In the fast-paced and unpredictable world we live in, having the right insurance coverage is not just an option—it’s a necessity. From unexpected medical emergencies to vehicle damage, property loss, or even long-term financial planning, insurance provides a safety net that protects you and your family when life takes an unplanned turn. But just buying a policy isn’t enough. In a city like Pune, where life is evolving rapidly, choosing the right insurance provider matters more than ever.

Pune, a city brimming with professionals, entrepreneurs, students, and retirees, has a wide range of insurance needs. As the demand for tailored insurance coverage grows, so does the need for trusted, transparent, and service-oriented insurance providers who can match you with the right protection plans.

The Changing Insurance Landscape in Pune

Pune’s transformation into a major urban and economic center has brought with it an increase in financial awareness and lifestyle aspirations. However, with rising healthcare costs, growing property values, and higher mobility, the risks are also higher. People are no longer looking for just a policy—they’re looking for complete insurance solutions that fit their lifestyle, career, and family needs.

This has led to the rise of professional insurance service providers who go beyond selling products. They provide strategic advisory, timely assistance, and ongoing support that truly adds value.

Why Your Choice of Insurance Provider Matters

1. Customized Solutions, Not Just Policies

No two individuals or families are alike. A good insurance provider doesn’t push generic plans—they understand your life goals, financial condition, and risk appetite to offer customized policies. Whether it’s health insurance with maternity add-ons or a term plan with riders, the right provider ensures your coverage fits you perfectly.

2. Transparent Advice and Honest Guidance

The insurance world can be filled with jargon and fine print. A reputable provider will break things down clearly, help you compare plans, explain inclusions and exclusions, and guide you with integrity, not just for commission.

3. Quick and Hassle-Free Claims Assistance

The true value of insurance is tested during claims. Top providers offer end-to-end support—from documentation to coordination with insurers—to make sure your claim is settled promptly and fairly. This is where many policyholders feel the difference between a generic agent and a professional service partner.

4. Access to a Wide Range of Policies

A trusted insurance provider in Pune will be partnered with multiple leading insurance companies. This ensures unbiased access to the best products, giving you choices instead of limitations.

5. Post-Sale Service and Support

Insurance isn’t a one-time transaction. Renewals, add-ons, claims, upgrades, and policy changes all require guidance. The best providers offer dedicated after-sales service, so you’re never left alone once the policy is sold.

Services a Trusted Insurance Provider in Pune Should Offer

-

Health Insurance: Individual, Family Floater, Critical Illness

-

Life Insurance: Term Plans, Whole Life, ULIPs, Retirement Plans

-

Motor Insurance: Comprehensive and Third-Party Car/Bike Insurance

-

Property Insurance: Home and Commercial Property

-

Business Insurance: Fire, Liability, Cyber Risk, Employee Benefits

-

Travel and Personal Accident Insurance

What to Look for When Choosing an Insurance Provider

-

IRDAI registration and industry certifications

-

Positive reviews and client testimonials

-

Access to top insurance brands and plans

-

Personalized advice instead of one-size-fits-all

-

Clear, transparent communication

-

Digital tools for policy management

-

Reliable customer support and follow-ups

In short, your insurance provider should act more like a trusted advisor than a salesperson.

Conclusion

Choosing the right insurance provider in Pune is about much more than buying a policy—it’s about finding a partner who understands your unique needs and stands by you through life’s uncertainties. As policies become more customizable and markets more competitive, the expertise and trustworthiness of your provider will directly impact your financial security.

Acornia Multiple Distribution Services is proud to be a leading name in Insurance Services in Pune, offering goal-based consultation, a wide array of insurance options, and unmatched customer support. Whether you’re planning for your health, wealth, or future, Acornia ensures your insurance journey is smooth, smart, and secure.

- Why Choosing the Right Insurance Provider in Pune Matters More Than Ever

- Acornia Multiple Distribution Services is proud to be a leading name in Insurance Services in Pune, offering goal-based consultation, a wide array of insurance options, and unmatched customer support.

- Insurance Provider in Pune

Related posts:

Nutrition and Wellness Programs in Assisted Living Communities in Oakville

Nutrition and Wellness Programs in Assisted Living Communities in Oakville

Dresses Dry Cleaner services Lisle, IL: BY Napervalue Cleaners

Dresses Dry Cleaner services Lisle, IL: BY Napervalue Cleaners

Welcome to Oasis Fitness: Your Path to Strength, Balance, and Renewal

Welcome to Oasis Fitness: Your Path to Strength, Balance, and Renewal

Integrating Type form with High Level: A Comprehensive Guide

Integrating Type form with High Level: A Comprehensive Guide

What Solar Looks Like on Flat Roofs, Metal Roofs, and Shingles?

What Solar Looks Like on Flat Roofs, Metal Roofs, and Shingles?

When Best Stock Market Institute Delhi Becomes Your Turning Point Forever

When Best Stock Market Institute Delhi Becomes Your Turning Point Forever

Learn Advanced Derivatives Trading Course from ICFM and Build Expertise in Financial Market Strategies

Learn Advanced Derivatives Trading Course from ICFM and Build Expertise in Financial Market Strategies

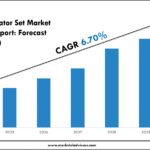

Chile Generator Set Market Trends & Forecast: Outlook to 2030

Chile Generator Set Market Trends & Forecast: Outlook to 2030