invest More As You Earn More

Want your investments to evolve with your career? A Step-Up SIP helps your portfolio grow as your income grows—perfect for Indian professionals. It’s a steady way to beat inflation and achieve your financial milestones.

Try the Step Up SIP Calculator to preview the financial power of this strategy.

What Is Step-Up SIP?

A Stеp-Up SIP is an advanced version of thе rеgular SIP (Systеmatic Invеstmеnt Plan). In a standard SIP, you invеst a fixеd amount monthly. Howеvеr, in a Stеp-Up SIP, thе amount increases annually by a fixed sum or pеrcеntagе. This is еspеcially usеful in India, whеrе many profеssionals rеcеivе yеarly salary hikеs.

It’s designed to match thе increase in disposable income whilе targеting long-tеrm wealth creation. Think of it as giving your invеstmеnt a boost еvеry yеаr, without thе strеss of a largе upfront amount.

Working Model of Step-Up SIP

It promotes disciplined investing with an increasing pattern over time. Let’s look

Fixed-Increment Step-Up SIP

You raise your SIP by a fixed amount yearly.

Scenario:

- Start with ₹5,000/month

- Add ₹1,000 yearly

- Year 2: ₹6,000

- Year 3: ₹7,000

- And so on

This option suits those who receive consistent annual hikes.

Percentage-Based Step-Up SIP

Here, your SIP grows by a fixed percentage of the previous amount.

Scenario:

- Start: ₹5,000/month

- Year 2: ₹5,500 (10% up)

- Year 3: ₹6,050

- Year 4: ₹6,655

It’s ideal if your earnings increase in percentages. Use the HDFC SIP Calculator to simulate potential corpus based on these increases.

Benefits of Step-Up SIP

- Income-Synced Investing: Grow investments with salary.

- Stay Ahead of Inflation: Contribute more every year.

- Auto-Mode Investing: Set up once and stay hands-free.

- Beginner Friendly: Start small, grow with ease.

Start, make sure you understand how to open Demat account for investing via online platforms.

Why Step-Up SIP Makes Sense

- Boosted Wealth Creation: Annual top-ups lead to larger maturity amounts.

- Automation Advantage: No need to manually adjust investments.

- Goal-Centric Planning: Helps fund long-term objectives.

- App Support: Use a SIP App to manage and track growth effortlessly.

How to Start a Step-Up SIP in India

Getting started is simple:

- Pick a trusted platform offering user-friendly interfaces and easy SIP setup, tracking, and management for Indian investors.

- Choose funds based on your risk profile. Equity funds suit aggressive investors, while hybrid or debt funds are better for conservative ones aiming for stable, lower-risk returns over time.

- Decide on your starting monthly SIP amount. Make sure it fits your current budget comfortably while supporting long-term goals like retirement, home buying, or your child’s education.

- Set up the Step-Up option by choosing a fixed annual increase or percentage increase. This ensures that your investment keeps pace with income growth and inflation automatically.

- Review your SIP performance every 6–12 months. If necessary, make changes based on market trends, life goals, or income changes to stay aligned with your financial targets.

Using the Step Up SIP Calculator provided by mutual fund platforms can show the difference your increasing contributions can make.

Step-Up SIP vs Regular SIP: A Quick Comparison

The main difference between a Step-Up SIP and a regular SIP lies in flexibility and long-term growth. Regular SIPs involve a fixed monthly investment, offering simplicity and consistency—ideal for beginners.

In contrast, a Step-Up SIP lets you increase your investment yearly, either by a fixed amount or percentage. This feature aligns well with income growth and helps combat inflation. While regular SIPs may offer slower wealth creation, Step-Up SIPs accelerate it by boosting contributions over time and bigger financial goals.

Who Should Consider It?

- Young Professionals with growing earnings

- Salaried Class with yearly salary hikes

- Investors with Goals like weddings or home buying

- Long-Term Savers looking to build wealth over time

Conclusion

A Step-Up SIP is your wealth partner that scales with your life. It encourages disciplined investing, supports financial growth, and brings long-term benefits. Start small, step up annually, and watch your money grow steadily.

- Step-Up SIP: Grow Your Wealth as Your Income Grows

- Discover how Step-Up SIP lets you invest more as your income increases. A smart, inflation-beating strategy for long-term wealth building in India.

- #StepUpSIP #WealthBuilding #SIPCalculator #SmartInvesting #InvestingTips

Related posts:

Discover the Best Fence Installation Services in Omaha with Huskins Services LLC

Discover the Best Fence Installation Services in Omaha with Huskins Services LLC

Summer Solstice Party Ideas & Activities for a Magical Celebration | BizzCrave

Summer Solstice Party Ideas & Activities for a Magical Celebration | BizzCrave

At the Time of Booking: What to Keep in Mind During a Medical Emergency

At the Time of Booking: What to Keep in Mind During a Medical Emergency

Streamline Your Business with an Automated Employee Payroll System

Streamline Your Business with an Automated Employee Payroll System

What to Expect When Buying a Solar Battery Locally – Pricing, Quality, and Local Support Insights

What to Expect When Buying a Solar Battery Locally – Pricing, Quality, and Local Support Insights

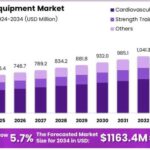

Aqua Gym Equipment Used in Holistic Wellness and Mind-Body Programs

Aqua Gym Equipment Used in Holistic Wellness and Mind-Body Programs

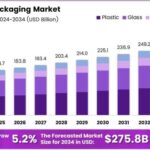

Transparency and Trust Through Beverage Packaging Supports Anti-Counterfeiting Measures

Transparency and Trust Through Beverage Packaging Supports Anti-Counterfeiting Measures

Key Time Management Strategies for Small Business Owners and Freelancers in 2025

Key Time Management Strategies for Small Business Owners and Freelancers in 2025