Buying a home is a monumental step, often marking a milestone in one’s life. For most individuals, this dream is fulfilled through home loans. While taking a home loan offers a convenient way to own a house, it’s important to understand the financial commitment that comes with it. One of the most useful tools in this process is an EMI calculator home loan a simple yet powerful online resource that helps you make better borrowing decisions.

In today’s article, we’ll explore what an EMI calculator is, how it works, and why it’s crucial for anyone planning to take a home loan.

What Is an EMI Calculator for Home Loan?

An EMI (Equated Monthly Installment) calculator for home loan is an online tool that helps you determine the monthly installment amount you’ll have to pay over the tenure of your home loan. It takes into account three major components:

- Loan amount: The principal you borrow

- Interest rate: The rate at which interest will be charged

- Loan tenure: The period over which you plan to repay the loan

By entering these values, the calculator instantly shows your monthly EMI, total interest payable, and total repayment amount.

Why Is It Important?

- Financial Planning

Using an EMI calculator allows you to gauge how much of your monthly income will go toward loan repayment. This ensures you don’t stretch your budget or commit to an amount that could lead to financial stress. - Time-Saving

Instead of manually calculating EMIs using complex formulas, an online EMI calculator gives you results instantly, allowing you to try multiple scenarios in seconds. - Comparison Tool

You can use the EMI calculator home loan tool to compare offers from different lenders. By adjusting the interest rate, you can see which lender offers a more affordable loan. - Better Negotiation

When you understand how EMIs work, you’re in a better position to negotiate the loan terms with lenders, especially when it comes to interest rates or tenure.

How Does an EMI Calculator Work?

The formula used to calculate EMI is:

EMI = [P x R x (1+R)^N] / [(1+R)^N – 1]

Where:

P = Principal loan amount

R = Monthly interest rate (annual rate divided by 12 and then by 100)

N = Loan tenure in months

While this might seem complicated, the online EMI calculator home loan tool simplifies this by doing all the math for you. Just plug in the numbers and get results instantly.

Example Scenario

Let’s say you’re planning to borrow ₹40,00,000 at an interest rate of 8% per annum for a period of 20 years.

When you input these values into an EMI calculator:

- EMI: ₹33,458

- Total Interest Payable: ₹40,29,920

- Total Payment (Principal + Interest): ₹80,29,920

This gives you a clear picture of what your long-term financial commitment will look like.

Adjustable Inputs for Better Insights

Most EMI calculators offer flexibility to change and adjust:

- Loan amount

- Interest rate

- Tenure

- Prepayments or part-payments (in some advanced calculators)

These features allow you to understand the impact of increasing or decreasing your loan amount, adjusting the tenure, or paying more upfront as a down payment.

Benefits of Using an EMI Calculator Home Loan Tool

- Clarity in Decision-Making

With a detailed breakdown of monthly EMIs and total repayment, you can make an informed choice about your affordability.

- Reduces Loan Burden Risk

If your EMI is too high, the calculator can help you restructure your loan by increasing the tenure or choosing a smaller loan amount.

- Boosts Credit Management

Knowing your monthly outgo helps you manage your other financial obligations and maintain a healthy credit score.

- Supports Pre-Approval Applications

Many lenders offer pre-approved loans based on EMI affordability. Using a calculator helps you qualify for better loan offers.

Common Mistakes to Avoid

- Ignoring Other Expenses: While EMI is a key component, don’t forget property taxes, maintenance, insurance, and registration costs.

- Choosing Lowest EMI Over Shorter Tenure: A lower EMI with a longer tenure may result in higher interest payment over time.

- Not Comparing Interest Rates: Even a 0.5% difference in interest can make a big difference in the long run.

- Not Considering Prepayments: Some borrowers don’t explore how prepayments can reduce total interest significantly.

Tips for Smarter Loan Planning

- Use the calculator before you apply for a loan to determine what fits your budget.

- Try out various combinations of loan amount and tenure to find the optimal EMI.

- Factor in your monthly expenses, other EMIs, and investments before finalizing the loan amount.

- Check if the EMI falls under the recommended 40-50% of your monthly income.

Final Thoughts

Taking a home loan is a long-term financial commitment. Whether you’re a first-time homebuyer or looking to upgrade, using an EMI calculator home loan tool is essential for responsible borrowing. It empowers you with data, helps you budget wisely, and avoids nasty surprises down the road.

Before signing any loan agreement, spend time understanding how different loan amounts, interest rates, and tenures affect your monthly outgo. A few minutes spent with an EMI calculator can save you lakhs in the long run.

- Why Using an EMI Calculator for Home Loan Is a Smart Financial Move

- Plan your finances better with an EMI calculator home loan tool. Learn how it helps you estimate EMIs, compare lenders, and make informed borrowing decisions.

- EMI calculator home loan

Related posts:

Dresses Dry Cleaner services Lisle, IL: BY Napervalue Cleaners

Dresses Dry Cleaner services Lisle, IL: BY Napervalue Cleaners

Easy EMI Card: Your Go-To Solution for Easy Monthly Payments

Easy EMI Card: Your Go-To Solution for Easy Monthly Payments

When Best Stock Market Institute Delhi Becomes Your Turning Point Forever

When Best Stock Market Institute Delhi Becomes Your Turning Point Forever

Learn Advanced Derivatives Trading Course from ICFM and Build Expertise in Financial Market Strategies

Learn Advanced Derivatives Trading Course from ICFM and Build Expertise in Financial Market Strategies

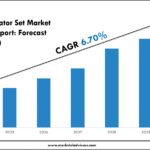

Chile Generator Set Market Trends & Forecast: Outlook to 2030

Chile Generator Set Market Trends & Forecast: Outlook to 2030

Trusted Fiber Laser Cutting Machine Supplier Delivering Advanced Automatic Laser Cutting Machines

Trusted Fiber Laser Cutting Machine Supplier Delivering Advanced Automatic Laser Cutting Machines

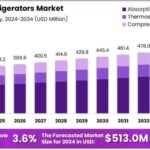

Small-Space Cooling: The Rise of the Minibar Fridge in Minibar Refrigeration

Small-Space Cooling: The Rise of the Minibar Fridge in Minibar Refrigeration

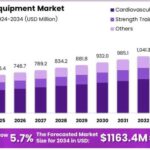

Aqua Gym Equipment Used in Holistic Wellness and Mind-Body Programs

Aqua Gym Equipment Used in Holistic Wellness and Mind-Body Programs