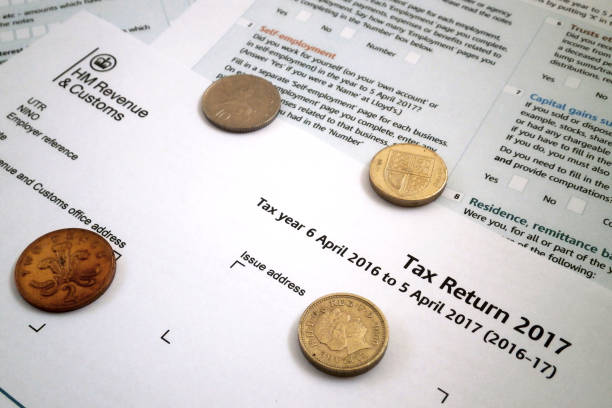

Why UK Tax Changes Matter for Pakistani Business Owners

Why UK Tax Changes Matter for Pakistani Business Owners

For business owners in Pakistan who operate in the UK or hold financial ties to British entities, staying updated on UK tax reforms is critical. Each fiscal year, the HMRC introduces new regulations that can directly affect profit margins, filing obligations, and business strategy. The 2024–25 tax year has introduced a range of changes, especially in areas like corporate tax, allowances, and digital filing requirements.

Whether you own property in the UK, sell goods cross-border, or maintain a registered company there, these updates may influence your decisions on investment, repatriation, and compliance.

Corporation Tax Reform

One of the most notable changes this year is the continued implementation of the UK’s tiered corporation tax system. As of April 2023 (applicable through 2024), companies with profits above £250,000 are taxed at the main rate of 25%, while companies earning £50,000 or less retain the lower 19% rate.

Businesses with profits between £50,000 and £250,000 fall under a marginal relief system. This sliding scale calculation increases the effective rate for companies in the middle bracket.

For Pakistani business owners managing UK-registered firms or subsidiaries, accurate profit forecasting is now even more essential. This tax differential also makes it important to reassess group structures and inter-company transactions.

Changes to Dividend Allowance and Capital Gains

The tax-free dividend allowance for UK residents has been cut from £1,000 to £500 in the 2024–25 tax year. This follows a previous reduction in April 2023. As a result, more shareholders—especially in owner-managed businesses—will see increased personal tax liability on dividends received.

Similarly, the capital gains tax (CGT) annual exemption has been halved to £3,000 for individuals and £1,500 for trusts. While the CGT rates themselves remain unchanged (10% or 20% depending on income level and asset type), the lower exemption means more transactions are now taxable.

Entrepreneurs in Pakistan who dispose of UK assets or earn income through property sales or business shares in the UK must now plan disposals more carefully, considering the reduced tax-free thresholds.

Introduction of MTD for Income Tax

The UK’s Making Tax Digital (MTD) initiative continues to roll out in phases. Starting April 2026, self-employed individuals and landlords earning over £50,000 will be required to maintain digital records and file tax updates quarterly through MTD-compatible software. Though this rule takes effect later, preparations begin now.

Businesses based in Pakistan but earning UK self-employment or rental income must ensure their accounting systems are ready. Those using manual or non-compliant digital systems may face penalties for late or incorrect submissions.

While VAT-registered businesses have already transitioned under MTD, the coming income tax changes highlight the UK’s broader move toward digital compliance. This affects how financial data is tracked, reported, and stored.

R&D Tax Relief Adjustments

For those involved in UK-based technology, innovation, or product development, reforms to the Research & Development (R&D) tax relief scheme came into effect from April 2024. A new merged R&D scheme is replacing the previously separate SME and RDEC (Research and Development Expenditure Credit) programs.

Under this new structure, all qualifying companies will receive a taxable credit, with rates varying based on profit status. The change aims to simplify the claims process but could reduce benefits for smaller firms previously under the SME scheme.

Business owners from Pakistan with R&D activity in the UK should reassess project eligibility, expenditure categories, and how these reforms impact refund value and corporation tax reduction strategies.

Increased Focus on Anti-Avoidance and Global Transparency

The UK government has intensified efforts to close tax avoidance gaps. New reporting requirements now apply to overseas entities owning UK property, demanding full disclosure of beneficial ownership. For business owners in Pakistan holding commercial or residential real estate in the UK through a corporate structure, this could mean additional filings and transparency checks.

Additionally, tax authorities have increased collaboration with international partners through the OECD Common Reporting Standard (CRS). This affects businesses and individuals transferring funds between UK and Pakistani accounts. Tax planning must now take into account both domestic rules and cross-border disclosure obligations.

Staying Ahead with Expert Guidance

With tax rules growing more complex and enforcement becoming stricter, international business owners can no longer rely on year-end corrections alone. Tax-efficient planning throughout the year is now critical.

Even small changes—like dividend thresholds or digital reporting mandates—can have substantial consequences if ignored. Business owners who stay informed and act early avoid costly penalties and missed opportunities for savings.

For Pakistani entrepreneurs with UK exposure, working with specialists who understand both regulatory environments brings added clarity and protection. Firms like SNS Accountancy assist clients in aligning their tax strategies with evolving laws, ensuring full compliance and optimized business performance across borders.

- UK Business Tax Updates You Need to Know in 2024

- Review 2024 UK tax updates for business owners in Pakistan. Stay compliant, informed, and ready with the latest financial regulations.

- TAX

Related posts:

Scott Tominaga Demystifies Private Equity – A Beginner’s Guide

Scott Tominaga Demystifies Private Equity – A Beginner’s Guide

American Gold Eagles vs. Gold Buffalos: Which Coin is Right for You?

American Gold Eagles vs. Gold Buffalos: Which Coin is Right for You?

Limited XPLR Merch Just Released Built on loyalty, suspense, and community

Limited XPLR Merch Just Released Built on loyalty, suspense, and community

ELAN SECTOR 49 GURGAON, SOHNA ROAD India Call +91-7765906259

ELAN SECTOR 49 GURGAON, SOHNA ROAD India Call +91-7765906259

Vito’s Way – A Powerful Story in the Making. Help Us Bring It to Life!

Vito’s Way – A Powerful Story in the Making. Help Us Bring It to Life!

Mutual Fund Deals: How to Decode the Smart Money Moves in Indian Markets

Mutual Fund Deals: How to Decode the Smart Money Moves in Indian Markets

Best Trading Platforms in India: A Comprehensive Guide for 2025

Best Trading Platforms in India: A Comprehensive Guide for 2025

Recharge your Airtel Mobile with ICICI Bank: Quick & Secure Recharge Options

Recharge your Airtel Mobile with ICICI Bank: Quick & Secure Recharge Options