Filing taxes isn’t always straightforward. Whether you’re a salaried employee, a small business owner, or a freelancer juggling multiple income sources, managing your taxes can quickly become overwhelming. Mistakes in tax filing may lead to penalties or missed deductions, which is why many individuals and businesses turn to tax preparation services for help.

Choosing the right provider, however, requires more than a quick Google search. A competent tax professional not only helps you file correctly but also ensures you’re not leaving money on the table.

In this article, we’ll walk you through essential insights and practical steps to help you evaluate and select a service that fits your needs.

Why Choosing the Right Tax Preparation Services Matters

Filing a tax return isn’t just a legal requirement—it’s a financial opportunity. Done right, it can yield significant savings. Done wrong, and it could result in penalties or an audit. Choosing the right tax service is crucial because:

-

Errors can lead to IRS scrutiny.

-

Incorrect deductions may reduce your refund or increase what you owe.

-

A knowledgeable preparer ensures compliance with ever-changing tax codes.

Even if your return appears simple, working with an experienced professional can lead to long-term financial benefits.

Types of Tax Preparation Services Available

Not all services are created equal. Tax prep options vary in terms of pricing, expertise, and personalized support.

1. Certified Public Accountants (CPAs)

CPAs are licensed professionals with extensive knowledge in tax law and financial planning. They are ideal for:

-

Complex tax situations

-

Business owners and high-income individuals

-

Audit representation

2. Enrolled Agents (EAs)

EAs are federally licensed and specialize in tax issues. They’re authorized to represent taxpayers before the IRS and often charge less than CPAs.

3. National Tax Chains

Firms like H&R Block or Jackson Hewitt offer quick and accessible services. While convenient, you may not get the same level of expertise as a CPA or EA.

4. Online Software and DIY Platforms

For straightforward returns, platforms like TurboTax and TaxAct offer user-friendly filing options. However, support is typically limited to chat or email, unless you pay extra.

What to Look for in a Tax Preparation Service

Choosing a provider should go beyond just cost. Consider these critical factors before making your decision:

Experience and Credentials

A preparer’s background is a strong indicator of their capability. Look for:

-

Years of experience handling similar tax situations

-

Active licenses (CPA, EA, or attorney)

-

Continuing education in tax laws and IRS changes

Someone who regularly files returns for individuals in your income bracket or industry can spot deductions others might miss.

Service Scope and Specialization

Ensure the provider offers services that match your needs. For example:

-

Do they handle both federal and state returns?

-

Can they manage investments, rental properties, or self-employment income?

-

Do they assist with tax planning for future savings?

Specialists in specific financial scenarios, such as small business or crypto investments, add extra value.

Transparency in Pricing and Process

Reliable tax services won’t surprise you with hidden fees or vague timelines. Here’s what to verify upfront:

-

Flat-rate or hourly billing? Know what’s included. Some providers charge per form.

-

Turnaround time. Especially critical as tax deadlines approach.

-

Filing method. Electronic filing speeds up processing and refunds.

Avoid services that claim “guaranteed refunds” or base fees on your refund size—both are red flags.

Client Support and Availability

Tax season can get stressful, and accessibility to your preparer matters. Evaluate the following:

-

Will you speak to the same person each time?

-

Are they reachable by phone, email, or in-person appointments?

-

Do they offer year-round service for post-filing support?

Some services vanish after April, which can be problematic if the IRS has follow-up questions.

Questions to Ask Before You Commit

A simple conversation can help you assess professionalism and fit. Consider asking:

-

How long have you been preparing tax returns?

-

Are you familiar with my industry or situation?

-

What happens if I get audited?

-

Can you provide references or testimonials?

Their answers will reveal not just knowledge but also how seriously they treat client service.

Red Flags to Watch Out For

Not every tax preparer operates ethically or within legal boundaries. Keep an eye out for:

-

Asking you to sign a blank return

-

Promising large refunds without reviewing your documents

-

Charging fees based on the refund size

-

Avoiding questions about their licensing

Legit professionals won’t hesitate to walk you through their process or provide verifiable credentials.

Pros and Cons of Hiring Tax Professionals

Let’s break down the advantages and drawbacks of outsourcing your taxes.

Benefits:

-

Reduces stress and saves time

-

Accurate filing with maximum deductions

-

Helps avoid audits and penalties

-

Tailored advice for future planning

Potential Drawbacks:

-

Cost may be higher than DIY software

-

Some may upsell unnecessary services

-

Risk of data breaches if not properly secured

Always do a cost-benefit analysis based on your personal or business finances.

Using Technology for Better Accuracy and Security

Modern tax professionals often leverage advanced tools for enhanced accuracy:

-

Cloud-based accounting systems

-

Secure document portals

-

AI-assisted form checks

Ensure your provider follows data encryption standards and secure online practices. Always ask how your data is stored and protected.

How Tax Preparation Services Improve Long-Term Financial Health

Choosing the right service is not just about filing returns. Long-term relationships with good tax preparers offer:

-

Strategic year-round planning

-

Better retirement or investment tax strategies

-

Ongoing compliance with evolving tax codes

Think of your tax preparer as a partner in your financial success, not just someone who fills out forms once a year.

Final Thoughts

Navigating tax season can be less daunting with the right professional by your side. Choosing the right tax preparation services isn’t merely a matter of convenience, it’s a vital part of your financial strategy. By assessing credentials, transparency, and alignment with your unique financial needs.

Click here to read more articles – globalpostnews.com

- Understanding the Basics of Choosing Good Tax Preparation Services

- Learn how to choose reliable tax preparation services with our expert tips. Ensure accuracy, save money, and avoid penalties this tax season.

- tax preparation

Related posts:

Syna World Redefining Modern Fashion & Syna Worldwide More Than a Brand

Syna World Redefining Modern Fashion & Syna Worldwide More Than a Brand

How the AED to PKR Open Market Rate Affects Pakistani Expats in UAE

How the AED to PKR Open Market Rate Affects Pakistani Expats in UAE

Top Temperature Data Logger Manufacturers in India – Reliable & Accurate Solutions Powered by Nimbus Technologies

Top Temperature Data Logger Manufacturers in India – Reliable & Accurate Solutions Powered by Nimbus Technologies

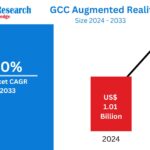

GCC Augmented Reality Market Size, Forecast 2025-2033: A Comprehensive Industry Analysis

GCC Augmented Reality Market Size, Forecast 2025-2033: A Comprehensive Industry Analysis

Embracing the Call — Supporting Life Through Christian Faith

Embracing the Call — Supporting Life Through Christian Faith

Make Waves on Your Birthday with SunFunFTL’s Luxury Boat Rentals in Fort Lauderdale

Make Waves on Your Birthday with SunFunFTL’s Luxury Boat Rentals in Fort Lauderdale

Biodegradable Packaging Trends Across Asia-Pacific & Global Markets

Biodegradable Packaging Trends Across Asia-Pacific & Global Markets

How to Use Magazine WordPress Themes to Create a Unique News Experience

How to Use Magazine WordPress Themes to Create a Unique News Experience